Rob Morgan, investment analyst at Charles Stanley, says: “Cost has always been important to me as a fund a selector, but what you need to consider is how much value a manager is adding for what they are charging – sometimes it’s not a lot.”

A useful analogy is the rise of price comparison websites used by consumers to find car or home insurance policies. While there are details on these websites about the services offered by each policy – whether legal assistance or breakdown cover is provided and the payout ratio of the provider, for example – search results are usually displayed by price, meaning this is often the basis on which a consumer makes their choice.

Mr Morgan adds: “When you look at products on a price basis it assumes that they are all inherently the same, but some insurance policies have additional features which you pay more for, just as some funds do.

“Trackers are cheaper because they have a more automated process; a specialist fund might need to spend more on research or a large team of analysts. Investors need to be concerned with performance after charges, not just cost.”

But there is already evidence that investors are becoming more price sensitive. It is clear in the rapid uptake of passive funds, which account for around 40 per cent of net retail fund sales. The pattern is also visible elsewhere in the investment world: research from the Platforum has found that investors who previously considered brand the most important factor when choosing a platform are now more likely to look at price. These changing preferences have consequences for advisers.

Claire Walsh, financial planner at Aspect 8, says: “The all-in fee is definitely a good thing and I think it could lead to fund costs falling, but I think as a result adviser costs are going to come under pressure too. Cost is high up most people’s priority list.”

Show and tell

So are investors finally getting any closer to understand the total cost of ownership?

Gina Miller, founder of the True and Fair Campaign, says: “The issue is how and where the all-in fee will be displayed, and that has not been specified.”

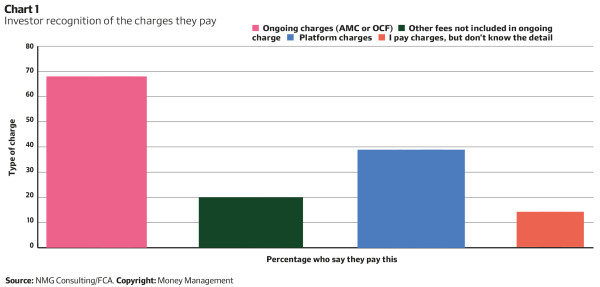

She worried that if the details are buried in the Kiid they will be of little help – the FCA’s study found just 3 per cent of investors read the document and as Chart 1 shows, many are unaware of the various charges they pay for a portfolio.