It has spent years being spurned by UK investors who found better investment opportunities elsewhere, whether that was in the UK, US, Japan or even in the emerging markets.

But recently the tide has turned and investor sentiment towards Europe has been improving.

Net retail sales of the Europe ex UK sector gathered by the Investment Association show this changing investor sentiment in quite stark terms.

There were significant outflows from this sector between September 2016 to January this year, with retail sales down -£341m in the first month of 2017.

Then from February until September this year net retail sales of the same sector have been positive, reaching £507m in August and dropping only slightly to £489m the following month.

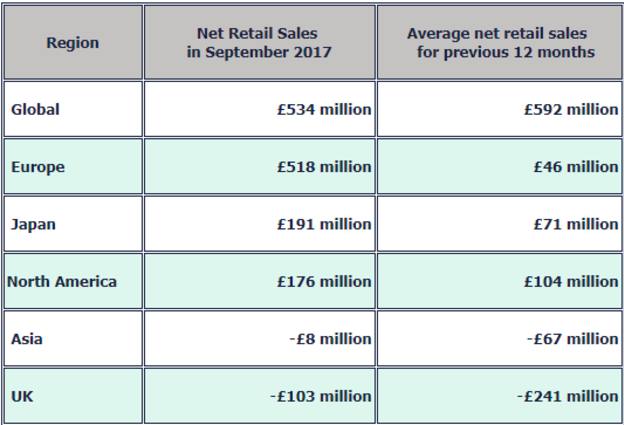

European equity funds were the second bestselling equity funds by region in September, with net retail sales of £518m, the same data set shows.

Figure 1: Net retail sales of equity funds by region

Source: Investment Association

Held back

Chris Hiorns, manager of the Amity European fund at EdenTree Investment Management, acknowledges the recovery in the region is long since due.

“Clearly, it’s the last of the major economies to recover after the credit crisis,” he observes. “We had a recovery fairly early on in the US which was meant to be the centre of the credit crisis, I think the UK followed more recently.

“Even Japan has managed to manufacture some growth there by very active policies.”

But he admits: “Europe really didn’t pursue those policies. It pursued policies not only of austerity from a fiscal point of view, but also it failed to carry out the same sort of monetary stimulus that occurred in the US, UK and Japan at a later stage.”

In fact, Europe was being held back by multiple recessions, according to Graham Bishop, an investment director at Heartwood Investment Management, who recalls the eurozone fell back into recession as recently as 2012.

Mr Hiorns says: “We had an abortive attempt to tighten monetary policy back, I think, in about 2011-12 and it was only more recently the ECB [European Central Bank] has had very active monetary stimulus, with quantitative easing – certainly a lot later than the other major economies, so this meant the recovery was deferred.

“Now I think it’s quite clearly underway.”

Europe has always been the last remaining recovery market, points out James Rutherford, co-head of investments for European equities at Hermes Investment Management.

He explains: “Europe, from a fundamental viewpoint and earnings viewpoint, has disappointed in its delivery for 10 years.

“I think if you look back over those 10 years, we always start the year, and the analysts all look for, about 10-15 per cent earnings growth and we don’t make it much past Easter before those expectations start falling again. For a number of years the expectations have gone from 10-15 per cent, and by the end of the year, they’re zero or slightly negative.”

Tristan Hanson, manager of the M&G Global Target Return fund, suggests sentiment towards European equities has improved “dramatically” in recent months driven by strong economic growth and thanks also to a belief major political risks have “diminished”, citing the victory for Emmanuel Macron in the French elections earlier in the year.

Political hurdles

Even at the start of 2017, investors were nervous about the run of political events and elections still to come across Europe, in which the threat of populist parties was on the rise.

However, one of the key election outcomes was that of the French election, which resulted in a strong win for the centrist candidate Mr Macron.

“The risk of a systemic crisis in Europe has diminished substantially in the eyes of investors, which explains the very muted overall market reaction to recent developments in Catalonia,” Mr Hanson adds.

“Meanwhile, the profits delivery of European companies has been strong this year and equity valuations are attractive relative to bonds or negative deposit rates.”

David Stubbs, at JP Morgan Private Bank, agrees: “Europe is back in favour for UK investors, with financial markets having performed well over the past couple of years as the economy has grown and risks have receded.

“For some time now, we have maintained a positive view on Europe’s investment environment against a backdrop of improving economic growth, falling unemployment, supportive central bank policies, and a rebound in business and consumer confidence.

“We have also seen political risks reducing following market-friendly election results in the Netherlands, France and Germany, and there are encouraging signs that the region’s financial system is less fragile.”

But he is also all too aware of the precariousness of the European investment recovery, emphasising that while he is optimistic about the region’s general direction of travel, “it is important to be aware of the differences across the region, which present both risks and opportunities”.

All of this has boosted investors’ confidence in Europe, even at a time when the UK is trying to extricate itself from the EU.

While investment into the UK may be slowing, as companies wait to see what the outcome of the Brexit talks between the UK government and the EU will be, UK investors are perhaps trying to hedge their bets by investing in booming Europe.

The political risks elsewhere are shining a rather favourable light on Europe, it seems.

Polar Capital’s Nick Davis, a European income fund manager, notes: "The improving European outlook has coincided with increased political uncertainty in the US (the Trump presidency) and UK (Brexit) and a moderation of emerging market growth.

“With elevated political risk pretty much everywhere, Europe looks less of an outlier on this front and a more diversified geographic approach makes sense.”

Add to this the fact US equity valuations are looking fairly expensive and many investors are considering more out-of-favour areas, such as Europe, says Mr Davis.

Noises off

But investors are prone to having their confidence shaken by political or economic noise coming out of a country or region.

Jeff Taylor, Invesco Perpetual’s head of European equities, admits Europe is good at generating political noise. “However, politics only really matters from an investment point of view when it poses a genuine threat to financial markets.

“In reality, Europe has seen far more market-friendly political outcomes than many commentators have predicted in the recent past,” he says.

Mr Taylor suggests: “We believe it is important to distinguish between the probable and the merely possible, which leaves us relatively relaxed about the market implications of political trends within the future EU of 27 states.”

eleanor.duncan@ft.com