As for disinvesting drawdown funds, there is an argument that if the client requires provision of income for the next 30 years, then a significant portion of capital would have to be earmarked anyway.

Of course, there are many ways to generate income solely from an invested portfolio, for example:

- Natural yield – Retirees match off investment returns against their income needs. But a poor run of investment returns could mean lower income or capital erosion.

- Moving to more cautious funds – Assigning tranches of capital into more cautious assets to provide income over a set number of years. However, many of these funds still fluctuate in value.

Blending is more than just finding a good rate, it’s about shifting risks for the retiree. If GIfL is treated as a ‘pseudo asset’, it’s the only vehicle that can meet both of those requirements.

True blending for a personalised solution

There are two areas for consideration; the impact on the remaining capital, and the effect on the sustainable withdrawal rate.

By securing an underpin of guaranteed income, the retiree (and adviser) are able to rebalance the remaining equities, incorporating the GIFL as part of the portfolio.

The real question though is whether this provides an income rate for the retiree that is sustainable for the rest of their life. To do this, we can look at replacing the bonds element of an example portfolio with a GIfL.

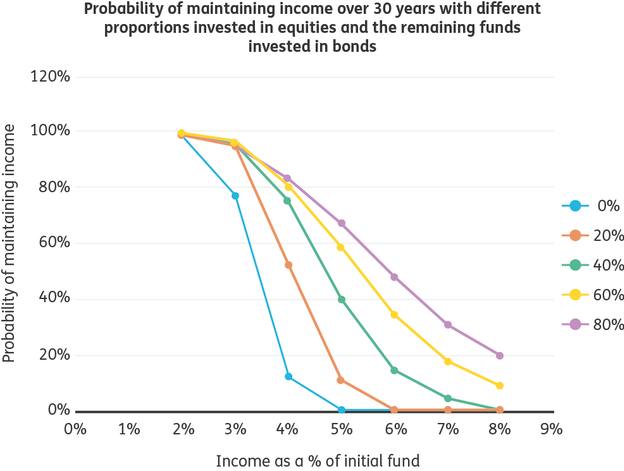

In chart 1, we have stochastically modelled the probability of maintaining income over a 30 year period.

This is based on a balanced set of equities, and investment grade bonds.

Chart 1

his shows that the higher the level of income taken, the probability of sustaining it changes in accordance with the mix of equities and bonds held. If the portfolio has 40% equities and 60% bonds, there is a 40% chance of maintaining income at 5% over 30 years. This also reflects the results shown by Morningstar in their recent paper, so shows consistency in results.

If 60% equities and 40% bonds is used, then the probability moves to 60% chance of success of delivering 5% income sustainably.

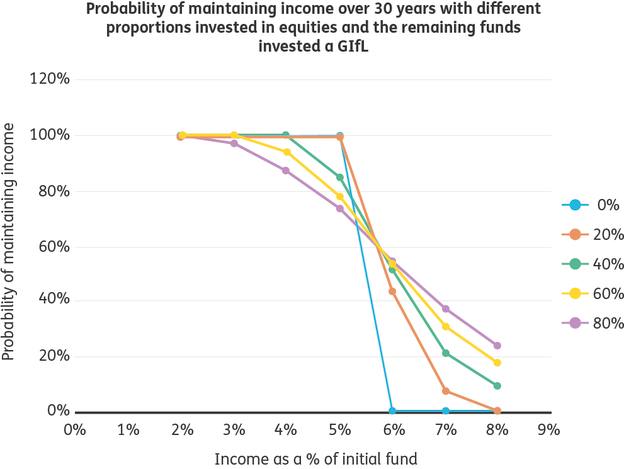

Now taking it a step further, what happens when we strip out the bonds element, and replace it with a GIfL. This example assumes 65 year old in ‘reasonable’ health, which generates an income rate of 5.8%, and uses the same stochastic simulations.

Chart 2

Now we can see that the curves have shifted to the right. If we examine the 40% equity holding again, then the probability of sustaining 5% income has increased from 40% in the previous chart to 84.9%. (To clarify, the 0% equity holding will fall away from 100% probability to 0% after the 5.8% income level, as this is would be the rate of income paid under the GIfL).

Looking at a higher equity content of 60%, the probability of sustaining 5% income is pushed up from 60% to just under 80%. Using GIfL even at higher withdrawal rates, still increases the probability of maintaining income, as the volatility found in bond funds, as well as the chance of a negative return has been removed.

Summary