Their prices are typically set according to supply and demand.

Other coins such as Ripple, Ethereum, Litecoin and Bitcoin Cash among others, have also gained popularity with the investment community.

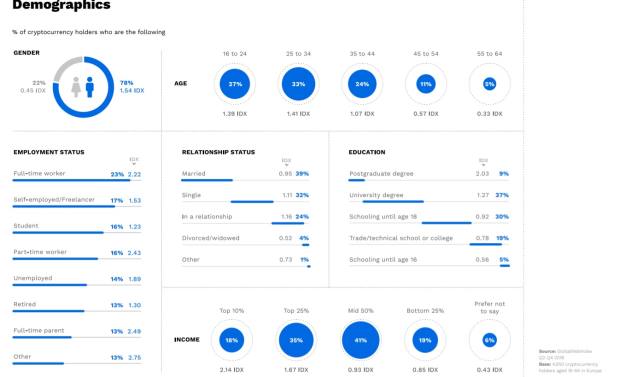

So who is investing in cryptocurrencies?

Across Europe, London has the highest concentration of cryptoholders, according to research by Global Web Index, in partnership with Bitpanda.

The study found that the level of cryptocurrency is related to:

- The youth of the market

- The share who work in engineering, financial services or banking

- The proportion of people who fall into the highest income group

Compared to the average internet user in Europe, cryptocurrency holders are more likely to be:

- High-income males working in European Financial centres in IT, engineering or finance

- Educated to a postgraduate level

- Under 35

- A full-time worker or freelancer

However, this stereotype is being challenged by increasing diversity as one in five cryptocurrency holders are women, and 40 per cent are over the age of 35.

There is clearly growing demand and interest about cryptocurrency investments.

Source: Global Web Index / Bitpanda

Simon Peters from cryptocurrency trading firm Etoro says: “Based on our own data, investors come from a range of backgrounds, rather than there being any one single group or investor-type.

"For us, perhaps the most interesting point about cryptoinvesting is how it’s attracted lots of younger or even first-time investors. These are people who would never have considered the idea of ‘investing’ before but have begun to learn about this world through crypto. The next task is to get them investing in other assets like stocks and bonds."

Additionally, cryptoinvesting is also popular with family offices and institutional investors.

Adviser clients are also very much part of those interested in cryptocurrencies.

According to an Etoro study last year, more than three in five (63 per cent) financial advisers in the UK have been asked about cryptoassets by their clients.

Despite this, most advisers are not yet in a position to provide information or guidance to their clients in response.

Mr Peters says: “The history of investment, and development of the crypto industry, however, suggest this may not be the case in another decade’s time.

“We are confident that in the future crypto will form part of a diversified portfolio for clients with an appropriate risk appetite across the wealth spectrum.”

Richard Byworth, chief executive of cryptocurrency and blockchain firm Diginex adds: "Once you touch cryptocurrency and start to look particularly at bitcoin and at the attributes of bitcoin the more you begin to understand this is interesting as an asset class.

"There's no question that pretty much every central bank in the world is devaluing their currency. The victims of this are people who are sat in cash of that nation state."

This is the trigger many experts say has led to the popularity of cyptocurrencies.

Russ Mould, investment director at AJ Bell

Russ Mould, investment director at AJ Bell says: "It may be no coincidence that Bitcoin and cryptocurrencies found fresh support just as equities wobbled, bond markets rallied and central banks did a policy U-turn, leaving interest rates as they are or even cutting them, rather than raising them.

"Bitcoin’s resurgence may reflect fears over the global economy and the prospect of lower rates for longer or even more quantitative easing if things get really difficult, as central banks lose control, although gold’s failure to perform this year does not fit with such a narrative.”

According to Mr Peters factors driving the popularity of cryptocurrencies, are:

First of all; cryptocurrencies are decentralised, meaning that they are not tied to central authorities or governments the way fiat currencies are. Their release is conducted solely as a result of mining and the whole system works exclusively on mutual trust of users.

Second; is the underlying blockchain technology they use. This digital ledger-style technology stores all the transactions that have ever been conducted. Every new block generated on this ledger must be verified by the ledgers of each user on the market, making it almost impossible to forge transaction histories.

A third reason is security. He says: “While hacks of cryptocurrencies aren’t unusual, their decentralised nature means that, unlike traditional banks, there isn’t one central point of weakness that can be exploited.”

But not everyone is convinced that it is a safe way to invest.

Mr Mould says cryptocurrencies:

- are still not universally accepted. Clients cannot buy their weekly groceries or pay their taxes with them.

- are subject to fraud (not that this necessarily distinguishes them from other forms or remote payment or investment).

- have no intrinsic value (though the same can be said for gold or paper money) and they do not generate a yield or cash (which some gold miners do, for example).

He adds: "Under such circumstances many clients and advisers may shy away or seek alternative portfolio diversifiers. But Bitcoin’s current resurgence is eye-catching and it may be that we are still in the early days of cryptocurrencies and blockchain-enabled payment systems."

As an investment, Adrian Lowcock, head of personal investing at Willis Owen, says cryptocurrency investment is a very high risk and very speculative type of investment.

He adds: “At a basic level I think this is more about the technology than the currency itself. As an investment we have seen how bitcoin has risen and fallen again and again.

“A lot of these cryptocurrencies and bitcoin included, have fundamental flaws in their design, which do not make them suitable as a currency.”

Philip Milton, financial planner at Philip J Milton says: “I am very much in the skeptical camp. You cannot have this thing as a currency, because it does not have a stable value and it does not have any substance behind it.”