Fund review: Agriculture steps out of its niche as world’s population keeps growing

Agriculture is a niche asset class, but has delivered consistent returns in the recent past and hence may be starting to attract more interest from investors.

Skye Macpherson, portfolio manager of BlackRock’s BGF World Agriculture fund, says: “Agricultural equities have delivered returns far in excess of those of UK and global equity markets, with a key tailwind being the very stable and consistent demand growth we have seen for grains and oilseeds. Since 1960 the growth rate has been 2.3 per cent per year.”

There are two different types of funds offering retail investors exposure to this asset class. Some invest directly in areas such as wheat, soyabeans and maize, but these are typically subject to a variety of restrictions and not accessible to retail investors. The alternative are funds that invest in listed agricultural companies.

The performance of agriculture funds can be affected by factors such as weather conditions, which can affect crop prices.

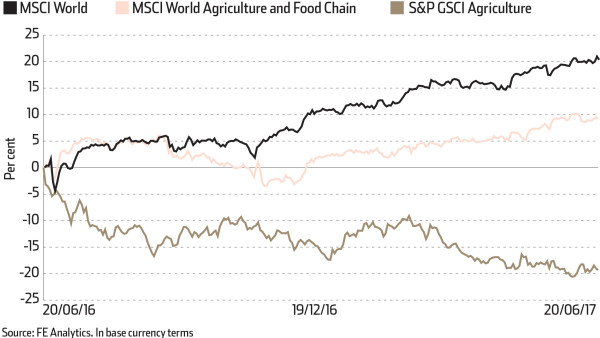

Ms Macpherson explains: “Over the past 12 months to end May 2017, agricultural equities, as measured by the Dax Global Agribusiness index, have gained 11.7 per cent, in line with the rise in UK equities, which are up 11.5 per cent (in US dollar terms).”

The main drag over the past year has been the mixed performance of agricultural commodities, which she notes are the key determinant of farmer incomes. The prices of grains such as soya, maize and wheat have all fallen, while sugar, dairy and livestock prices have been stronger.

“The reason why grain prices have continued to weaken has been production growth exceeding demand growth for several years now,” she adds.

Jon Andersson, head of commodities at Vontobel Asset Management, observes: “Looking back at the historical 10-year price trends for soyabeans and maize, both grain commodities are currently trading around 15 per cent and 20 per cent off their respective lows. Moreover, for the same period, the absolute highs for these two commodities are approximately 85 per cent and 125 per cent above current prices.”

The expanding world population and increasingly urgent need for food supplies would seem to suggest agriculture will be a good long-term investment.

Hugo Rogers, co-manager of the Liontrust GF Global Water and Agriculture fund, describes how urgent the need is for more food, water and energy: “Water and agriculture present long-term investment opportunities because of such significant structural change.

“Supply needs to adapt to satisfy a 2 per cent annual increase in demand for agricultural products and a 3 per cent increase in demand for water. This will require investment in infrastructure and technology such as new seed technologies, railroads inland in Latin America, port expansions in export regions, refrigerated logistics, storage, education, farm consolidation and desalination.”

There are also signs merger and acquisition activity in the sector is picking up, with several confirmed deals between some of the world’s largest agricultural names. German-based Bayer’s $66bn (£52bn) purchase of US seed maker Monsanto was one of the largest takeovers in 2016 and points to a healthy industry.

Ms Macpherson says: “We view agricultural shares as attractively valued versus broader equity markets and believe the pick up in M&A in the sector over the past 12-18 months suggests others also see value.”

THE PICKS

Baring Global Agriculture

James Govan manages this £69m fund, which launched in January 2009. A sector breakdown reveals the fund has 16.5 per cent allocated to fertiliser companies and 16.5 per cent exposed to seeds and crop protection companies. By region, the portfolio’s largest allocation is to the US, which accounts for 36 per cent, while Canada makes up 19.7 per cent. Mr Govan has delivered a solid performance over one, three and five years, according to FE Analytics. In the three years to June 7, the fund generated a 29.8 per cent return.

Pictet Agriculture

This £168m fund invests in companies operating in the agribusiness value chain. Managers Gertjan Van Der Geer and Cédric Lecamp have 45.3 per cent allocated to the US, followed by 11.1 per cent of the portfolio in Japan. Among its largest holdings are Whole Foods Market and Deere & Co. FE Analytics shows the fund has outperformed the IA Specialist sector over one, three and five years. In the past five years to June 7, the fund delivered an impressive 65.3 per cent return.

EDITOR’S PICK

Sarasin Food & Agriculture Opportunities

Henry Boucher invests in food and agriculture companies across the world to achieve capital growth. The portfolio’s top three holdings at the end of April are Marine Harvest, Treasury Wine Estates and Leroy Seafood Group. A breakdown of its geographical allocation reveals the portfolio has 29.8 per cent in Europe ex UK, closely followed by North America, which accounts for 22.5 per cent. FE Analytics shows the fund has a strong record of outperformance. In the three years to June 7 it delivered a 45.8 per cent return.