Investors have piled an average of £124m a week into UK ESG funds this year as the popularity of sustainable and ethical investing continues to rise.

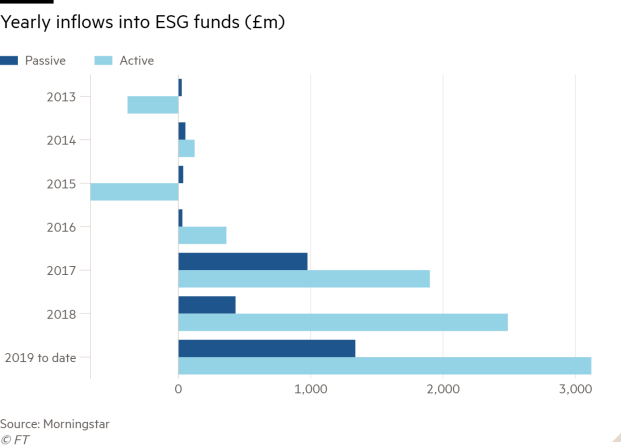

Data from Morningstar showed a hefty £4.4bn had been invested in ESG funds so far in 2019, with 70 per cent of inflows heading into active funds.

Environmental, social and governance (ESG) investing takes into account ESG factors alongside financial markers in the investment decision-making process.

It has become a more commonplace part of the global investment space in recent years, with ranking systems for ESG products being the latest addition to the market.

Morningstar's data showed flows into ESG products increased by nearly 2500 per cent between 2014 and now.

Yearly inflows into ESG funds gradually increased in the past five years — with a slight dip in 2015 — and jumped 53 per cent in the past year alone.

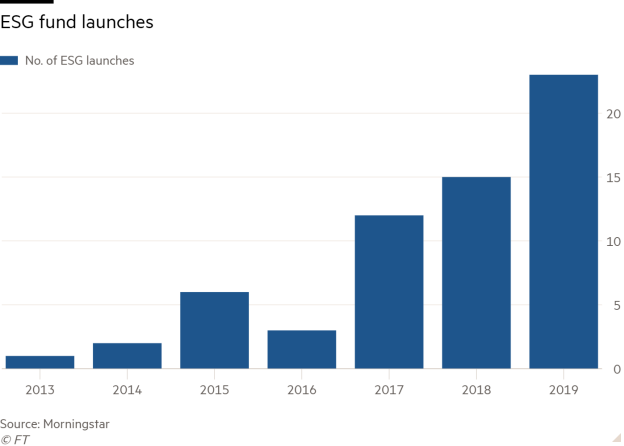

Fund houses have been keen to capitalise on the increased interest in ESG investing, launching 23 funds into the ESG market so far this year.

This is compared with 15 last year, 12 the year before and a mere two in 2014.

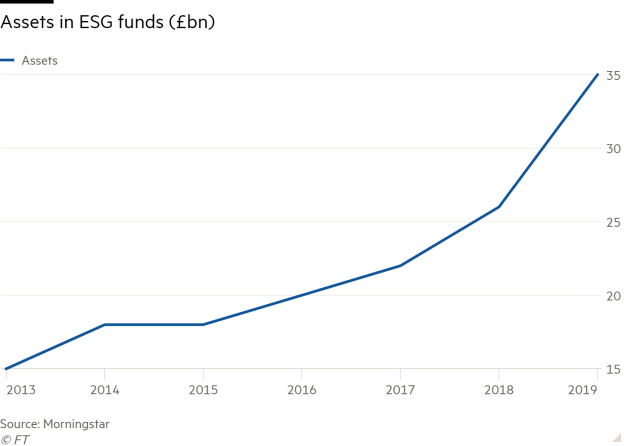

Naturally the increase in flows and fund options for investors has resulted in a steady increase of assets in ESG funds.

This meant assets under management in ESG products have doubled over the past five years, from £17bn in 2014 to £35bn in the first three quarters of 2019.

Tim Morris, IFA at Russell & Co Financial Advisers, said he had a few clients who were “passionate about ethical investments” but thought quite a bit of the new money into ESG funds would be from institutional investors.

Mr Morris said it was his younger clients that were driving much of his increased research into the ESG space as the corporate ‘fat cat’ culture carried less appeal.

He said: “You only have to turn on the news and watch Greta Thunberg or Extinction Rebellion in action to see how passionate the younger generation are about protecting the planet, so there is a focus at all levels.”

Alan Chan, director at IFS Wealth & Pensions, also has clients who request ESG and ethical related funds.

He thought the increase was down to investors becoming more conscious about where their money was invested — wanting to make a profit but at the same time investing responsibly.

Mr Chan added: “I’m sure there’s a lot of direct inflows as well as advisers and wealth managers and large pension funds going forward.”

But Darren Cooke thought a lot of the rise of ESG was down to active managers launching funds in the ESG space in order to 'justify the fees they charge'.

He said: “I think it’s a chicken and egg thing. I have only been asked once for ethical investments in six years but that could be down to awareness.

“Clients don’t know about such things as ethical investments so they don’t ask.”

Darius McDermott, managing director at Chelsea Financial Services, agreed, adding he thought ESG was “absolutely here to stay” but that it would be a “slow burn”.

Advisers were recently blamed for the UK retail market's slow uptake in ESG investing as Andrew Gilbert, senior investment manager at Parmenion, said the vast majority of consumers would want to invest ethically if given the option but that IFAs often lacked the knowledge or time to advise on such products.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.