What sort of income strategies can be used within a portfolio?

Variety, they say, is the spice of life and to some extent, that sentiment is true of an investment portfolio.

Obviously, everything depends on the individual clients' circumstances, financial capability, sophistication, tolerance for loss and appetite for risk. Some like a lot of spice; others have a palate more suited to bland, staple investments.

But for all types of clients, there are many types of (regulated) income-generating investments which can be put into a multi-asset portfolio. There are also unregulated ones which must come with advice, and then there are some that are probably best avoided.

The majority of multi-asset portfolios will contain some exposure to fixed income investments, whether funds investing in bonds, or individual bond securities.

These can include a host of fixed income securities with some very interesting names and make-up (Co-Cos or Pandas, anyone?) but essentially the most common mixture are sovereign bonds from any government, in any currency denomination; or investment-grade corporate bonds - again, from any country and in any currency; as well as higher-risk, lower-rated credit (often called 'junk bonds').

But when spreads are tight between all the various types of bond, and the yields are compressed, investors need to look beyond the realms of pure credit to find their desired levels of income.

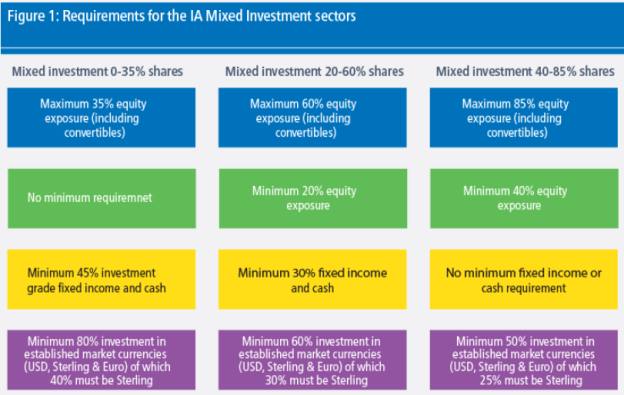

The three main Investment Association sectors which contain the lion's share of multi-asset and multi-manager retail investment funds are Mixed Investment 0-35% Shares, Mixed Investment 20-60% Shares and Mixed Investment 40-85% Shares.

As the table below, provided by Aviva Investors, shows, fund managers whose multi-asset portfolios sit within these three sectors do have some flexibility in terms of what they can invest in, within certain parameters.

Equity income

This is why multi-asset funds will also seek to diversify across other types of income-generating investments.

Patrick Norwood, insight analyst for Defaqto, explains: "One of the most common strategies is diversifying across the different asset classes likely to produce income, such as equities that are expected to pay high dividends, bonds and property."

Equity income has indeed proved popular over recent years, particularly as listed companies in the UK, US and even in Japan and China have started to raise or issue dividends to shareholders.

Bob Szechenyi, investment director for Rathbones, comments: "As a house predominantly invested in equities, we would derive most of our income from shares.

"However, we believe it’s important to diversify your sources of income, and would most likely use a combination of equities, fixed income strategies and property vehicles."

Derivatives

Another way of generating and maintaining an income payout is through the use of derivatives within a multi-asset portfolio. Essentially, this is akin to an 'insurance' on the portfolio, making sure that even in a tough environment, the fund will be able to meet its income obligations to clients.

Mr Norwood comments: "In this case the fund will seek to sell call options (usually monthly), on the individual positions held within the portfolio.

"The derivatives will have the effect of 'topping up' the fund's income when the assets fail to produce enough of it naturally, but will sacrifice some of the returns when they are greater than a certain level.

"These funds will normally have a specific target income yield."

Not all managers use derivatives or such portfolio protection; many rely on diversification and managing the associated risk.

Stephen Crewe, director of Fulcrum Asset Management, has expressed the view the "obvious advantage" of mitigating risk through portfolio protection and diversification, is that if one can maintain capital while others are suffering drawdowns, opportunities emerge to make investments at 'fire sale' values.

Commenting in FTAdviser, Mr Crewe acknowledges: "Absolute return strategies can be implemented in ways that generate real, distributable income while following an identical underlying investment strategy."

Alternatives

Depending on how much the client is willing to pay for the management of the underlying funds in the portfolio, and depending on their risk tolerance and investment time horizon, other assets can be considered.

One of the most talked-about recently is property. This can have significant returns in terms of rental yield, far above the 0.5 per cent bank base rate - and even lower returns on cash savings accounts - and currently outstripping the CPI, at 2.7 per cent and on par with the RPI, at 4 per cent (as at 15 March).

For example, according to Savills, prime City (London) rental yield on commercial property is 4 per cent, while Knight Frank puts the average residential property yield across the UK's main cities between 4 per cent and 4.25 per cent, as at 28 February 2018.

Infrastructure, aircraft leasing and litigation finance are also becoming popular within some multi-asset portfolios, as well as in some self-invested personal pension and small, self-administered schemes for income-hungry pensioners with a high risk appetite.

Tim Morris, IFA for Russell & Co Financial Advisers, commented: "In addition to the standard fixed interest, alternatives are increasingly being used as a diversifier.

"Fund managers with serious financial clout can invest in several multi-million pound infrastructure projects. This can produce alpha within their portfolio."

He caveats the use of these by adding: "On that topic, I wouldn't want exposure to all infrastructure firms. Just look at the knock on effects of the Carillion debacle."

Additionally, not all multi-asset managers are comfortable with ramping up the risk simply to chase yield.

Mr Szechenyi says: "We would not invest in more esoteric areas of the market such as litigation finance or aircraft leasing, where headline yields might look optically attractive but do not necessarily compensate you for the underlying risk."

Risk and taxation

For Joe Roxborough, chartered financial planner at Ascot Lloyd, a good income-generating multi-asset fund isn't necessarily one that only focuses on income at any cost.

He says there are two reasons why he is averse to doing so: taxation - given the government has reduced the tax-free allowance on dividend income from £5,000 a year to £2,000, and diversification.

Mr Roxborough says: "By focusing solely on a nice income, you are limiting your investment options and reducing diversification within the portfolio as a whole.

"In addition, you are perhaps not paying due attention to the inherent risk of the investment itself.

"There may be a very good reason a fund is producing double-digit returns when no-one else is, and that might not be due to clever management. Berkshire Hathaway, by contrast, the investment conglomerate of the most famous investor of all time, Warren Buffett, has never paid a dividend."

Not the be-all and end-all

While multi-asset portfolios have the ability to invest far and wide to generate income, chasing yield via various strategies and stratagems is not always the answer to the investor's desire for a regular payout.

The more esoteric the income stream, the higher the risk of the overall portfolio, and managers and advisers alike are not keen to run their clients' portfolios up the risk curve just to get that extra bit of yield.

Mr Szechenyi explains: "We prefer sustainable sources of income which are derived from higher quality, cash-generative companies, where the cash can be reallocated into the business – a progressive dividend stream should therefore take care of itself."

"In short", says Mr Roxborough, "I would check the tax situation and not put 'natural' income production as the number one factor in portfolio construction.

"Instead, think about safe withdrawal rates from the portfolio, factoring in for inflation and costs, as well as having a cash buffer for particularly poor years. This takes a bit more effort but you will be rewarded with a more diverse portfolio and, in many cases, a lower tax bill."

Ultimately, as Mr Crewe has expressed, traditional approaches to income generation, such as cash or government bonds, are no longer "viable solutions for income-seeking investors", especially when combined with annual drawdowns from the fund.

Therefore, while maximising the income of a portfolio is a "legitimate goal", he warns this must always be done with "a close eye on associated risk".

simoney.kyriakou@ft.com