Environmental and social change should shape the way we allocate capital to generate long-term returns.

The relationship works the other way too: Strategic asset allocation can direct private capital to where it is most needed to help alleviate the most pressing social or environmental problems.

Let us take the E in ESG first.

Environmental issues pose increasing risks for investors. Global warming poses both long-term physical risks as well as nearer-term risks as the energy sector shifts from fossil fuels to low-carbon alternatives.

These risks will affect the performance of certain asset classes in various ways. For example, real estate and infrastructure are at particular risk in areas prone to flooding, storms and wildfires.

Meanwhile, power utilities, oil and gas, transport and some industrial activities are at risk from the move away from fossil fuels.

Then there is the S in ESG: social.

Perhaps the most important challenge for strategic asset allocation today is the fact that interest rates remain stubbornly low – with obvious implications for long-term returns from government bonds.

Many economists argue this is because of a chronic ‘savings glut’ – essentially, too much money is chasing too few investment opportunities, pushing down interest rates in the process.

The savings glut has various causes, but among the most important are two social factors: ageing populations and income inequality.

Corporate governance – the G in ESG – is also important for strategic asset allocation.

The biggest event for asset prices in the past 80 years – the global financial crisis – was largely caused by systematic failures of governance in the global banking industry.

One lesson from the crisis is the need for long-term asset allocators to be more attentive to systematic governance risks.

Investors typically think about asset allocation from the perspective of investment returns.

But capital allocation decisions can also make a difference to social and economic outcomes.

A defining feature of many of the world’s biggest challenges is that solutions require increased flows of private capital.

The most important example is climate change.

To meet the goals set out in the 2015 Paris climate agreement, investors need to allocate an additional US$1.5tn (£1.2tn) a year to renewable energy and other low-carbon projects.

Increased capital flows are also necessary to achieve other UN sustainable development goals: accelerating development in poor countries and protecting an increasingly fragile environment, as well as tackling air pollution and water scarcity.

Climate change offers a test case for improving the impact of strategic asset allocation.

Investors can use the equity and bond markets to allocate to companies and projects that provide low-carbon energy and transport solutions.

Renewable-infrastructure equity, ‘green’ bonds and sustainable property offer additional avenues for environmental impact investing.

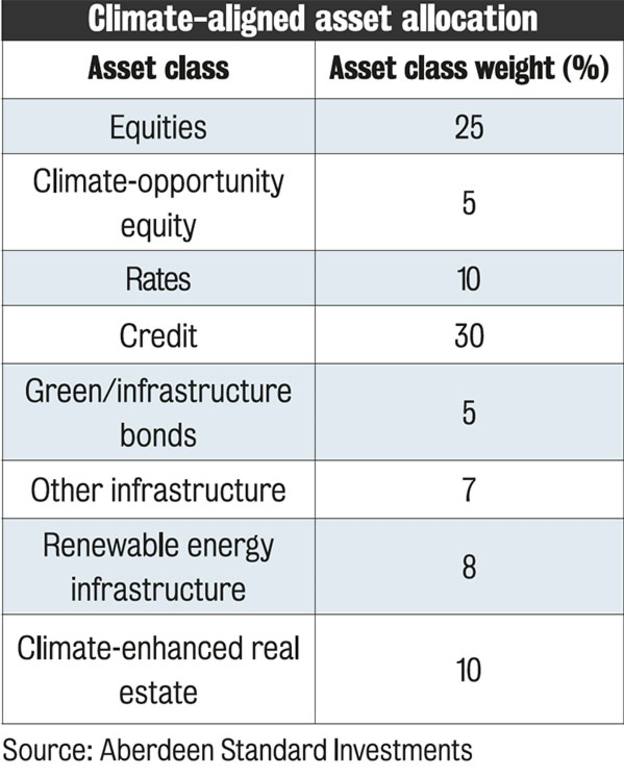

We have constructed three model portfolios with different ESG-related allocations.

These span an estimated 3 per cent allocation to climate change in a traditional equity-bond portfolio, a more diversified portfolio with a 7 per cent allocation and a climate-aligned portfolio with around 20 per cent of its assets assigned to climate solutions.

Our research shows these portfolios offer very similar expected returns and risk, but with very different real-world impacts.

This raises an exciting possibility. It suggests the strategic asset allocation process can be modified to create strategic portfolios with significantly higher capital allocations to finance the energy transition, but without sacrificing expected risk-adjusted returns.

By taking this approach, investors may be able to help close the climate-financing gap, without compromising investment returns or conflicting with fiduciary and regulatory constraints.

To have maximum effect, this high-impact strategic asset allocation must be coordinated with more ambitious government policy and efforts to accelerate technological change and encourage investor ingenuity.

It requires a shift in mindset: investors must realise they need not just passively respond to market forces, but can play a role in shaping a more prosperous and sustainable future.

Craig Mackenzie is head of strategic asset allocation at Aberdeen Standard Investments