Offering clients access to investment trusts as well as open-ended funds is “part of being an independent adviser”, some IFAs have argued as research showed trusts still face barriers in the advice market.

A report from the Lang Cat entitled 'You can do it: Overcoming the barriers to using investment companies on platforms', published last week (October 9), showed 94 per cent of assets on adviser platforms were invested in funds or cash.

Advisers have historically tended not to use investment trusts and some platforms — such as Old Mutual Wealth or Aegon — do not even offer trusts as an investment option.

But some IFAs have argued providing clients access to investment trusts or at least considering them as a valid choice had to be “part of the review process” for independent advisers.

Simon Munday of Prosperity IFA said: “As IFAs, we feel it’s our duty to have analysed all types of investment when putting together portfolios for our clients, considering unit trusts, investment trusts, exchange traded funds and whatever else is out there as part of building a suitable client recommendation.”

Adviser at Kingsfleet Wealth, Colin Low, agreed. He said: “Providing the choice of investing in an investment trust is part of being an independent adviser.

“We feel they should be offered or considered alongside open-ended funds.”

Peter Chadborn, director at Plan Money, thought it was not “essential” for an IFA to offer investments trusts to every single client as each firm had specific reasons for their investment selection.

He added: “However, to be independent, the IFA must be able to identify when an alternative or addition to their core proposition would be appropriate, such as a trust or a VCT, and [in] those instances should recommend beyond their core investment proposition.”

According to the Lang Cat report, adviser aversion to investment trusts was down to an “inherent market bias”.

This was partly because suitability rules had generated an increasing reliance on model portfolios — portfolios designed for a certain type of consumer, primarily based on risk — and investment trusts were viewed as ‘incompatible’ with such portfolios.

As investment companies trade at a premium or discount to net asset value, where the shares themselves are worth more or less than the assets in the trust, some advisers thought it was impossible for one client to have the exact same portfolio as another who shared their risk profile, the report stated.

Liquidity of investment trusts was also seen as an issue, according to the Lang Cat, as it could be difficult to manage large movements in or out of trusts.

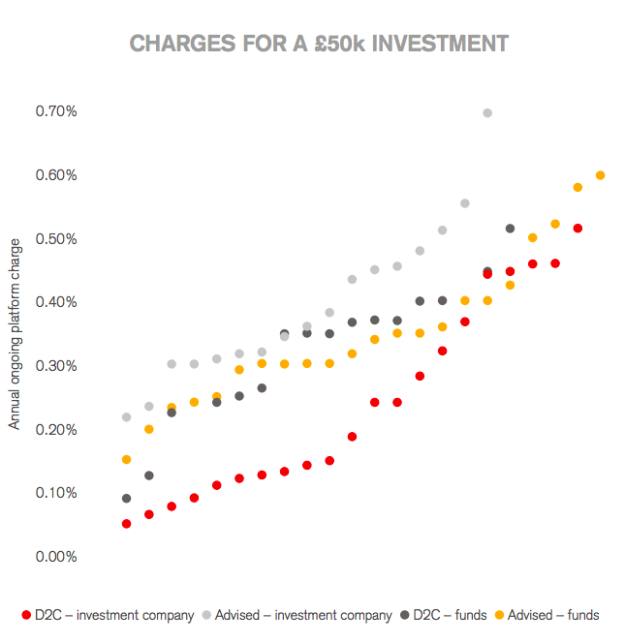

On top of this, the report showed adviser costs were generally much higher for investment trusts than funds. By comparison, trusts on direct to consumer platforms were cheaper than funds.

Source: the Lang Cat

The report also highlighted the complexity of trusts and advisers’ lack of knowledge of them, the fact trusts were harder to analyse than funds, and that they did not “fit into” an adviser’s tech or risk systems as reasons for the lack of investment in trusts.

But investments trusts have experienced growth over the past few years, according to the Lang Cat, as the £822.5m Smithson Investment Trust (the biggest ever) launched and investment trust assets passed £200bn for the first time after doubling over the last six years.

On top of this, the report stated the future could look brighter for investment trusts.

Besides, Product Intervention and Product Governance Sourcebook regulation (PROD) introduced by the FCA could lean advisers into trusts more, according to the Lang Cat.

The report stated: “PROD could be the great counterbalance. Advisers must evidence suitability of products and investment services by client segment.

“We have yet to see how the FCA will enforce the regulation, but it may prompt some reflection from advisers. Can they really claim to be meeting the needs of all clients without a consideration of investment companies?”

imogen.tew@ft.com