A preference for Asian equities is also apparent among UK professional investors – despite the growing travails of both the China and Indian economies. The latter is now wrestling with growth falling to a five-year low and a crackdown on shadow banking that has hurt consumer demand.

But discretionary fund managers appear buoyed by the attractions of emerging Asia. Research from Asset Allocator, a sister title to Money Management, shows that the average DFM Balanced portfolio now has a higher weighting to dedicated Asia ex Japan equity funds than it does to broader EM portfolios.

Longstanding uncertainty over the prospects for Russia and Brazil have also contributed to this shift. The latter may have returned to investors’ radar since a change of government last year, but the idea of the ‘Bric’ quartet as the main driver of EM growth is now a distant memory.

Leading lights

But when it comes to fund managers themselves, recent winners have tended to congregate around a handful of the same stocks. A look at Table 1, showing the top performing funds and trusts over the past five years, underlines this.

The top performer is a relatively unknown portfolio. Vontobel’s offering has more than £3bn in assets, but the vast majority of these stem from continental European investors rather than those in the UK. Its investments are less unusual, however: while its name emphasises a sustainable approach, many of its top holdings are akin to those in other standout strategies.

Chinese technology firms such as Tencent and Alibaba, as well as component manufacturers such as Taiwan Semiconductor, have formed the bedrock of many an EM investor’s portfolio in recent years. Vontobel ranks two in the top five and all three in its top 10.

In keeping with this, the three other leading portfolios over the past five years – run by Hermes, JPMorgan Asset Management and Baillie Gifford – also count these names among their top five or six positions.

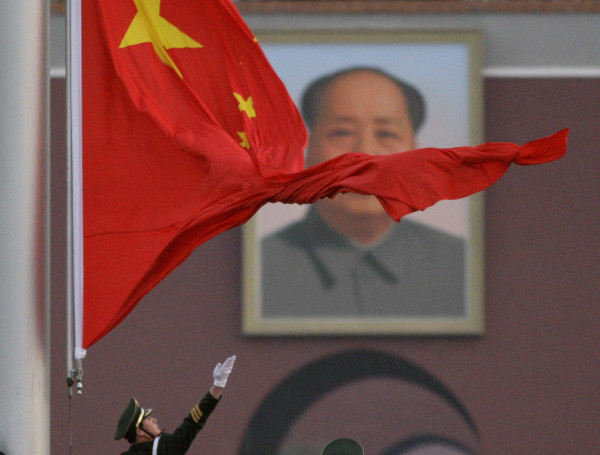

And there are other similarities outside the tech sector: insurer Ping An is held by three of the four funds. As these names suggest, China remains the focal point for the typical EM fund, despite the ongoing impact of the trade war.

Thus far, these strategies have paid off. As Table 1 shows, returns over the past 12 months are in double-digit territory, well in excess of the typical open-ended fund. These portfolios are backing the Chinese tech giants to continue to prosper, whatever happens to the country’s economy.