Traditionally, fixed income plays an important role as a risk dampener in a portfolio, as well as providing income, liquidity and return.

However, in the years following the global financial crisis, some investors were reaching for yield by shifting their bond allocations towards higher-yield funds or towards flexible fixed income strategies.

Market sell-offs always trouble investors, and often prompt a rethink of asset allocation decisions.

When considering fixed income exposure, a key question to ask is whether it is providing adequate protection from equity market volatility.

While a shift towards higher-yield funds have benefited some portfolios in the short term, as the macroeconomic environment evolves and accommodative monetary policy comes to an end, investors are now questioning whether such an approach is suitable for the long term.

Since the crisis, central banks in the US, UK, Japan and Europe embarked on extensive quantitative easing programmes to support their economies.

Key points

- Fixed income has historically been a risk diversifier in a portfolio

- Investors have been piling into high yield to get better returns

- They may not be getting adequate compensation for the risks they are taking

They built up their balance sheets by buying government, corporate and securitised market debt.

They also lowered interest rates in an attempt to stimulate growth. These expansionary policies led to two key outcomes for the bond market: a fall in yields and a tightening of credit spreads.

Essentially this is indicating that investors are getting less compensation for the risk they are taking.

This in turn led investors to reach for yield and take on more credit risk, as they move out of higher-quality investment grade asset classes and into lower-quality high yield investments.

Flexibility could be risky

Investors have also turned to flexible fixed income funds as they look to navigate the uncertain interest rate and volatility environment. These funds typically have sizeable allocations to high yield to boost returns.

This shift could be seen in high-yield fund flows, which markedly increased in 2016 and 2017.

Why is this a cause for concern now?

While some quantitative easing remains in place, accommodative policy is coming to an end. As the global economy continues to grow, we expect interest rates to normalise and volatility to increase.

As this happens, risk –which has fallen due to accommodative policy – could increase and revert to historical levels.

In effect, investors who have sought yield or moved into flexible bond strategies may be unaware of how much risk they are taking on.

They could be in a position where their current fixed income exposures (to areas such as high yield) may not meet their long-term strategic objectives.

Fixed income diversity

What does this mean for current fixed income allocations?

The traditional role of fixed income in a portfolio is to provide diversification away from higher-risk asset classes, namely equities.

However, the fixed income universe is diverse, and different bonds have different levels of risk. High quality government bonds, such as UK gilts, are typically considered to be risk-free, whereas a corporate bond may have a risk profile more similar to that of equities.

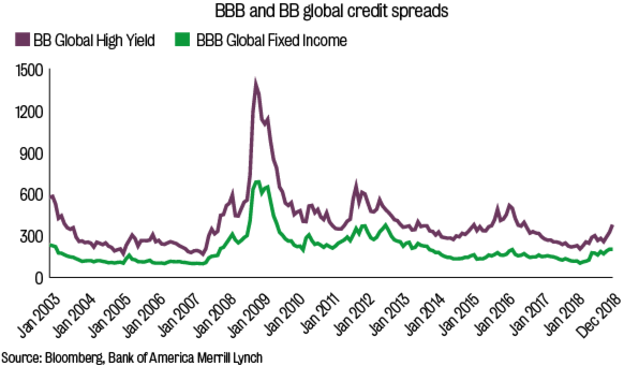

High-yield bonds typically have higher default rates than investment grade bonds but, as a result of quantitative easing, volatility levels have fallen, which has caused spreads in both sectors to compress.

This has arguably led to a positive skewing of certain risk measures, giving investors a misleading representation of the true underlying risk of the high-yield market.

Furthermore, as the central bank policy continues to normalise, risk could also return to historical levels and corporate default rates could increase.

The global BB-rated high yield market returned 12.5 per cent in 2016 and 8 per cent in 2017, while the global BBB-rated market – which is classed as investment grade – returned 6.1 per cent in 2016 and 5.4 per cent in 2017.

Since then, credit spreads have continued to compress and the yield pick-up between BBB and BB-rated bonds has narrowed, as can be seen in the graph above.

In fact, the spread difference is now lower than historical averages. Investors are taking additional risk without being compensated as they once were in a more uncertain market environment.

Is an active strategy worth the higher risk?

Flexible or unconstrained bond funds have gained significant traction since the crisis.

They typically take the form of go-anywhere investment strategies, where active views are taken across credit, interest rates and currencies.

Though these funds can add value to a portfolio, they can carry higher risk. It is worth taking into account that if a fund takes large interest rate bets, the diversification quality of fixed income can become eroded.

This is because the duration element within fixed income typically works to keep correlations to equities lower.

So, how should investors respond?

As monetary policy normalises, investors who had made changes to their bond allocations should consider reallocating back in line with their long-term investment objectives.

Remember: fixed income, within the context of a wider diversified portfolio, is designed to provide:

• Diversification – away from higher-risk asset classes, such as equities, and act as a shock absorber in a multi-asset portfolio.

• Liquidity – that investors can draw upon, when required, without significant changes in value.

• Income – fixed income is a key source of stable income for investors.

• Return – higher-risk fixed income, such as credit asset classes, should provide a higher return relative to government bonds.

It is important to note that fixed income risk and return is asymmetric: if a bond issuer defaults, the investor could get nothing – in this way a bond investor can lose more than they can gain.

As such, while upside return is important, protecting the downside is key given the diversification properties of fixed income.

Investors cannot predict the future, but they can prepare for it.

Regardless of market conditions, investors can give themselves the best chance of investment success by choosing a suitable balanced asset allocation for their long-term goals, paying attention to costs and sticking to that plan.

Kunal Mehta is senior investment product specialist at Vanguard Europe