Equity valuations is a multi-dimensional subject, considering various issues in essence around the organic growth outlook and risk factors affecting the price of a business.

An appropriate way to judge overall US equity valuations is to consider S&P 500 index data in this context.

Profitability and outlook

The US and global economic outlook are in the process of moderating, but remain constructive despite the uncertainties around trade tariffs and the (long) duration of the current upswing.

Despite some general concerns about the latter, there is little information in the absolute length of an economic cycle – it is more about potential real or financial imbalances – which are currently not of particular concern.

Key Points

- Some observers have concerns about high levels of profitability with US equity valuations

- One way to consider equity valuations is to bring price volatility into the equation

- We are currently in the proverbial ‘sweet spot’ for higher equity valuations in the current inflation context

Further to this, the current level of US economic growth above the preceding peak has not yet reached its historic average level. Most leading economic indices are moderating, but remain in expansionary mode.

Some have concerns about the current high level of profitability and expect a process of normality in this context. With the S&P 500 general capacity utilisation on its long-term average and the intense focus on business productivity – supported by the positive effects from technological advances – we believe businesses can maintain relatively good levels of profitability.

Absolute valuation levels

The intrinsic value of any business in essence represents the current value of all future proceeds.

This is clearly subject to numerous projections and personal views. The consolidated analyst consensus target valuation upside for the S&P 500 index constituents currently amounts to plus 10 per cent – not implying this may materialise anytime soon.

Many investors prefer earnings valuations in decision-making. Considering data since 1990, the S&P 500 is currently valued at an 18.8 price-earnings multiple, slightly lower than its average of 19.6 times.

In terms of 12-month earnings expectations, the index is currently trading in line with its forward price-earnings average of 17.2 times.

Both the free cash flow and dividend yields are moderately lower than their respective average levels (4.6 per cent vs 4.9 per cent and 1.9 per cent vs 2.1 per cent respectively). The dividend cover of 2.3 times in this context is also on its average level.

The current enterprise valuation/earnings before interest, taxes, depreciation, and amortization valuation of 13.1 is well above the average of 10.6 times.

Countering this, the total debt/EBITDA ratio of 4.2 is lower than the average level of 4.6 times, reflecting a higher than average profitability to debt level (without recognising the cash holdings). The current low interest rate environment clearly is a critical positive factor in this context.

Relative valuation levels

Valuations also have to be considered in the context of broader economic factors. The absolute level of interest rates plays a major role in this context.

The equity risk premium (the earnings yield minus the government bond yield) is currently plus 3.2 per cent – one standard deviation above its long-term average.

This reflects a relatively cheaper equity market. The current ERP equals the average should we consider only data since the credit crisis (a conservative approach over an era of ultra-low interest rates).

On a similar basis, the free cash flow yield spread with the bond yield is currently half a standard deviation above its average. The dividend yield is more than one standard deviation above its own average.

A novel way to consider equity valuations is to bring price volatility into the equation and assess the level of euphoria or despair in earnings valuations.

Interestingly enough, also on this basis the current valuation is close to its average level, reflecting a disciplined marketplace.

Inflation

The level of inflation is a critical factor in equity valuations, for various reasons.

The current environment of low and stable inflation reduces economic risks with a more certain business outlook, in sharp contrast to the pre-1985 era.

The Alan Greenspan Goldilocks phase of a ‘not too hot, not too cold’ economy with its benefits also comes to mind in this context.

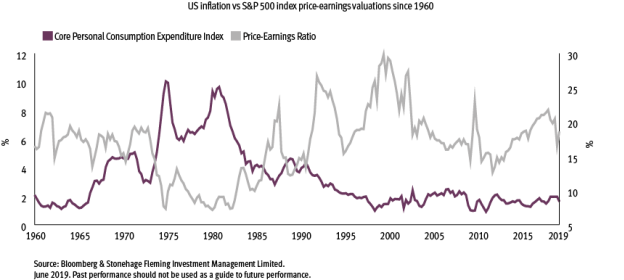

There is a clear historic correlation between inflation and earnings valuation levels, as reflected in the chart.

We are currently in the proverbial ‘sweet spot’ for higher equity valuations in this inflation context. With personal consumption expenditure at 1.6 per cent and consumer price index at 2.0 per cent and a continuing benign outlook, the current 18.8 times price-earnings fits well into both the first two inflation categoriesin the chart.

There is no single good answer to the question of the level of equity valuations. Considering all of the above information, we can, however, make a case that valuations are fair barring an unexpected economic shock.

Different investors have different approaches in considering their investment activities.

Some look for cheap entry points to increase the probability of fair future returns and are willing to wait for below-average valuations before getting tempted into the market.

They may put a lower consideration to the economic or business outlook.

We do not perceive the current market circumstances to offer these investors that many opportunities.

Against this, others may first consider the quality of the potential investment and the sustainability of its future organic growth potential and then consider its valuation metrics.

They may have less risk of their businesses disappointing and may be more comfortable with the higher level of valuations we see currently.

Gerrit Smit is head of equity management at Stonehage Fleming