The head of the fund firm’s MyFolio multi-manager range said his unfettered and active portfolios had begun to shift away from US stocks as valuation concerns came to the fore.

Winners out of this were European and Japanese value equity investors, including Invesco Perpetual’s Stephanie Butcher and Schroder Tokyo fund manager Andrew Rose.

Mr Hambi said the move was part of a wider change in allocation since the election of Donald Trump in the US. The team is reallocating towards risk assets – leading to underweights on defensive funds and overweights in growth and equity strategies.

This has also meant building overweight positions in emerging markets at the expense of UK credit, equity and property.

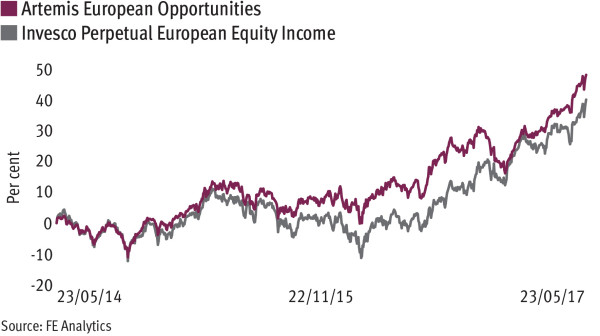

In the £366m MyFolio Multi Manager II fund, Mr Hambi said an increased European exposure was expressed via Ms Butcher’s value-biased European Equity Income fund and Mark Page’s Artemis European Opportunities growth strategy.

“They work really well side by side,” Mr Hambi said.

The team also added to the Mirabaud Pan Europe Small and Mid Cap equity fund run by former SLI manager Ken Nicholson.

A trio of Japanese equity funds also saw inflows from SLI as part of the shift towards value. Of the three offerings, two have value approaches and account for 80 per cent of the allocation.

Additions were made to the Schroder Tokyo and Morant Wright Nippon Yield funds for value exposure, and the offshore Tokio Marine Japanese Equity Focus for growth.

Mr Hambi said: “We have got growth and value equal in the portfolio, but in some areas like Japan, where value tends to outperform, we have an 80/20 value/growth split.”

“Japan and Europe are cheap and have been unloved. Fundamentals are good so there is a lot to like. We are cautiously optimistic as a house and see economic growth being good, which will lead to an uptick in corporate earnings,” Mr Hambi added.

The portfolio’s growth bias is more prominent in its US equity exposure, but this has been reduced to a 1.5 per cent overweight to fund recent changes. Reductions were made to passive exposure and two active vehicles.

The Multi Manager II fund has around 40 per cent US exposure via passive products, and also uses Old Mutual Global Investors’ quant-based North American Equity fund, as well as the Artemis US Select vehicle run by Cormac Weldon. All of these holdings were reduced.

However, the Brown Advisory US Smaller Companies and Wellington US Research Equity funds, both of which were added to the portfolio in the wake of November’s US election, were spared from the cuts.

Mr Hambi said: “There are two funds we have introduced that we didn’t touch. We get good cashflows, so we bought smaller positions and have new cashflows go into them.”

The Multi Manager II fund – which sits in the new IA Volatility Managed sector with a 6-9 per cent volatility range – has also recently upped emerging markets exposure with the addition of Henderson’s Emerging Markets Opportunities fund run by former First State manger Glen Finegan.

This holding complemented a position in the Invesco Perpetual Global Emerging Markets fund run by Dean Newman, Mr Hambi added.

KEY NUMBERS

3

Number of UK-focused asset classes the fund is currently underweight

1.25ppt

Fund’s overweight position to Japanese equities