It’s enlightening to see that ESG sits regularly at the top of the corporate agenda.

Yet, it is a trend that has been building for a long time.

Through the 90s, I had great pleasure working with the Rathbone ethical team (now called Rathbone Greenbank) on individuals’ wealth that was invested with a conscience or an environmental focus.

I no longer run SRI, ESG, or ethical specialised mandates directly, however, ESG is still a crucial lens for examining the companies we invest in.

Renewable energy

For example, for over a year now we have invested in Digital Realty, a US-based provider of computer server storage facilities.

Facebook, a client of the storage firm, requested that all of its servers be powered by renewable energy.

This was a trend that Digital Realty had already implemented, with the whole of its EMEA business being powered from only renewable sources.

This matters. Particularly in an industry that could be facing a level of maturity after strong growth over the last decade.

Securing the next client is getting tougher, and therefore, businesses have to offer something that differentiates them to the end consumer whose demands for cleaner products are growing rapidly.

In a fragmented market like data warehouses, standing out by focusing on a sustainable business should help during tougher times too.

There is also a lot of change coming down the line for consumer facing businesses.

In the UK, 84 per cent of homes are connected to the gas grid and use gas for heating.

By 2050, all of these homes will have had to decarbonise their heating for the UK to meet its net zero targets. This is not as far away as it seems.

A recent Future Gas report estimates that by 2030 low carbon heating must have reached the stage of mass roll out. This also means that the next five years are crucial to get the design of the roll out, regulatory standards, and early adopters all in line.

Decarbonising challenge

But who will pay for this change?

Poling commissioned for the report suggested that only 14 per cent of the public placed decarbonising their home as a top priority for government tackling climate change.

This leads us to be concerned that the gas supply companies could be at the forefront of bearing a disproportionate amount of this cost – at the very least, in terms of the infrastructure needed.

Due to this dynamic, having exposure to these groups for more than 5-10 years in this uncertain cost environment is something we avoid.

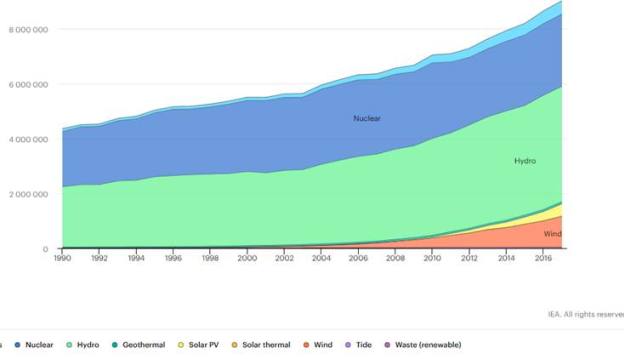

Chart shows low-carbon electricity generation by source - world

Source: IEA Electricity Information 2019

On the flip side, supporting groups such as E.ON, who only provide renewable electricity to the UK market, exposes funds to positive change too.

We need to seek future investment opportunities that can help funds gain exposure to groups engaged in positive change on the environment.

I recently visited a vertical farm at the James Hutton Institute.

Outlook

This technology is only starting to break into the public consciousness and potentially offers a lower carbon footprint for growing vegetables.

Where there were previously few opportunities for public credit funds to get invested in this trend, there are a lot more arising - particularly in terms of providing financing for the buildings.

With our large private credit team, we hope to get early exposure to this positive trend.

With the amount of change needed for environmental targets to be hit, it is important to have scale in your investment manager.

We can use our global network to find positive opportunities, be aware of areas to avoid, and indeed, investigate early the future investments of tomorrow.

These opportunities are not just for specialist green or ESG funds but for every investor to be both concerned and excited about.

Luke Hickmore is a senior investment manager at Aberdeen Standard Investments