A saver who invests only in large-cap companies is passing up return opportunities.

In fact, savers are ignoring the bulk of the value created by listed companies.

Yes, stock selection is more challenging in the small and mid-cap sector.

Investment banks and stockbroking businesses devote less resource to researching small-caps.

As a result, equity research on small- and medium-sized companies is patchy, and many analysts have little experience of small-caps.

This is largely because the small- and mid-cap universe of companies is larger in number than the blue-chip universe.

Key Points

- Smaller companies have a lot to offer investors

- Small companies are more likely to grow more quickly

- They are also more risky

Analysis is therefore more time-consuming and less remunerative.

This creates an information gap that can open up interesting investment ideas for specialised investment managers, especially in areas such as biotech and technology, where the rewards for successful innovation can be significant.

Speed and scalability

As a general rule, smaller companies have impressive growth potential: it is less of a feat to double a turnover of a few hundred million euros than to double revenue that is already in the billions.

They can react nimbly to changes in market conditions, for example.

Nevertheless, higher growth opportunities are usually offset by higher risks.

Small- and mid-cap profits are usually less stable than those of bigger, more established businesses, and their share prices are prone to volatility.

The impact of a new product failure or crisis situation that is easily absorbed by a large business through its market share and financial weight can sink a small company, which has thinner financial reserves and brand capital.

Exposure to unexpected risk is even more of an issue in the biotech sector.

At any time numerous therapies will be under development, but many will be in early clinical development and can take years to reach the market, if they even get that far.

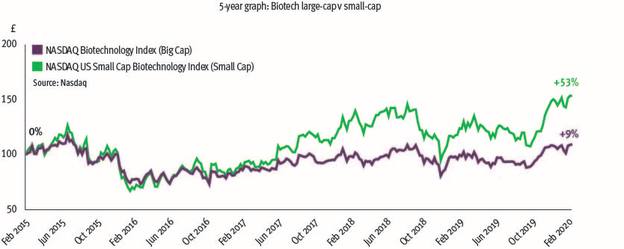

For equity investors seeking exciting growth companies in the small- and mid-cap space, biotech offers compelling opportunities.

Not only are they funding vital research to allow people to live better and longer, but despite political pressure to cut drug prices in the United States, the biotech industry has performed quite well so far in 2020.

Investors are still optimistic about biotech’s long-term prospects, thanks to the pace of innovation, the ageing global population, and increasing access to healthcare for people worldwide as they grow richer.

Most new advances in medicine are in the hands of small- and mid-cap companies.

We see many mid- and small-cap healthcare and biotech companies with high growth rates, with their future geared towards clinical success, product approvals and revenue growth.

The larger companies in the industry must gear their business models towards high-selling drugs that have already been approved and brought to market.

If they see a promising new treatment in late-stage development by a small business, they buy the company or technology and maximise its potential through broader and often parallel clinical investment trials, and their distribution networks.

In this way the shareholder owners of the small business are handsomely rewarded for their risk-taking.

So, innovation is a big driver of takeovers in healthcare and biotech.

We believe the current attractive valuations of smaller and mid-cap biotech businesses will continue to fuel M&A activity in the sector.

The takeover of cancer drug producer Celgene by Bristol-Myers Squibb for $70bn (£53.1bn) last year demonstrates that large-cap companies can also be in play if they reach depressed valuation levels.

Biotech trends

So how do investors exploit the small-cap theme in biotech?

The first rule is to understand that a generalist investor will not have all the resources to judge the scientific information and the clinical trial successes.

So always work with an experienced expert.

And remember that however good analysis is, plenty of drug research will end up in a dead end, with no profitable outcome.

So it is important to have a diversified portfolio.

In biotech, it is a good idea to begin by looking at where the disruptive products and technologies are.

For much of its history, the big blockbuster drugs that have been dominating the pharmaceutical market were based on chemical compounds.

In the past two decades, drugs have increasingly been displaced by biologics, drugs made from biological compounds, with the current experts considering the disruption potential of the genetic medicines in development.

Substantial investments in genetic medicines are expanding at a fast pace and seek to treat disease by repairing or replacing the faulty genes that cause the disease.

An example of a biotech stock in the mid-cap end of the biotechnology market is Ionis Pharmaceuticals.

Ionis is pioneering an approach called RNA antisense, which can be used to block the production of disease-causing proteins.

Growing revenue from Ionis’ portfolio and its research and development alliances have allowed the company to beat expectations during every quarter last year.

This growth spurred the company to raise full-year guidance for revenue and profit when it reported its third-quarter results in 2019.

Small and mid-cap equities are reliable drivers of growth in an investment portfolio, at a time when many industries are grappling for growth.

In the biotech space, a specialist investor is required to evaluate the potential of new drug candidates and technologies.

While the prize for success is substantial, the high risk that many candidates will fail along the way means that investors’ portfolios must always be well-diversified.

Daniel Koller is head of the investment management team at BB Biotech