The latest shift saw the Treasury announce that EIS rules would pivot to ensure the focus was on “knowledge-intensive companies”.

It follows previous concern from regulators that EISs were too focused on “capital preservation”, whereby investments were made with the aim of simply not losing money, and the tax breaks alone providing the return on investment for the underlying client.

Alex Davies, who runs investment specialist Wealth Club, says: “Last year about half of the money that went into EIS funds was of an asset-backed/capital-preservation nature, such as pubs, wedding venues, storage businesses, films, and so on.

“The new rules mean money has to go into far more growth-orientated deals. These are more risky than the old-style deals, but do offer the potential for much higher returns.

“With asset-backed investments, everything was relatively predictable. You don’t expect anything to go massively wrong or spectacularly well. In other words, the best manager will not perform much differently from an OK manager. With early-stage investments it’s a completely different story.

“Things can and do go massively wrong or spectacularly well. And the role of the fund manager or fund management team is absolutely crucial.”

The rules governing the VCT sector have been altered in similar fashion, tilting the focus towards investments that involve placing capital at risk, rather than asset-backed businesses.

More change may be possible on this front: FTAdviser reported in early November that Treasury head of investment tax Donald Stark said the government would be “viewing, with interest, whether the types of investments being made in 2018 and beyond are different from those that have been done in the past”.

The question now is whether the regulatory shifts will have any impact on interest in the sector – and managers’ ability to invest the money that does come in – or whether the wave of excess pensions money will continue.

A banner year

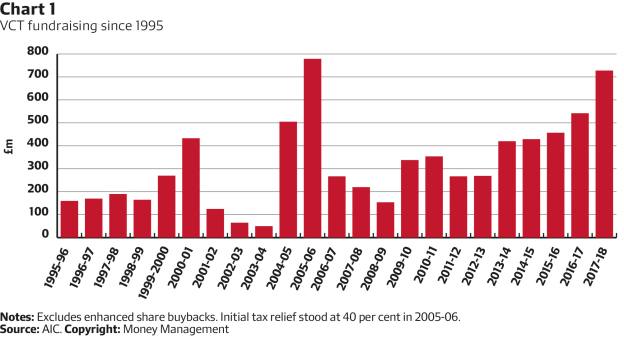

VCT funds raised the second-largest amount ever from investors in the 2017-18 tax year, as Chart 1 shows. The final figure was in excess of £700m, driven by investors having maxed out their pension allowances and a rush to get in ahead of possible changes regarding the eligibility of underlying investments.

Richard Hoskins, co-founder of consultancy Kin Capital, says “there are very few VCT firms that have not had to change their spots” to react to the rule changes introduced in recent years.

He adds: “Some of these rule changes are only now starting to bite, and the ability of managers to deploy cash at sensible valuations is the number one issue in the VCT market at the moment. There are some great VCT managers that care about investors, are transparent, and can deploy capital. But there are not enough. The VCT market is in need of new entrants.”

Jason Hollands, who runs the VCT business at Bestinvest, within the Tilney Group, says he thinks it is unlikely that fundraising for the 2018-19 year will top the amount secured in the previous 12-month period.

He explains: “Many of the VCTs that raised significant sums last year still have cash to deploy. The rules have also changed here, requiring them to achieve a minimum of 80 per cent invested in qualifying investments, up from 70 per cent. Some of last year’s fundraisers either won’t be back this year at all, or else will look for more modest sums.”

Mr Hollands predicts future fundraising cycles will see VCTs raise more modest amounts, but on a more regular basis, in accordance with the fact that early-stage companies typically require several rounds of follow-on financing, rather than a single tranche. That would mark a notable change from previous activity, which saw many VCTs back management buyouts at profitable, relatively mature businesses.

But Mr Davies says he believes the total raised by VCTs this year will be similar to that seen in 2017-18, with demand again driven by pension investors.

Underlying investors

Will Fraser-Allen, deputy managing partner at VCT manager Albion Capital, says that while the tightening of the rules has narrowed the range of companies into which funds can invest, this had not led to an erosion of value for the underlying investor. He says this is because the rules encourage investment into businesses with intellectual property, and in particular technology businesses.

As a result, Albion has recently increased the resource it uses to seek out technology companies in which to invest. With more entrepreneurs seeking to enter this space, Mr Fraser-Allen says the supply of firms in which his funds can invest is expanding at least as fast as capital enters the VCT sector, despite the rule changes.

But not all managers are able to deploy capital quickly, and this is a particular problem for those running EIS. Mr Clark warns of a continued “capacity crunch” as the sector grows in size, with firms unable to use funds within the standard 12-month timeframe.

The consequences of this for investors is that they may not receive the EIS tax breaks as intended. Under HMRC rules, the investor only becomes eligible for the tax break once the capital has been deployed into a qualifying company, not the EIS itself. If it takes more than a year to invest the cash, the tax break may be triggered in a different year than was intended by the underlying investor.

Mr Clark says the way investors can avoid this is by placing the capital into the EIS early.

Mr Hoskins echoes this, agreeing that changes to the rules governing the types of investments that these portfolios can seek out is causing delays.

Ultimately, as the sector adjusts to the new reality, it is the product providers themselves who may put a cap on fundraising amounts this year.

Paul Latham, managing director at Octopus Investments, says he expects fundraising for VCTs to be lower this year as a result of the rule changes, forecasting something of a year of transition as companies seek to adapt. He agrees there are capacity issues on some fronts, and with VCTs not wanting to have capital they cannot invest quickly, they are likely to seek to raise less.

The elephant in the room is what happens if the government gives the go-ahead to allowing pension funds to dedicate a small part of their assets to the likes of VCTs, a proposal likely to be included in a forthcoming FCA discussion paper on patient capital. From a demand perspective, interest in this kind of venture capital isn’t likely to ebb any time soon.

David Thorpe is investment reporter at FTAdviser.com