All four pillars of emerging market debt – US dollar sovereign bonds, corporate bonds, frontier bonds and local currency sovereign bonds – offer a higher yield than government bonds in developed markets.

However, these returns are not risk-free. Investors must be able to analyse debt sustainability across this diverse universe.

Diversification is not guaranteed either.

Yields are sensitive to global risk appetite, which drives flows into and out of the asset class. Investors need to understand the monetary policy frameworks, exchange rate regimes and political institutions of these diverse economies.

These differences help determine the extent to which markets are driven by local versus global factors.

As the EMD asset class continues to grow, investors will be forced to revisit their approach to investing.

Less than three decades ago, investors wishing to invest in EMD were restricted to a small set of US dollar bonds, mostly from Latin American nations.

Today, the four pillars that make up the asset class account for around a quarter of the global bond universe. Yet most global asset allocators continue to invest little in EMD.

Moreover, they primarily own US dollar sovereign debt. What are the practical steps investors can consider to take full advantage of this asset class?

The largest and most liquid bonds in emerging markets are now those issued in local currencies. Default risk is negligible for these bonds. However, investors are exposed to the volatility of emerging market currencies.

The yield on these bonds can be less sensitive to global capital flows, increasing the diversification potential. But investors must understand the exchange rate regime to assess how independent monetary policy is.

To potentially reduce currency risk, investors can fund purchases of local currency bonds using a basket of currencies rather than their base currency.

Investors should select a basket of currencies that they expect to move in tandem with those of emerging economies. These could include the euro, sterling and Australian dollar, which also typically depreciate against the US dollar and yen – during a crisis.

Countries on the frontiers of investing include some of the fastest-growing economies. A number of countries are adopting the political, economic and market reforms necessary to promote growth. This is allowing many countries to issue US dollar bonds for the first time.

These issues may come with the support of the International Monetary Fund or World Bank. The involvement of these global institutions provides some comfort to investors that appropriate policies are in place.

However, local institutions are less developed than in more mature markets and data quality is less reliable. Investors need to engage with locals to build a robust understanding of the risks.

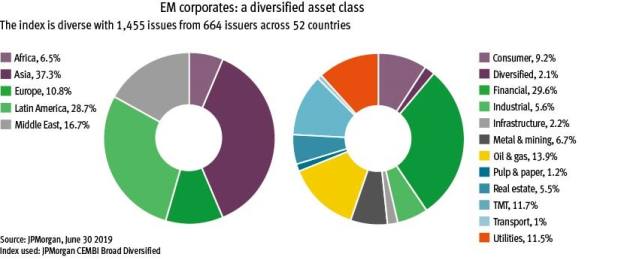

The emerging market corporate bond universe is less well researched than either government bonds or domestic equities. This creates the opportunity to generate alpha through bottom-up security selection.

It is possible to find companies with strong balance sheets and low leverage, offering attractive yields.

Reforms that improve transparency, reduce corruption and strengthen central bank independence will help attract long-term capital.

This reduces inherent country risk. Investors should monitor changes in these factors to identify attractive investment opportunities.

Rapid economic progress in emerging countries is driving growth in debt markets. Today, investors have an unprecedented range of opportunities across over 80 countries. These markets offer the potential for attractive yields to those investors able to assess the risks involved.

Accessing the widest range of investment opportunities can increase the chances of investors achieving their goals.

Brett Diment is head of global emerging market debt at Aberdeen Standard Investments