One of the most interesting, and divisive, economic thinkers of the present age is Thomas Sowell.

Mr Sowell is of African-American heritage and grew up in a single-parent household in Harlem, New York. Initially unable to finish high school for financial reasons, he later joined the army and then studied at Harvard, becoming a professor at Princeton.

Among the more influential of his ideas is that of “the general glut”. This is the idea that recessions are caused not by an absence of demand for goods and services in the economy, as advocates of Keynesian economics argue, but rather by an oversupply of goods and services.

This excess eventually leads to companies going bust, pushing unemployment upwards, a further reduction in demand, and a vicious cycle that sees the gap between supply and demand widening again.

In the years after 2010, it seemed as though the UK was heading in this direction, with Merian fund manager Richard Buxton being among those who noted that domestically and in the rest of the world, “there is an oversupply of everything except oil”.

According to Mr Sowell’s analysis, this should have led to higher unemployment in the UK, with companies cutting jobs because they were unable to sell products.

There are many UK-specific reasons why this didn’t happen, including demographic changes, with a cohort of workers born in the 1960s starting to retire en masse, freeing up jobs for those entering the labour force.

Alternative ideas

Bank of England chief economist Andy Haldane says there is another reason. He and colleagues at the BoE believe the policy of quantitative easing helped to preserve jobs. They argue that by keeping interest rates low, and pumping cash into the system, the central bank ensured companies were able to finance themselves in a cheap way, and stay in business longer, despite having profitability hit by the oversupply in the economy.

The downside of this was that those companies had little scope to raise wages, creating the counter-intuitive situation where employment is increasing but wages are not.

Unconventional monetary policy can only ever have a limited lifespan. Eventually, interest rates must rise, and when they do, the more traditional effects of a ‘general glut’ might be expected to take hold.

One longer-lasting impact on the economy of those ‘zombie companies’ being able to stay afloat is the negative effect on the long-term growth rate of the economy. This trend is less influenced by the day-to-day events of politics and public policy than by the pace of innovation in the economy.

Companies that can stay in business, but which earn little economic return, have neither the capacity nor the incentives to spend cash on ways to become more innovative, as the market for goods and services is not expanding rapidly enough.

If interest rates are rising, then innovation should be taking place. That is because the pace of economic growth is expanding, justifying an increase in expenditure on research and development, and potentially leading to a rise in the trend rate of growth.

The problem with this scenario is that just as companies begin to feel confident about expanding demand for their product or service, and so feel justified in lifting R&D spending, interest rates rise as QE comes to an end. This will lead to a greater reluctance from banks and shareholders to fund the sort of speculative investing that comprises much of R&D, thereby reducing the chances of this actually happening.

Cycle path

That is the opposite of what typically happens in the business cycle, as previously discussed in this column. The traditional cycle sees companies using periods of low interest rates to invest some of their capital in innovative ideas, while early-stage and blue sky companies attract capital from investors eager to keep their cash away from the low interest rates offered by banks. This creates a wave of innovation – much of it into products that are poor investments, but the best of the innovation survives the cull caused when interest rates rise, helping to lift the long-term trend growth rate of the economy.

QE has interfered with the way the business cycle typically works. While the full consequences of the economic upheaval caused by this policy may not be apparent for years to come, global equity investors may start to view the UK negatively if they view the path of UK economic growth being directed more by the vagaries of monetary policy and less by long-term trend growth.

This development would have similarities with the way eurozone equity investments are currently viewed by some: attractive investments when global interest rates are low at a time of general growth, but to be avoided as rates rise. Over time, this is likely to lead to a decline in the valuation of UK shares relative to those of other developed markets.

Doubting domestic shares

Simon Edelsten, a global equities fund manager at Artemis, has an aversion to investing in UK equities because he believes the areas of strongest structural growth in the world, including healthcare, are not well represented in the UK stock market.

An economic scenario wherein interest rates, not innovation, are the driver of UK growth would reinforce the negatives Mr Edelsten sees in the domestic stock market.

On top of this comes the potential impact on long-term trend growth of the UK leaving the EU. Mr Haldane says the major impact of the UK’s departure will be on this growth rate, which the BoE has revised downwards from 2 per cent annually to 1.5 per cent.

He suggests this reduction in the trend rate of growth is the result of a decline in productivity, caused by an expected drop in population as the level of immigration into the UK falls.

Mr Haldane’s view is that an increase in the number of workers in an economy boosts productivity, and that because migrant workers are more likely to be of working age and doing higher-skilled jobs, they are in aggregate more productive than indigenous workers. Hence a decline in inward migration reduces the level of productivity and the long-term growth rate – a shift that would ironically push the UK’s economic model closer to that of many eurozone countries, where asset price movements are more closely linked to the global economy than to domestic political events.

Mr Haldane also notes that any sort of deal that restricts trade is also likely to be harmful to productivity and to drive down long-term trend growth. His comments are all predicated on there being some form of an exit agreement between the UK and the EU.

The idea of a supply glut is not universally accepted. The economist Ann Pettifor, who advises the UK Labour Party, among other roles, takes the view that there is no such thing as too much supply, only insufficient demand, and therefore the response of politicians should always be to increase demand.

Output gap

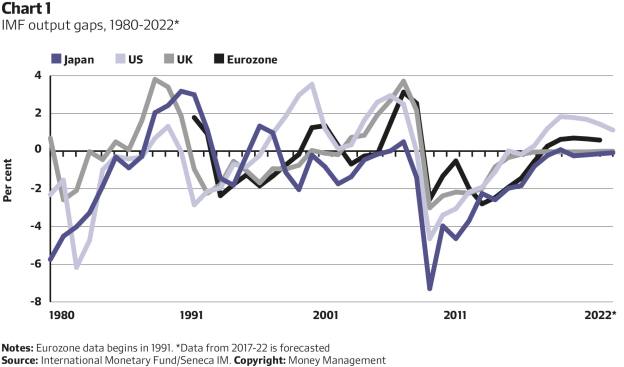

An examination of the tepid levels of UK GDP growth and wage growth in the decade since the financial crisis gives some credence to this argument. But as Chart 1 shows, the UK economy is already growing at close to the level of its long-term potential. That should indicate inflationary pressures are brewing in the system. The fact that growth is weak while still being above the trend level – known as a positive output gap – indicates that many of the travails of the UK economy are structural in nature, rather than cyclical, and so would be less responsive to a stark increase in government spending.

A positive output gap at a time of low growth indicates that while interest rates are likely to rise, it will be to a level lower than has historically been the case. For investors, this is likely to boost companies listed in the UK that earn revenues overseas, while harming businesses such as banks that do well when the UK is growing.

David Thorpe is investment reporter at FTAdviser.com