Today, more than 100m people around the world invest and trade online.

The UK has the most online traders in Europe, and while there are country and regional differences in trader and investor mindsets, the trend is only heading in one direction: more and more individuals are taking advantage of the democratisation of information, education and market access to achieve their own financial goals and impact and influence the society they live in.

To a large extent, the democratisation of trading and investing has been fuelled by the internet.

Key Points

- The internet has democratised online trading

- Most managed investment solutions are too expensive and underperform

- Open models of technology allow for quicker and cheaper adaption

I founded Saxo Bank in 1992 and we were one of the first companies to focus on leveraging the internet to deliver better investment solutions.

When we started on this journey, our principal belief was that the many, rather than the few, should be able to access the world’s financial markets in an optimal way.

New technologies and the availability of information and knowledge have helped create a more level playing field, which means the investment opportunities and tools previously only available to large financial institutions on Wall Street are now available to the people on Main Street – at ever lower prices.

My belief remains that everyone should have the freedom to build a comfortable foundation of savings and maximise those savings for retirement or to support other life goals.

Benefits of online trading and investing

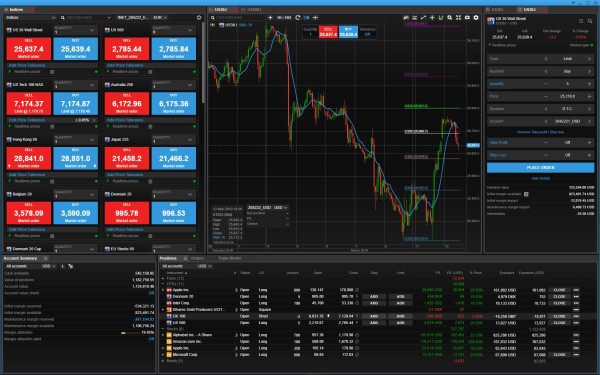

For those new to the world of online trading and investing, one of its primary advantages is the ability to access a wide variety of asset classes – equities, bonds, commodities, exchange-traded funds, mutual funds, futures, options, contracts for difference and other products – from a single place and at cheaper rates than those offered by typical financial intermediaries.

The ability to efficiently diversify across geographies and asset classes is important because your investment universe plays a key role in determining your overall investment returns.

Individual savers and investors often end up investing in portfolios that concentrate on a few domestic stocks.

We drink wine from France, wear shoes made in Vietnam and travel to other continents for our holidays – so why are investments often overwhelmingly local?

In a globalised economy, multi-asset trading allows you to invest in any macro cycle and hedge those exposures accordingly.

In addition to nearly round-the-clock access to global capital markets, online trading has brought about reduced transaction costs.

For example, in the 1980s, the cost of making a trade on the NYSE reached hundreds or even thousands of US dollars, today it can be done for less than $10.

The impact of investment costs and fees can be difficult to grasp but the effects on returns can be profound.

The Danish consumer council has calculated that by shifting your savings and pensions from traditional bank-backed investment solutions to lower-cost investment alternatives, individuals can save the equivalent of four years of retirement over a lifetime.

In other words, many people work four unnecessary years on behalf of their investment providers.

Given that statistic, it is no wonder that more and more people are eschewing traditional forms of investing and turning to online alternatives to build wealth sustainably over the long term and improve their retirement nests.

In addition to price efficiency and diversification, another benefit of online investing is the ability to avoid brokerage bias, a common problem in the past, where brokers were given financial incentives to pass on certain products and instruments to their clients.

Some online providers make sure to steer clear of this bias and focus on clients’ interests and needs.

They also offer a more transparent choice than what is offered by the fund supermarkets, where recent examples show that some of the best-performing funds were excluded from their recommendations.

While online trading does have many potential advantages, it requires careful decision-making to avoid common drawbacks.

Clients need to be well-informed and comfortable with the level of volatility and risk expected in relation to their investment horizon.

We have also seen established online providers offering excessive leverage on trading instruments, often contrary to clients’ interests.

Of course, clients need to be vigilant about misinformation, steering clear of get-rich-quick schemes, and make sure to stick to regulated providers they are fully comfortable with.

Even savvy institutional investors have fallen prey to financial scams.

More digitisation needed

Far from being stuck in the traditional world of broker-to-broker phone trading (reminiscent of 1980s movies), most large marketplaces today are electronic, and most trading happens on online platforms that should be available to retail investors.

There are some exceptions, with bond markets having been notoriously slow to adapt to electronification, though in 2016 we set out to change this by digitising access to bond liquidity for our retail clients, resulting in much faster execution times and an average improvement of 30 basis points for corporate bonds and five-10bp improvement in government bonds.

Such price improvements can make a big difference to investor returns.

A role for managed investments

Many investors still prefer guidance when they invest through a managed solution. Investing in funds with diversification can be a wise choice for people without the time or desire to pick stocks or other investments for their own portfolios.

The problem is that most managed investment solutions presented to average investors by their providers are frequently too expensive or underperforming – and all too often both.

They also sometimes only include the company’s own funds and products, leaving better-performing solutions outside of the clients’ purview.

Again, digital solutions that combine guidance with transparency, performance and lower costs are on the rise.

Many also want to invest in long-term trends and themes that they believe in.

For those investors, products that allow investment in trends such as robotics, clean energy, electric vehicles, environmental, social and governance, and cyber security to name just a few, are more relevant than ever, and can be made available to everyone digitally.

A warning sign for the investment industry

This shift towards more open business models with clients at the centre holds a lesson for the wider investment industry.

Business models that do not have clients at the centre are quickly becoming obsolete.

In my view, the model of the future focuses on global access to all asset classes built on efficient global technology that is open to outside partnerships.

Providers insisting on building everything themselves will simply not be able to keep up with technology, competition and client demands.

By running a more open model leveraging specialised solutions from partners, investment providers can build a low-cost, flexible and state-of-the art client experience.

And the flexibility of running an open model allows for quicker and cheaper adaption to clients’ changing needs as new products and services can be added, without adding high costs and complexity.

The trend of online trading and investment is irreversible and should be a warning sign to businesses that do not offer their clients the choice and transparency to make their investment decisions.

As more and more people, empowered by technology, transparency and knowledge, decide to take control of their own destiny when it comes to reaching their financial goals, the investment industry will need to respond by opening up its business models through better technology, more transparency and choice of investments.

Only then will they reap the benefits of digitisation and retain and grow their client base.

Kim Fournais is founder and chief executive of Saxo Bank