Investors withdrew £7.5bn from the open-ended funds managed by Invesco in the year to the end of August, according to data from Morningstar.

The figure equates to an average of £625m per month for the past 12 months, with £929m being withdrawn in the month of August alone.

In total £1.7bn was withdrawn from UK open-ended funds in August 2019, meaning Invesco was responsible for half of the net outflow across the whole market.

The Morningstar data contained better news for Schroders however.

The firm had net inflows of £121m in August. This was the first month in a year that Schroders had investors putting more cash in than they withdrew, and it was Schroders' best month for inflows since late 2017.

Chart 1: Total flows by firm

| Total Estimated Net Flows | £millions | ||

| Fund Groups | August 19 | 1 year | Asset £bn |

| BlackRock | 922 | 1,604 | £125 |

| Aviva | 495 | 5,080 | 59 |

| LGIM | 109 | 1,412 | 46 |

| Invesco | -929 | -7,510 | 46 |

| Royal London | 274 | 5759 | 43 |

| Fidelity | 86 | 1,570 | 40 |

| Baillie Gifford | 269 | 2,748 | 37 |

| M&G | -182 | -11,369 | 35 |

| Schroders | 121 | -3,267 | 34 |

| BNY Mellon | -193 | -4982 | 30 |

Source: Morningstar

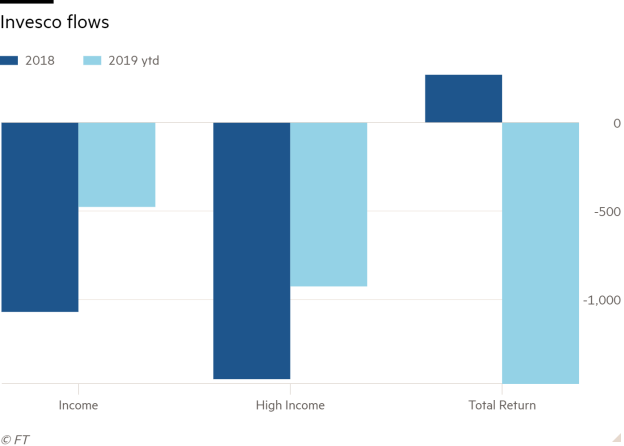

Over the past year Invesco had outflows of £7.5bn, with its Total Return fund contributing £1.9bn towards this, while its Income and High Income funds also suffered large outflows.

An representative of Invesco said: “The net flow picture improved in the second quarter versus the prior quarter across both our active and passive capabilities, while sales levels remained generally strong for the firm.

"Invesco continued to see strength in its ETF capabilities, reflecting evolving demand as clients react to uncertainty in the market environment.

"We anticipate demand for active capabilities will return once these global issues are resolved and markets normalise.

"In addition, we expect renewed traction in our active strategies with the redomiciling of the local Oppenheimer capabilities and the launch of our Model Portfolio Service.”

Mark Barnett’s Income and High Income funds, which were once managed by Neil Woodford prior to his departure to set up his own firm in 2014, have lost at least £7.5bn of assets as a result of outflows over the past three years.

The funds have struggled in performance terms as well with the Income fund, which has now shrunk to £2.71bn, losing 5 per cent over the past three years, compared with a return of 20 per cent for the average fund in the sector in the same time period.

The High Income fund has shrunk in size to £6bn, having been £10bn when Mr Woodford departed, and has lost 4 per cent over the past three years in performance terms.

Darius McDermott, managing director at Chelsea Financial Services, said: “The UK equities team at Invesco have always been a bit contrarian and used the value style of investing, and that is a style that has been out of favour for a while in the wider market.

"I also think the funds run by Mark Barnett have suffered a little bit of a contagion from the suspension of the Woodford Equity Income fund, as there are quite a few holdings that both managers have.”

Many of the poorly performing investments that have blighted the performance of Mr Woodford's funds over the past year, such as Provident Financial and Burford Capital, were also held in the funds run by Mr Barnett.

Burford Capital's share price collapsed in August amid accusations around its accounting practices.

Mr Barnett takes the same view as Mr Woodford about the implications of Brexit on the UK economy, arguing that the negativity is misplaced, which makes UK domestic shares a relative bargain.

The woes on the UK equities desk are not confined to Mr Barnett’s funds, however.

Martin Walker's Invesco UK Growth fund has shrunk in size from about £1.2bn in 2017 to the present £904m.

This fund deploys the value style of investing, which, until very recently, has been severely out of favour with the market.

This style of investing tends to perform best when there is widespread economic growth in the global economy, which has not been the case in recent years.

In contrast, in a lower growth world growth stocks tend to perform better. This is because with growth scarce the market pays a higher price for companies that are growing.

The catalyst for the shift between the styles is typically interest rates rising.

Higher interest rates also push bond yields higher, and that makes the relatively low yield of the growths stocks look less attractive.

The persistently low interest rates that have prevailed across most of the globe since the financial crisis have hampered the performance of funds run by Mr Barnett, Mr Walker, and Mr Woodford, as well as dozens of other managers who use the value style across the equity market.

Away from UK equities, the Invesco's Targeted Absolute Return strategy has lost 1.4 per cent over the past three years.

Absolute Return funds were extremely popular with investors in the years after the financial crisis, as they aim to deliver a "return in all market conditions" and to have lower volatility than equity funds.

But investors pulled £1.3bn from funds in the IA Total Return sector in December and January last year. In August £298m was pulled from the Invesco Global Targeted Return fund.

Chart 2: Total flows by fund

| Funds | Total estimated net flows | ||||

| Top funds | Aug 19 | One Year | Assets £mil | ||

PUTM Bothwell Global Bond fund | 405 | 409 | 559 | ||

Federated Prime Fund | 340 | 1570 | 5035 | ||

Vanugard FTSE All Share | 289 | 1652 | 9404 | ||

BlackRock ACS World ESG | 228 | 390 | 386 | ||

| Bottom funds | |||||

ASI Global Absolute Return | -933 | -9606 | 6935 | ||

Aviva Investors Multi Strategy | -376 | -933 | 4,493 | ||

Jupiter European | -350 | -780 | 5280 | ||

Invesco Global Absolute Return | -298 | -1903 | 10,622 | ||

SW Corporate Bond Tracker | -214 | -125 | 5783 |

Source: Morningstar

A relatively poor performance of Absolute Return funds in the sector is seen as normal when equity markets are rising. But in the more volatile market conditions of the past year, the funds have also performed poorly.

Tom Sparke, investment director at GDIM in Cambridge, said: "We remain open-minded about every aspect of creating diverse portfolios but currently do not have any exposure to Absolute Return funds.

"I think there are a handful of very good options in this space but there are a significant number of funds that have disappointed at key times, or failed to keep up with their stated targets.

"In these times where protection is key I think investors may look back to these funds for further diversification."

david.thorpe@ft.com