Investors have pulled an average of £3.5bn a month from active funds since Mifid II rules highlighted the extra cost of active management to fee-pressured advisers.

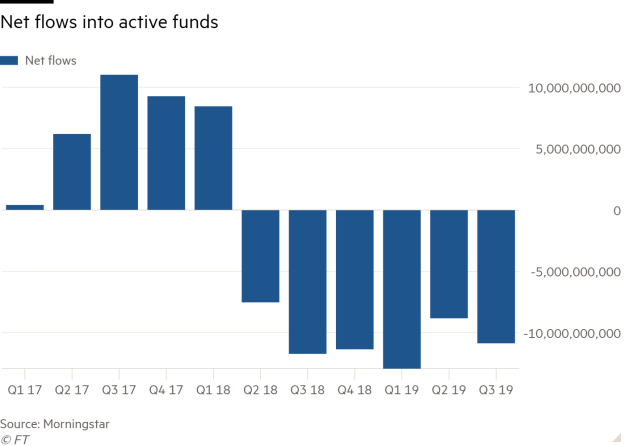

Data from Morningstar showed active funds had seen net outflows every quarter since the second quarter of 2018, totalling £63bn of withdrawn assets. Before Q2 2018, the active sector as a whole had experienced net inflows.

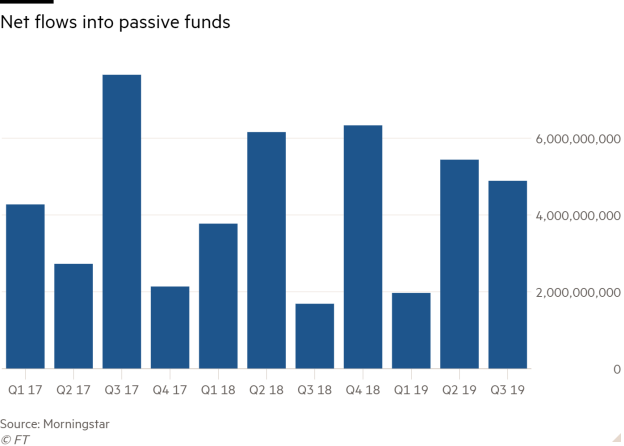

Passive funds have fared far better over the past two years, seeing net inflows — totalling £47bn — every quarter since the start of 2017.

The Mifid rules introduced at the beginning of 2018 made it mandatory for advisers to break down costs for their clients periodically in the interest of greater transparency and value for money.

This means the difference in cost between active and passive funds was more noticeable at a time when pressure on adviser fees and client costs has been increasing.

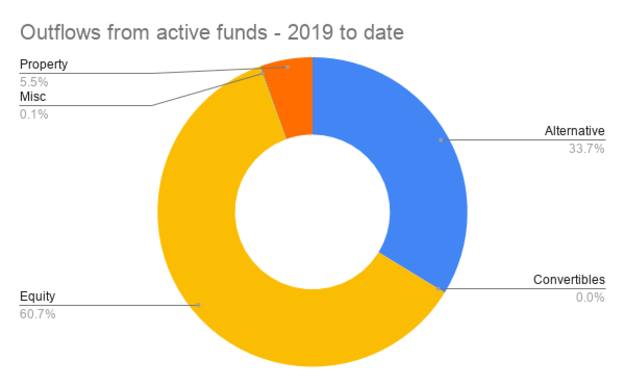

Investors removing their assets from active funds mainly pulled money from equities — £20bn in the first three quarters of 2019 and £11bn last year — but alternative funds also took a hit, losing £11bn and £10bn in Q1-Q3 2019 and 2018 respectively.

Active convertibles saw net outflows both years, while fixed income suffered in 2018 but has seen net inflows so far this year. Meanwhile £1.8bn was pulled from property in the first three quarters of 2019 despite seeing positive flows last year.

Tracker funds have been growing for a decade. According to the Investment Association passive funds now make up nearly a fifth of all funds (17.5 per cent), but in 2009 only 6 per cent of funds available were passive products.

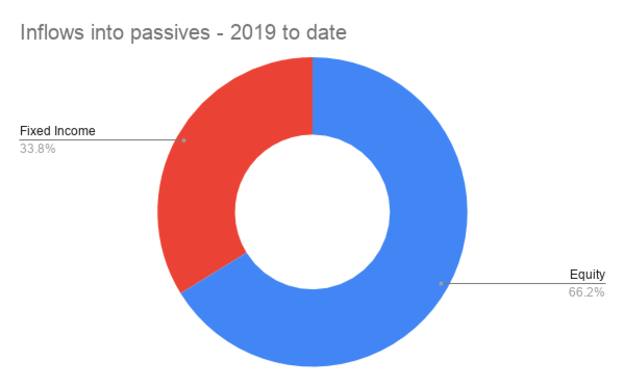

Investors have pulled money from multi-asset passive funds over the past two years, while piling assets into equity and fixed income tracker funds.

In Q1-Q3 of this year, £8bn was invested in passive equity funds while £4bn went into fixed income products.

Advisers have primarily pinned the outflows from actively managed funds on the difference in cost, particularly at a time when IFAs are experiencing pressure on fees.

Paul Stocks, director at Dobson & Hodge, said a lot of advisers were adopting a primarily passive model, partly because Mifid II meant the full extent of the costs of investing was being highlighted.

He also thought regulatory scrutiny over charges led some advisers to choose passives because it was easier to “give advice that way” as they did not have to justify the extra fees paid for active management.

Chartered financial planner Scott Gallacher also thought cost had become a “significant issue” for advisers and their clients and that this was reflected in the outflows from active funds.

“Mifid II is clearly part of this as it has highlighted that some active funds can be significantly more expensive than previously thought,” he added.

Dave Penny, managing director at Invest Southwest, also thought the performance of some high-profile active managers, such as Neil Woodford, had been poor since 2018 and provided the “perfect storm” for the active sector.

He said: "It is very likely that Mifid II focus on overall costs will have put pressure on advice-led investment, where the adviser needs to be able to justify costs — hence the shift in favour of the lower cost passives."

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.