Article 3 / 4

Investing in property & infrastructureAdding real estate equities to improve risk-adjusted returns

Of the varied ways to access property, investing in stocks exposed to the sector or investment trusts is one often utilised by fund buyers.

Around three-quarters of the global property equity market is made up of real estate investment trusts (Reits), which typically provide a yield higher than traditional equity markets. But the investment is still equity exposure with price volatility a consideration, so how do they fit into a multi-asset portfolio?

Real estate equities have the potential to generate attractive long-term total returns, comprising a mixture of dividend income and capital appreciation. The market is sizeable, with a capitalisation of around $1.4trn (£1.1trn) spread across 21 countries.

Unsurprisingly, the US has the largest representation in the index – accounting for more than 50 per cent – followed by Japan and the Netherlands, using the FTSE Epra/Nareit Developed index as a proxy.

The main concern for investors is over-exposure to volatility for what is traditionally used as a diversifying asset class.

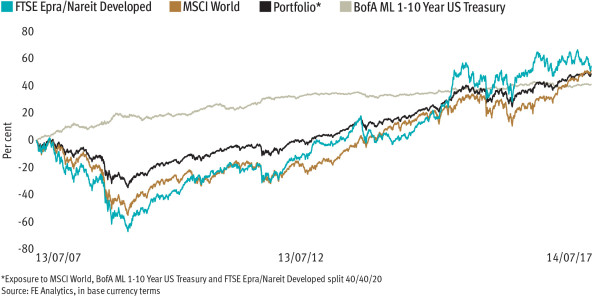

If we measure an investment’s volatility based on its annual rate of return alone, real estate equities have been more volatile than developed market equities and US Treasuries since 1990. This suggests the annual rate of return for the asset class has wider fluctuations than developed market equities and fixed income.

However, it is inappropriate to consider volatility in isolation. What matters for a multi-asset portfolio is the extent to which real estate equities behave over time relative to other asset classes.

Correlation is commonly used to measure the extent to which two asset classes move similarly in response to market events, with any figure lower than one demonstrating some diversification benefits.

History shows real estate equities are effective in providing some diversification to an investment portfolio, as they tend to react differently to market conditions than other asset classes.

The average correlation between real estate equities and developed market equities over the past 20 years, for example, is 0.7. Therefore by adding real estate equities to a portfolio consisting of developed market equities and fixed income, we can achieve diversification and improve the risk-adjusted return of the total portfolio over the long term.

Another way of comprehending the volatility and its impact on a multi-asset portfolio is to examine how sensitive real estate returns are to wider market movements. This can be measured by the ‘beta’ of real estate equities compared, for example, with general equities.

In other words, beta measures the amount of systematic risk (or diversified risk) against general equities. A beta above one means that real estate equities are more sensitive to the performance of general equities; a beta below one means they are less responsive to general equity market performance.

The results suggest that real estate equities have similar or lower beta when compared with developed market equities as a whole. Since real estate equities are not perfectly correlated with developed market equities, overall portfolio volatility can be reduced.

Real estate equities can have a role to play in multi-asset portfolios, but allocations should be modest – especially compared with the overall equity portion – as they do carry more volatility.

Despite this and short-term correlation with equity markets, real estate equities can offer diversification benefits and have the potential to improve a portfolio’s risk-adjusted returns over the long term.

Thomas Yuk is a multi-asset product specialist at HSBC Global Asset Management

KEY FIGURES

0.67

Average correlation between global and property equities in the past 20 years

17.5%

Annualised volatility of the FTSE/Epra Nareit Developed Market index

14%

Annualised volatility of the MSCI World index

0.84

Average beta of global and property equities in the past 20 years