First established by the government in 1994-95, venture capital trusts (VCTs) and enterprise investment schemes (EISs) have since become a major draw for investors and can form an important part of the intermediary’s toolkit. But a key element of the products’ appeal – a generous helping of tax relief – has meant they have increasingly attracted the attention of the chancellor.

Each Budget brings with it fears that favourable tax conditions detailed in Table 1 could be taken away, or onerous new rules put into play.

These anxieties are not entirely unfounded. As recently as 2015, rule changes made it harder for VCT managers to find qualifying companies to invest in. EIS vehicles have faced their own constraints – the schemes were barred from investing in renewable energy in early 2015.

Table 1: Tax relief for EISs and VCTs

| Scheme | Annual amount individuals can claim relief on, under new rules | Income tax relief | Minimum qualifying period for share relief | Tax payable on dividends |

| Enterprise investment scheme | £2m | 30% | Three years | Yes |

| Venture capital trust | £200,000 | 30% | Five years | No |

| Source: HMRC. Copyright: Money Management |

The latest Budget, delivered in November, has left tax-efficient investors with a fresh set of changes to digest. The government’s latest approach has met with a warm response from industry figures. But it brings a range of challenges and opportunities for intermediaries.

Skin in the game

The measures unveiled by Philip Hammond seek to encourage support for potentially high growth, “knowledge-intensive” companies, operating in sectors such as technology, while ensuring that EIS and VCT structures are not “used as a shelter for low-risk capital preservation schemes”.

This involves a combination of carrots and sticks. In the first category, the government will double the amount an individual can invest in knowledge-intensive businesses via EIS each year to £2m. The amount of money that such firms can receive from VCT and EIS structures will also double, to £10m a year.

On the other side of the approach is a plan to introduce a new test, which will “reduce the scope for and redirect low-risk investment” out of the VCT and EIS space.

Some of these changes should be of little concern to intermediaries. The increased amount businesses can receive from such funds will have little direct effect, while the doubled allowance for EIS investment is only likely to be of relevance to the very upper echelons of the private client world. According to HMRC figures, just 150 people invested the entire £1m allowance in 2015-16.

“The big headline was the doubling of the EIS allowances for knowledge-intensive companies,” explains Tilney managing director Jason Hollands. “[But] these are a narrowly defined type of business with high levels of [internal] investment, and in reality this will be of interest to a handful of very wealthy business angels rather than clients of advisers.”

Testing times

The most important news for clients is the introduction of the low-risk test, which will use a set of principles rather than strict rules or exclusions to make sure tax-efficient investors are backing riskier ventures. Advocates have played down the change, saying the measure has offered a greater level of certainty for the VCT and EIS sector.

Alex Davies, of Wealth Club, which caters for high net-worth individuals and sophisticated investors, says this move was viewed as “unexpectedly positive” for the industry.

“It had been widely rumoured that certain types of EIS and VCT, such as those that had assets, could be banned,” he adds. “There were also concerns tax relief might be restricted. Neither of these things happened.”

Others echo this view. Ian Sayers, of investment trust trade body the Association of Investment Companies (AIC), says: “Governments are always looking at new things [to back], but the tax relief has been preserved. The government is still committed to VCTs.”

From the next tax year, a “risk to capital” condition will apply, whereby HMRC will decide if an investment qualifies for relief. This principle-based assessment will judge whether it is a bonafide long-term investment involving a degree of risk.

“What HMRC doesn’t want is investments which are purely constructed for the tax relief,” adds Mr Davies.

A Treasury spokesman has confirmed that existing investments will not be affected. But for clients considering new investments, the equation has changed.

Ben Yearsley, of Shore Financial Planning, believes the immediate changes will be much more pronounced for EIS investors than those using VCTs, because the latter had largely eliminated asset-backed and low-risk investments, while EISs “had continued to exploit the rules”.

As such, EIS products will have to adopt a new approach to stay relevant. Investors using either of the two will find themselves potentially taking a more adventurous investment strategy.

“VCTs, which typically raise money via top ups to existing products, will gradually creep up the risk scale as existing lower-risk investments are sold and are replaced by earlier stage, higher-growth opportunities,” he adds.

“This isn’t necessarily a problem, but what it will likely mean is that dividend payments will become more inconsistent.”

Intermediaries now need to assess what is right for clients. Those worried about a shaky dividend stream may feel uncomfortable about the changes. The new approach may not suit older clients, or others who could have a lower tolerance for risk.

Education, education, education

The test could have several positive effects. Some clients may take an interest in these products because greater risk, in theory, promises greater reward. More importantly, the changes make it easier to compare and contrast different offerings.

“What it does in the medium and longer-term is bring around quite a lot of clarity because everything is growth-focused,” notes Guy Tolhurst, managing director of alternative investments specialist Intelligent Partnership. “It puts them in the same risk-reward bucket.”

Such clarity has major implications for the sector. It simplifies life for investors, while potentially boosting transparency and driving greater competition between providers. But in the short-term, the onus on growth investing is likely to create more legwork for advice firms.

“This year there should be a lot of recalibrating client expectations and understanding of growth and the underlying companies that target growth,” says Mr Tolhurst.

“Before, you might have had capital preservation mandates, closely controlled by the fund manager, so it’s relatively predictable. Now you might have money invested across at least 10 portfolio companies. Three in 10 of those could fail. Advisers need to tell their clients that the failures happen before the wins.”

This approach should extend beyond client conversations, according to Mr Tolhurst, who emphasises the need to have conversations about the risks involved.

“Due diligence has never been so important,” he says. “When a loss hits it may be two or three years since a client was warned about this. So documenting the audit trail, how you arrived at that decision and how you prepared the client for losses before success will be really important.”

Supply and demand

Shifts in the rules affecting tax-efficient vehicles have led to a fluctuation in supply and demand over recent years.

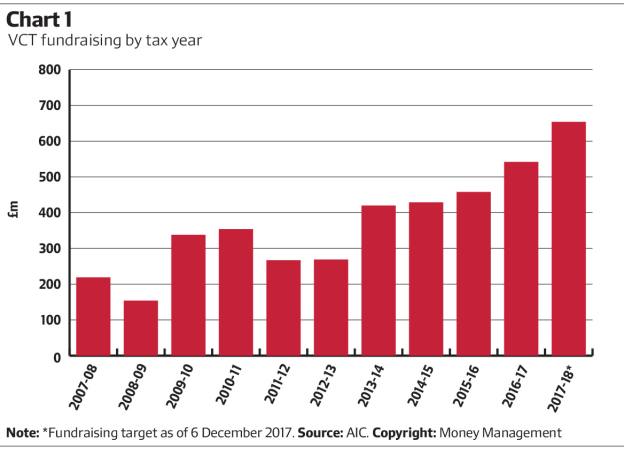

In the 2016-17 tax year, VCTs raised £542m, the second highest amount on record, according to AIC figures set out in Chart 1. This came about after cuts to pension allowances pushed savers to seek out other tax-efficient ventures. At the same time, supply was hampered by European rules that prohibited VCTs from recycling funds into management buyout and replacement capital deals.

Expectations for the 2017-18 tax year are higher still. As of 6 December 2017, £386m had been raised against a target of £654m, with commentators predicting another bumper period for fundraising.

The high target for this year has been put down to the fact that managers have digested the rule changes of recent years. Insiders also believe firms had been attempting to pull in money earlier than usual, particularly in the run-up to a Budget they feared would herald a crackdown on the sector.

Given the volume of money flowing into the likes of VCTs, managers may struggle to deploy all of this cash immediately. As such, investors may experience an initial ‘cash drag’ on returns.

Despite high levels of demand, it typically isn’t until the last few months of a tax year that much of the fundraising for tax-efficient products takes place. Specialists believe that, while a ‘year-round’ approach to investing in these products would be desirable, this looks unlikely.

“People tend to look at things relatively late in the day. I would like to think people will change but I think the reality is it’s more a necessity rather than a conscious decision,” notes Mr Sayers.

Improvements to be made

The government’s latest action may have given VCT and EIS managers a sense of longer-term security, but there is still much to be done before certain investors give the schemes their blessing. Some worry, for example, that in areas such as fees, transparency and performance, these vehicles still lag their mainstream peers. One fund buyer, who wished not to be named, describes them as “10 years behind” mainstream funds such as Oeics in this regard.

In their favour is the fact that, as listed vehicles, VCTs are subject to rigorous reporting standards. Meanwhile Mr Sayers has been quick to defend performance, and noted that the higher costs of tax-efficient offerings were down to the due diligence involved. But some believe more could be done.

“Fees and performance will be much more important than they have been before. This year, there have been increases in initial fees and AMC,” says Mr Tolhurst.

“It may have been driven by the changes in the Budget and the cost of sourcing deals. I hope that fees will be more heavily scrutinised by the advisers as they sit in the same risk/reward bucket. Competition should drive that.”