The spreading pandemic has toppled global markets as governments established lockdowns and imposed travel bans. Advisers have been stressing the importance of their existing plans to clients, but some have expressed concern over client reactions.

Philip Milton, a financial adviser and a discretionary fund manager at PJ Milton and Co, said the situation was “catastrophic” for anyone who had invested “sensibly in accordance with their needs” up until a matter of weeks ago and was looking to retire.

He added: “Nothing can be said to diminish that impact for anyone, and liquidations in the face of such acute conditions are not wise.”

Alan Lakey, adviser at Highclere, said he anticipated a “huge cancellation of paying into non-essential plans such as pensions or savings schemes”, stating: “I’ve already had many calls. These seem to fall into two camps: people who are still saving for when they reach pension age, and people in drawdown.

“Some of the first have said they wish to suspend contributions and there may be some sense in that, as living today is of prime importance.

“The people in drawdown who have seen fund values plummet may opt to reduce or suspend income. This may also be the case for those drawing on large Isa or other invested funds.”

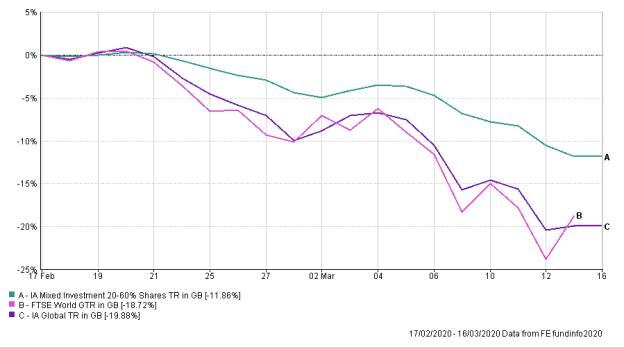

The FTSE World index and the IA Global sector have each dropped around 20 per cent since mid-February. Clients invested in a typical balanced portfolio have seen more than 10 per cent knocked from their pot over the past few weeks. The IA Mixed Investment 20-60% Shares sector, home to many multi-asset funds has dropped about 12 per cent since February 17.

Sequencing risk — the fact that the capital value of a pot can erode significantly if ‘negative years’ arrive during the early years of drawing down on a portfolio — would exacerbate this risk.

This means those having to draw from their retirement pot may wish to limit the amount they are taking during a period of major market falls.

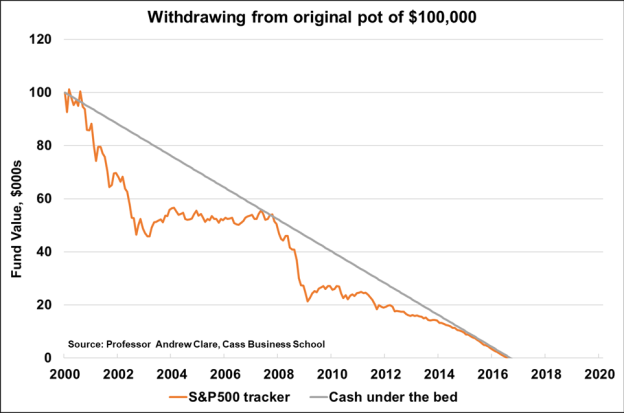

As an example of how drawdown can go wrong, Andrew Clare, professor of asset management at Cass Business School, said a retiree with an average pension pot of $100,000 (£81,600) in 2000 who had consistently drawn down from their pension would have seen their pot depleted within 15 years due to the tech and financial crashes.

He said: “This chart shows the impact of someone who has withdrawn $500 (£408) per month from an investment pot initially worth £81,600 [in falling markets].

“Because of sequencing risk, they would have run out of money in 2016 — about the same time you run out of money from investing in a shoe box under your bed.”

The same sort of dangers will present themselves to those persisting in drawing down income over the coming months, should markets continue to falter.

Mr Milton said clients facing this situation would have to be “flexible”. He said: “Pensions plans are not simply for ‘retirement’ but are part of a flexible armoury which may enable people to choose when they retire and how they do so financially. They need to buy time.”

Ricky Chan, director at IFS Wealth & Pensions, agreed the crisis could mean some people would not be able to retire as quickly as they had planned. He advised those already in drawdown to avoid crystallising losses.

The scale of those losses will also depend on how diversified an investor's portfolio is. Some diversification tools have been called into question by the current sell-off: gold has fallen more than 10 per cent in recent weeks despite being held as a hedge against equity market falls. Government bonds also struggled in the week ending March 13, but have since resumed their status as an asset class that moves inversely to shares.

Cautious model portfolios at advice firm Informed Choice remain 1.4 per cent higher over the past 12 months. Its moderate portfolio was down 2.4 per cent over the same time period.

Market commentators expect further falls for risk assets, with some calling for trading to be suspended entirely until a path through the pandemic emerges. But some advisers said market moves should not affect those with a solid financial plan in place.

Alistair Cunningham, director at Wingate Financial Planning, said: “If you have done the planning then this sort of event is part of that plan.

“We build our financial plans to take into account events like this. If somebody was going to retire but now cannot, they do not understand the risks of retiring and were not ready financially.”

Meanwhile Paul Stocks, director of financial planning at Dobson and Hodge, said the situation was a “little concerning” for some clients, but added that once their overall financial plan was emphasised, clients could understand the context and see why these events should not affect their plans.

Paul Gibson, director at Granite Financial Planning, said: “Our clients have an overriding financial plan in place and are invested in globally diversified portfolios so unless their plans change, we won’t be making any knee jerk changes.

“We always recommend that clients have an adequate emergency fund to draw on."

The Pensions Regulator has also flagged concerns over managing defined benefit risks and liabilities as Covid-19 threatens to impact pensions schemes.

TPR stated: “We expect trustees to have appropriate monitoring and contingency planning in place and to be alive to risks that would have significant consequences for their scheme and members.”

It urged trustees to identify, manage and monitor the impact coronavirus could have on meeting a scheme’s funding objectives.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.