Article 3 / 8

The Guide: Half-year reviewRising inflation poses risks to portfolios

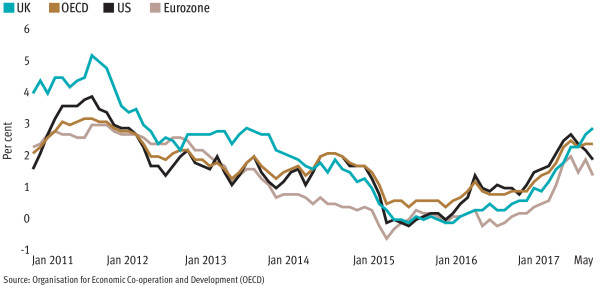

Inflation expectations have come full circle since falling in mid-2014: they rebounded in February 2016 and stabilised in 2017. However, contrary to some market commentators, we do not believe the recent plateau signals an end to reflation, but rather that the US economy has reached the point where the risk for inflation is substantially tilted to the upside.

Cyclical inflationary pressures continue to build and the drag on inflation from low energy prices and a strengthening US dollar has faded. This shift in the inflationary environment – from one dominated by deflation fears to one in which inflation is expected to return to normal levels – has important implications.

Measures of core inflation gradually began to rise in the second half of 2015 as the US economy continued its recovery from the global financial crisis. The year-on-year change in the core personal consumption expenditures index — the preferred measure of the US Federal Reserve — rebounded from a near-term low of 1.3 per cent in July 2015, to 1.8 per cent in February 2017. The year-on-year change in the core consumer prices index (CPI) — the more widely cited measure of inflation — also rose, from 1.6 per cent in December 2014 to a range of 2–2.3 per cent over the past year.

The acceleration in US wage growth is evidence that cyclical pressure is indeed building. Importantly, rising wages have also begun to broaden in the past two years, unlike in the early 2000s, when workers at the top end of the wage scale experienced the strongest gains, while workers with lower income experienced none. A strengthened global economy is also providing support, as highlighted by the International Monetary Fund, which recently reaffirmed its view that the global economy will grow more rapidly and more broadly across developed and emerging economies in 2017.

We have reached an inflection point for inflation. Deflation risks have been replaced by rising inflation expectations and, based on cyclical factors alone, inflation of 2–2.5 per cent is likely. Furthermore, there is structural risk from a possible backlash against globalisation, which could lead to protectionism and higher prices. In this scenario, inflation could exceed 3 per cent.

Given this risk, investors should revisit their portfolios to ensure they have assets that can protect against inflation. It is important to note that inflation can corrode purchasing power even at moderate rates. A 0.25 per cent month-on-month increase in the CPI – or roughly 3 per cent annualised – compounds to a 14 per cent loss in purchasing power over five years.

Thirty years ago options were limited to mainly gold and large-cap equities, but now investors can use a number of assets to hedge while maintaining their investment plans.

Because inflationary pressures are likely to be relatively moderate, investors should consider assets that also offer capital appreciation or income. These include real assets such as real estate, which can offer stable cashflows, commodities that contribute to headline inflation rates, and infrastructure, which is positively correlated with inflation because it tends to consist of monopolies – such as bridges, toll roads and airports – with few alternatives for consumers.

Companies with pricing power also enjoy sustained demand for their products or services, even when prices rise. In effect, they can pass on price increases to customers without losing market share. Equities also offer exposure to growth and may provide returns, even if inflation is dormant.

Liquid versions of these assets offer the added benefit of flexibility, allowing for allocation changes in response to different manifestations of inflation. For example, real estate should benefit from rapidly rising property prices and rents; commodities would benefit if the US dollar weakened; infrastructure would benefit from fiscal stimulus targeting increased infrastructure spending.

Inflationary pressures today are not something to be alarmed by but to watch carefully. Investors have a number of options that they can use in portfolios to help blunt the impact of inflation.

Sources of inflation vary, and they may require different solutions. By employing a flexible approach, investors can address inflation while maintaining the potential to earn capital appreciation and income.

Ron Temple is co-head of multi-asset and head of US equities at Lazard Asset Management