Venture capital trusts cannot be considered a like-for-like alternative to a pension, an expert has warned, as more savers have been putting their money into the products due to the narrowing of other tax efficient investment routes.

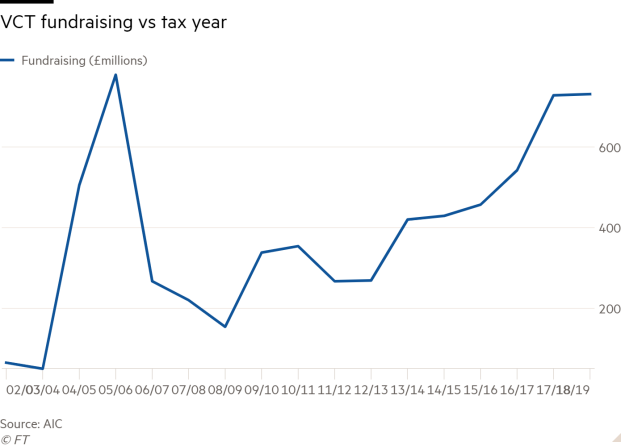

The amount of money invested in VCTs has increased sharply over the past decade, increasing by 374 per cent from £154m in the 2008/09 tax year to £731m in 2018/19.

It has also seen a steep rise in the two years gone — from £542m in 2016/17 to £728m for 2017/18 - before flattening out at £731m in 2018/19.

VCTs are like investment trusts but only invest in small, young and typically unlisted companies.

Although such companies are riskier and statistically more likely to go bust, investing in a VCT comes with a 30 per cent income tax relief from the government and any returns are tax free.

The trusts have performed well in recent years — the top 16 VCTs have all at least doubled investors’ money on a net asset value return basis over the last 10 years while 2018 had the second biggest VCT season on record, according to data from the AIC.

Many put the rise in popularity of VCTs down to the cuts to the pension allowances and restrictions on buy-to-let investing which has resulted in VCTs being one of the few tax efficient investment avenues left for wealthier investors.

In 2014 the government reduced the pension annual allowance from £50,000 to £40,000 — leaving wealthy investors with £10,000 extra to invest elsewhere — while the tapered annual allowance, which gradually reduces the allowance for those on high incomes, was introduced in 2016.

Buy-to-let investing also took a hit with the introduction of an additional 3 per cent stamp duty surcharge on second homes in April 2016 which was closely followed by cuts to mortgage interest tax relief.

Annabel Brodie-Smith, communications director of the Association of Investment Companies, said: “VCTs offer a highly tax-efficient way to invest. The popularity of the trusts has grown significantly in recent years.

“The restrictions on pension investments and the taper down in contribution allowances have been big drivers in the increasing investment in VCTs.”

But Jason Hollands, director at Tilney, said VCTs “cannot be considered a like for like alternative to a pension”.

Mr Hollands said he was a “big fan” of the products but that any investment into VCTs should be measured and proportionate to the investor’s overall portfolio, their appetite for risk and ability to tie their money up for the medium to longer term.

He added: “The tax features on VCTs are attractive — though not as generous as a pension for a higher or additional rate taxpayer — but these exist for a reason.

“The tax perks are provided by the government to incentivise investors for the risks involved when investing in the types of fledgling enterprises that VCTs are focused on and that the policy makers wish to support.”

The government rules over which businesses qualify for a VCT are prescriptive which can lead to a relatively narrow opportunity set, unlike a pension where most schemes are invested in large, publicly traded securities.

The businesses are typically younger than seven years, have less than 250 employees and £15m of assets, and they are usually unquoted.

Alongside this, a range of businesses — such as property development, legal services, financial activities and banking — are specifically excluded from being held in VCTs.

Mr Hollands added: “VCTs are part of the answer to those who find they have limited scope for further pension investment, but should not be considered as a straight replacement.

“Maximising core allowances such as ISAs and pensions should take priority before investing in VCTs and any investment in the later should only represent a modest proportion of an overall investment portfolio comprised mainly of liquid investments.”

Alex Davies, founder and chief executive of Wealth Club, said: “It is all about balance and no one is suggesting for clients to invest all their money in VCTs — a 5 to 10 per cent would typically be the maximum.

“[VCTs] are “more risky” but for the right person who understands the risk, they are one of the last relatively simple tax efficient investments left.”

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.