Picture a millennial: face glued to their phone, sipping a flat white and scrolling through social media while waiting for a taxi they hailed through an app.

It is no wonder then that, when it comes to competitive threats in the financial advice industry today, automated advice solutions are front of mind – especially when discussions revolve around the wants and needs of younger investors.

Appetite for automation

Given this, we focused part of our recent UK adviser-client survey on gauging investor attitudes to automation.

Perhaps unsurprisingly, younger investors – those under the age of 40 – showed a greater propensity to experiment with automated online services.

Of the 315 advised clients under 40 we surveyed, almost 70 per cent were either currently using, or said they were likely to use, a robo-adviser alongside their financial adviser.

This is a service we defined as providing portfolio management advice using algorithms tailored to your appetite for risk, without human interaction.

Seeking more than advice

Although younger investors may be more willing to adopt robo-advice, our survey also revealed they tend to place a higher importance than their older counterparts on services we consider “holistic”.

This includes helping clients build financial self-confidence and prioritise their goals. These are the very services human advisers are best at providing and, coincidentally, are the hardest to automate.

For example, 84 per cent of investors we surveyed under the age of 40 considered behavioural coaching to be important, compared to just 71 per cent of older investors.

Similarly, 77 per cent of those under 40 felt it was important to explore their emotional relationship with money; this dropped to just 56 per cent of those aged 60 and above.

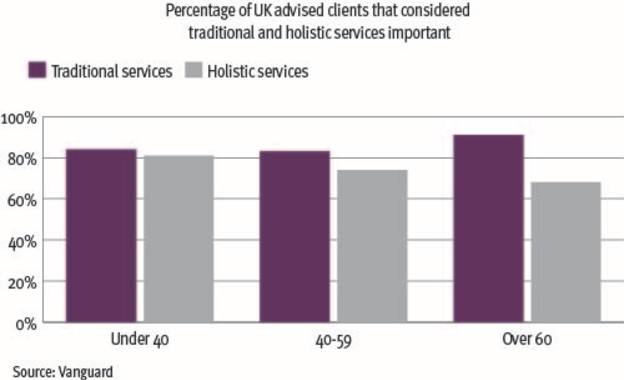

Younger investors also placed lower importance on the more “traditional” elements of advice, such as providing reports and fund recommendations – the services that are easiest to automate.

While this difference in preferences between traditional and holistic services is significant, our results actually showed that younger investors tended to rate all advisory services as highly important.

As the chart above shows, across the 15 services we looked at, the percentage of younger clients rating each as important ranged between 73 per cent and 86 per cent.

This was unlike the older groups of clients, where there was a much greater change in scores from one service to the next, reaching from a high of 95 per cent to a low of just 39 per cent.

We wondered what could be behind this apparent generational shift in attitudes. One idea was that it could simply be due to the life stage of these investors. Building financial literacy may be a higher priority for younger, less experienced investors.

Are younger investors really that different?

This raises the question: are the needs of younger investors different from their older counterparts, and if so, in what ways?

Growing up with technology and coming of age in the financial crisis will have undoubtedly shaped their experience.

But the key differentiator for younger investors is surely that they face far greater financial challenges than may have been the case for preceding generations.

Younger investors need to prioritise repaying their student loans, saving for a deposit on a home and investing for retirement and the expenses of later life, almost certainly without the security of a defined benefit pension to look forward to.

Although younger investors may demonstrate different behaviours in the way they consume advice, their underlying needs are not dissimilar from young people in preceding generations.

It would also be a mistake to think of them as one unified group. The millennial generation is arguably the most diverse to date and, spanning 15 years, their needs as investors will likely differ greatly within the cohort.

Millennials and Generation Z are a significant demographic, outnumbering baby boomers and Generation X combined.

Given their financial challenges, they potentially represent an enormous opportunity. One natural way to engage with the younger generation is as the heirs of existing clients. However, studies suggest the majority of advisers are not doing this.

The benefits of doing so are clear. Building relationships with clients’ children lessens the cost of acquiring business, helping save on time invested up front.

Furthermore, our survey results suggest this could increase the likelihood of successful referrals: 77 per cent of the investors under 40 who selected their adviser based on personal recommendation did so because it came from a family member or a friend.

The human element

It is evident from our survey that younger investors value the more holistic – and, crucially, more human – elements of the adviser-client relationship.

These are the very elements of advice that are least susceptible to automation. While younger investors’ openness to automated advice services may suggest a longer-term strategic threat, we strongly believe the model of advice with a human element will remain predominant.

Key Points

- Younger investors place more importance on human contact

- Younger investors face greater financial challenges than older investors

- They are best served with a combination of digital service and human interaction

These ‘digital natives’ are likely best served through a combination of digital means and good old-fashioned human interaction. In fact, we expect to see greater variety of advice models combining both elements, to best suit the preferences of each individual investor.

By leveraging technology, you can reduce costs, speed up your processes and streamline some of the key services you offer, such as portfolio management.

This frees up time to tailor your business to the unique needs of each client.

So while digitalisation may be the driving force behind some of the competitive pressures we see in the advice industry today, it may also be the solution for future-proofing your practice.

So go ahead, use that app to order your next coffee. You might be surprised how powerful an ally technology can be.

Georgina Yarwood is an investment strategist at Vanguard UK