As Chart 1 shows, that has ensured the EM benchmark remains below other global indices over the past half decade.

The problem for the asset class this year is that the dollar has not weakened as investors had hoped – despite the Fed cutting rates for the first time since 2008 earlier this summer. Increased nervousness over the prospects for global growth has strengthened the dollar’s safe-haven properties, even as US monetary policy loosens.

Faltering fundamentals

And despite many of these economic concerns centring on the health of the US, UK and European economies, EM fundamentals themselves are also deteriorating. In July, the International Monetary Fund cut its 2019 forecast for economic growth in emerging markets to 4.1 per cent, the lowest level since the financial crisis and notably below the 4.4 per cent predicted as recently as April.

The problems facing the asset class are such that the Financial Times published an article on July 16 with the headline ‘Does investing in emerging markets still make sense?’. Questions are now being asked about the long-held theory that EM economies will eventually converge with their developed market counterparts.

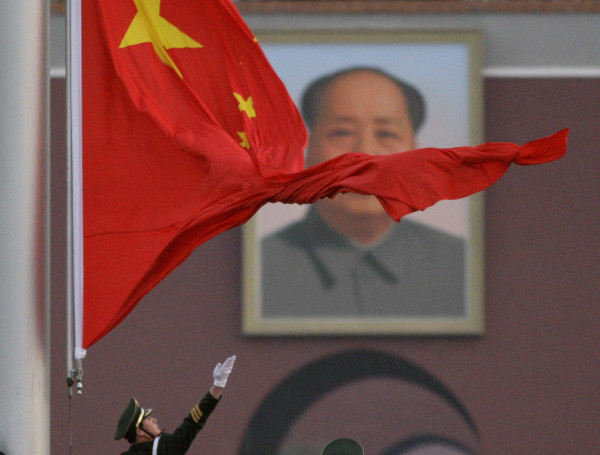

Indeed, growth rates in some countries are now slower than they are in developed economies. The demographics still favour developing countries, but the US-China trade war is having a particular impact on how investors view the world, for two related but distinct reasons.

The first is that it appears to be worsening a slowdown in the Chinese economy. The second is that it calls into question the globalisation thesis that has dominated conventional economic thinking for decades. Some of the drivers of recent growth appear to have already come to an end. The FT article noted that foreign direct investment into emerging markets fell to its lowest level since the 1990s last year.

Pockets of growth

But while a period of ‘deglobalisation’ would not bode well for the sector, advisers will be aware that not all EM countries are equal. Some have already benefited from the trade war – restrictions on Chinese goods helping boost export growth in nations such as Vietnam.

Emerging Asia in general could be seen as something of a sweet spot for the asset class. Despite cutting growth forecasts for China, India and south-east Asia in July, the IMF still predicts that emerging Asian economies will grow by a collective 6.2 per cent this year. That is little changed from the 6.3 per cent rate it predicted in April.