An astonishing £5tn is expected to pass from baby boomers to other generations over the next few years, according to various reports.

However, the industry is split on the best possible approach in dealing with this intergenerational wealth transfer.

This issue was covered at the FTAdviser roundtable hosted in tandem with Charles Stanley, where industry experts discussed the key challenges posed by intergenerational wealth transfers to the adviser community.

Recent research by Brooks Macdonald also found £327bn is set to be passed on from baby boomers to around 300,000 younger potential clients over the next decade alone.

So what are the key issues related to intergenerational wealth planning?

One of the issues highlighted at the panel was whether companies should be linking advisers with clients who are of a similar age rather than dealing with different generations.

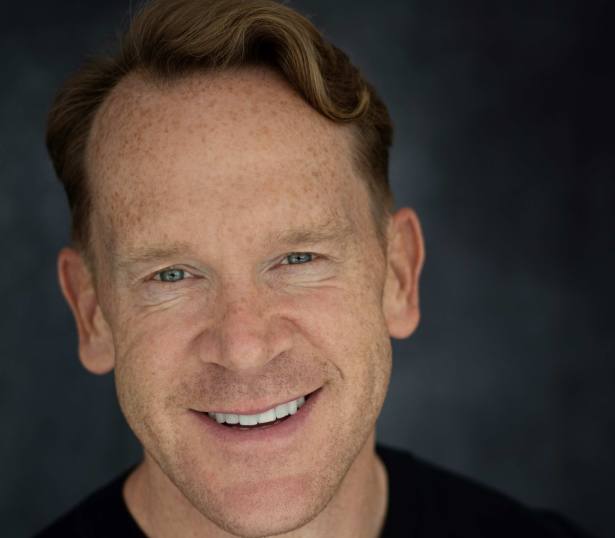

Sean Osborne, head of national accounts at Charles Stanley, said: “It is not just fashion that changes with time, it is also our attitude towards money that has changed over the past three generations.”

Segmentation

Kay Ingram, director of public policy at LEBC Group, said it was important for financial advice companies to hire different advisers for different generations in order to better grasp the financial issues faced by millennials.

“We will often appoint a different adviser to each generation. A 30-year-old does not want to talk to an older person, and older people do not want to take life lessons from 30-year-olds,” she joked.

The panel was told by another delegate: “Younger people want to talk to people who have had similar experiences to theirs.”

Key points

- There is debate over whether advisers should be the same age as clients

- Advisers have to be aware of vulnerable clients

- ESG factors might be another factor for younger clients

However, Hayley North, chartered financial planner at Rose and North, held the opposite view.

According to Ms North, people prefer to speak to advisers from a different generation as they often have different experiences compared to their own.

She said: “It is not necessary to match age to the client.

“I actually think it is very beneficial to have the same advisers [for all age groups].

“Their position may be different, their views may be different and they may want to do some practical things in a different way, but I also don’t think it is necessary to have another adviser.”

Vulnerable clients

The issue of vulnerability was also highlighted by the panel, and whether advisers have to take extra steps to identify them and protect them from taking poor decisions.

Mr Osborne said: “Vulnerability in its entirety is not just about older clients.

“What about younger clients with very little experience with money? Sometimes people who have very little experience with planning and money suddenly get entrusted with quite a large inheritance.”

Ms North noted it is harder to deal with clients who initially were not vulnerable, but have become so due to changing circumstances such as divorce or the death of a loved one.

“It is hard when people have been good clients, and they have this temporary incapacity soyou have to step in and say, ‘I am not going to do what you told me to do’.”