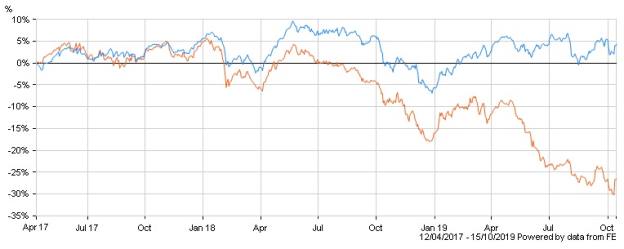

Neil Woodford's fund management career appears to have come to a rapid close this week, but it was back in the summer of 2017 that things first began to go wrong for his investments.

Yesterday (October 15) it was announced Mr Woodford's suspended Equity Income fund, initially touted to reopen in December, would be wound down and the former star manager fired from the fund.

He then walked from his remaining two investment vehicles before confirming he had taken the decision to close Woodford Investment Management.

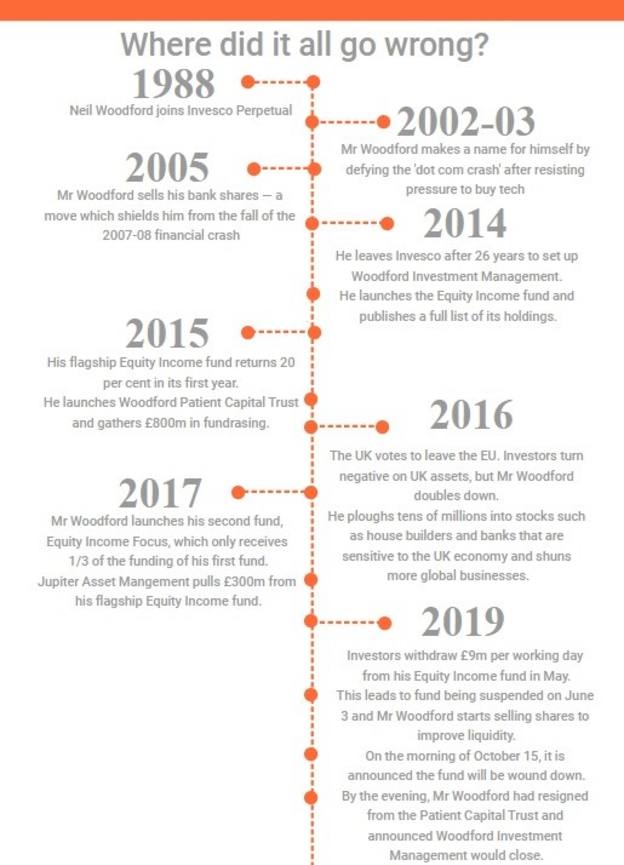

Although his flagship fund had been suspended from June 3, data shows the fund had continuously underperformed its peers from much earlier than that, from July 2017.

After two years of beating the UK Equity Income Sector's average — 18.7 per cent compared with 10.7 per cent in the year to October 2015, and 9.7 per cent compared with 8.6 per cent in the year to October 2016 — the fund's returns began to diminish.

The strategy underperformed the FTSE All-Share in 2016, and was hit by a number of stock-specific issues the following summer. Share price collapses for favoured holdings like doorstep lender Provident Financial saw Mr Woodford's fund return just 0.5 per cent in the 12 months to October 2017 — compared with a sector average of 11.4 per cent.

In the final two years of the fund's life, as further share price falls left the manager wrestling to ensure that his unlisted holdings did not exceed a 10 per cent regulatory limit, Mr Woodford lost 12.1 per cent and 27.5 per cent, respectively.

Source: Hargreaves Lansdown. Orange: Woodford's fund. Blue: Equity Income Sector.

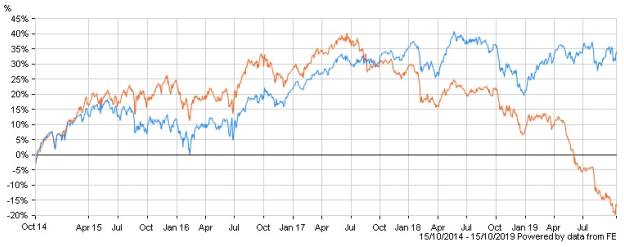

Data on Mr Woodford's Income Focus fund, although only launched in April 2017 and free from unquoted positions, tells a similar tale.

The fund beat the sector average in its first three months, but from July 2017 it underperformed peers.

Source: Hargreaves Lansdown. Orange: Woodford's fund. Blue: Equity Income Sector.

In the year to October 2018, the fund lost 12.8 per cent compared with an average peer loss of 4.8 per cent.

In the past year the fund lost 18.7 per cent compared with a sector average return of 5.1 per cent. The fund has also now been suspended.

The share price of Mr Woodford's investment trust — the Woodford Patient Capital Trust — also fell steadily from July 2017:

Source: Hargreaves Lansdown

Following yesterday's events, the share price dropped as much as 13 per cent this morning. By mid-afternoon it was trading at 32p, well below the 37p at which it closed on October 14.

Ben Yearsley, director at Shore Financial Planning, said July 2017 was likely the moment the effect of the UK's vote to leave the EU culminated.

He noted the lead up to July 2017 had seen a number of domestic challenges for the UK market.

He said: "You had the initial fall in June 2016 but almost for three years since, domestic stuff has fallen. Anything Brexit related bottomed out this summer."

At the end of March, Article 50 — the article which allows any member state to withdraw from the union — was triggered and in April, former prime minister Theresa May lost an election and left parliament with no majority.

Mr Yearsley added: "The election changed the dynamic a lot and shifted a lot of things."

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.