The tales of struggling retailers on the UK high street are hard to overlook. Thomas Cook, with more than 500 travel agents across the UK, is the latest big name to have fallen victim to changing consumer trends and follows once familiar names such as Austin Reed and Karen Millen into the history books.

As a consequence of the increasing headwinds facing the retail sector, investors in the bricks and mortar stores from which retailers trade – high street shops, shopping centres and retail parks – are also coming under pressure. The changing tastes of consumers, who increasingly prefer to shop online, coupled with high rents and the burden of business rates, have resulted in lower returns and increased instability for investors and companies which own property in this sector.

However, where there are losers there are likely to be some winners too. In this case, the continued shift towards shopping online for everything from books to clothing and music to groceries has fuelled the expansion of a relatively new sub-sector in the property market, big box warehouses.

Without a physical storefront and with the need to store, pick, pack and ship customer orders it is estimated that online retailers require three times more warehouse space than traditional bricks and mortar retailers. Not only does the online business model require more warehouse space, the pace of growth in online retail sales is rapid. In January 2008 internet sales accounted for 4% of all retail sales made in the UK, by September 2019 the proportion of internet purchases was at nearly a fifth (19.1%).

It is this boom in internet shopping that has powered the increased demand for strategically located logistics hubs, all supported by technological innovations such as improved connectivity and the growth of digital data and the cloud. These modern and highly efficient distribution centres are used to house stock, organise and pack online orders for delivery and deal with rising numbers of refunds. Such assets have been a huge success story for investors and have made SEGRO, a leading owner and developer of both big box and urban warehouses, the largest REIT in the UK with a market capitalisation of £9.0bn.

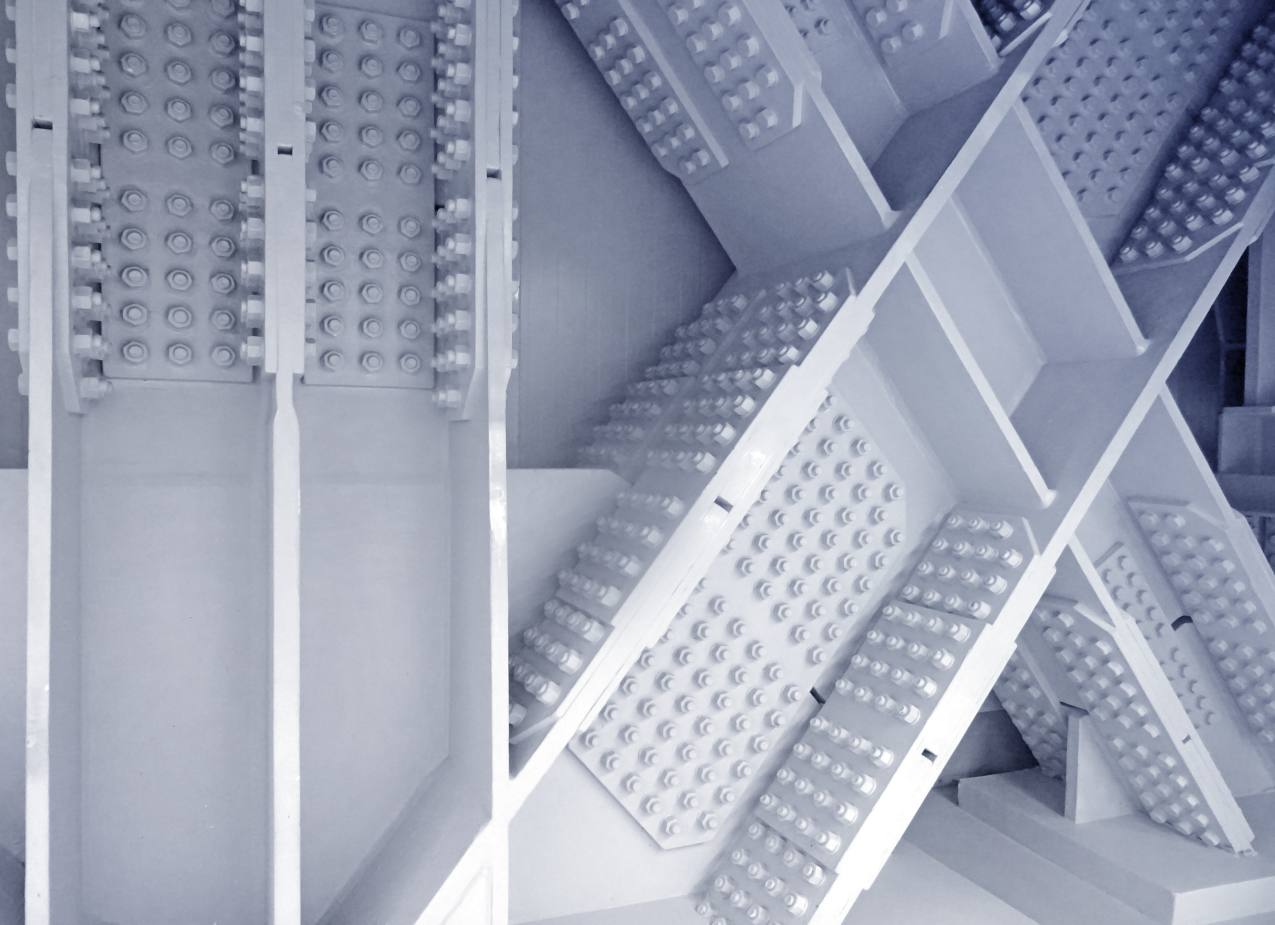

It is a sub-sector that did not exist in a meaningful way 20 years ago, but these key logistics warehouses are now very much in demand. Big sheds covering anything from 300k and 1m sq. ft (equivalent in area to 13 football pitches) are usually located next to major roads and transport links for quicker delivery and distribution. Importantly for real estate investors the tenants of these big box assets are increasingly making significant investments inside the buildings they rent. Typically installing sophisticated order fulfilment technologically to enable efficient pick and dispatch of customers’ orders. Such a high level of tenant investment is good news for landlords as it tends to increase the stickiness of the tenant who are prepared to sign long term index-linked leases.

Retailers from Amazon to John Lewis to Marks & Spencer all have extremely large, 1m sq. ft customer fulfilment and distribution centres. Ocado, the largest dedicated online supermarket, is an example of the future direction for these logistic hubs. The Gravis team recently visited one Ocado fulfilment centre, a vast operation with robots roaming freely around the building collecting and delivering items to fulfil customer orders within hours of ‘checkout’. It is this level of technological innovation which has propelled the growth of Ocado – it now accounts for 15% of all online grocery sales – as well as demand for fulfilment centres to service their customers. This is great news for the likes of Tritax Big Box REIT which owns 58 assets around the UK including the Ocado asset that we visited.