Once seen as a niche offshoot of property, infrastructure is fast becoming an asset class of interest to many investors.

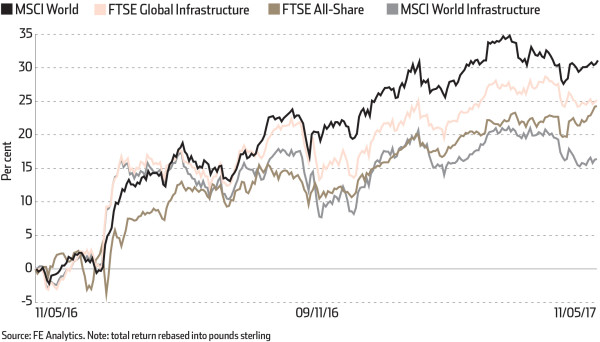

Performance has been good, with the FTSE Global Infrastructure index gaining 25.2 per cent in sterling terms in the 12 months to May 11 2017, slightly behind the MSCI World index’s increase of 31.1 per cent, but ahead of the FTSE All-Share’s 24.3 per cent rise, data from FE shows.

Meanwhile, continued commitments from governments for increased infrastructure spending are likely to further fuel interest in the space.

Nick Langley, co-chief executive and chief investment officer at Rare Infrastructure, notes that in the US the rail sector, in particular, is set to be a large beneficiary of the proposed tax cuts by president Trump.

Mr Langley adds: “We expect the quantitative easing by the European Central Bank to support solid but unexciting economic growth in the medium term, which in turn supports the valuations of economically sensitive securities such as rail, airports and toll roads.”

Michelle McGrade, chief investment officer at TD Direct Investing, suggests the best way to gain exposure to the increased government infrastructure spend is “by investing in a broad range of sectors, rather than focusing on pure infrastructure plays”.

“Infrastructure funds, while remaining solid investments, may not immediately benefit from the new government spend. ETFs focusing on these areas may therefore be a better option,” Ms McGrade says.

Michael Howard, head of alternative investments at Prudential Portfolio Management Group, says infrastructure has grown in popularity because of the demand for yield and its diversification benefits. But he warns: “Infrastructure is extremely diverse, but in essence refers to assets that are associated with the provision of public goods and services that ensure social and industrial productivity. It is important to understand that there is a range of return expectations from the various sub-strategies.”

Ingrid Weston, senior product specialist, infrastructure debt, at HSBC Global Asset Management, adds that while there is plenty of capital available for infrastructure financing, investors still need to be mindful of the cost of accessing the asset class and to understand the true risk profile of the investments.

“With the ever-expanding definition of infrastructure and high valuations, with little ability to absorb any degree of disappointing performance over the longer term, a strong credit risk focus and investment discipline is key to delivering what is naturally expected of infrastructure,” Ms Weston says.

Looking ahead, Stephen West, partner at Gravis Capital Management, adds: “The tailwind for UK infrastructure investing is the continued supply of high-quality investable assets producing fixed, long-dated cashflows with upward-only inflation links.”

Mark McKenzie, senior portfolio manager at Thomas Miller Investment, notes there has been a period of heavy fundraising in the listed UK Infrastructure sector, with heavily oversubscribed capital issues by HICL Infrastructure and International Public Partnerships indicating investor appetite for the sector is not waning.

But he warns: “Such pronounced growth has led to concerns over style drift in the sector. [Investors] must be wary of the changing characteristics of the underlying portfolio.”