Following the pattern of ESG investing as a result of the great wealth transfer that is taking place in the US, American financial advice company Sage Advisory has pointed to similar patterns that will develop across the world, with the UK and other similar countries experiencing the so-called ‘Greta Thunberg investment effect’.

Komson Silapachai, CFA and vice-president of research and portfolio strategy at Sage Advisory, said younger investors in the US were leading the way.

He explained: “Millennials are a generation reliant on 401(k) [pension] plans for retirement savings, representing 75 per cent of the workforce by 2025.”

Because of this, businesses have had to adapt to meet the investment needs of the ‘next generation’, and where the provider or adviser has not been able to do so, investors have gone elsewhere.

Mr Silapachai said: “Given millennial interest in ESG investing, it is no surprise investment professionals have been working to increase the availability of ESG investments, but this has not been true of 401(k) options.

“In 2019 there were over 280 ESG-focused mutual funds and ETFs [exchange traded funds] according to Morningstar, but only four per cent of 401(k) plans have ESG funds available according to Plan Sponsor Council of America.

"However, two-thirds of millennials said they would increase their 401(k) contributions if they knew their investments were doing social good, according to a Natixis survey.”

Emma Smith, ESG research analyst for Sage Advisory, said: “One way millennial investors have been getting around this lack of availability is through the use of ESG-oriented robo-advisers, which have seen inflows over the past several years.

"As ESG investing continues to become mainstream, millennials will continue to contribute investment dollars to this growing and evolving space.”

Global ESG drivers

Climate change has become a major topic of concern for citizens and governments across the globe, but how might this feed into people's portfolio decisions, and again, what lessons might the UK be able to learn from other countries where investors are starting to vote heavily with their conscience?

Mr Silapachai said the topic was heavily discussed in the 2020 US Democratic presidential debates, and agreed Ms Thunberg has “captivated youth across the world with her message of radical change”.

This, together with the world “receiving a window into a cleaner planet as an unexpected consequence of the current global pandemic”, meant investors were delivered a stark reminder of how much humans can affect the planet, and how that effect can be positive or negative.

And awareness is crucial, with global eyes watching closely what the US does, and investors taking seriously the global threat that climate change presents.

He added: “With the US’ decision to withdraw from the Paris Climate Agreement, now more than ever investors are becoming increasingly aware that change needs to come from all forms of action, including the use of investment dollars. This awareness will likely drive investment portfolios towards climate-focused investments over the next decade.”

UK-based investment advisers agree. According to Chelsea Financial Services’ Ryan Lightfoot-Brown, senior analyst at the company, younger people in particular are voting with their feet in-store and with the money in their portfolios.

In an FTAdviser podcast, Mr Lightfoot-Brown commented: “Greta Thunberg’s generation is more media-savvy nowadays, so any standards not acceptable to ESG investors are going to be highlighted much more, and disseminated quickly on social media.

“This has a double effect — from consumers who want to distance themselves from companies with poor ESG, and at the board and director level, as they don’t want to be in charge of a company called out in the media.”

His view is that people don’t want to invest in a company that could put itself at risk of being on the wrong side of the climate change argument.

Additionally, ESG strategies and funds specifically investing along ESG lines in the UK have strongly outperformed their peers this year.

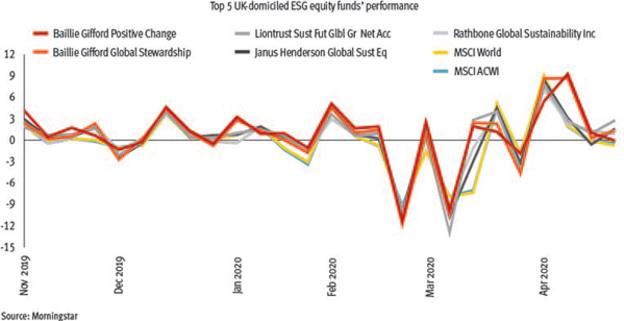

According to data from Morningstar, as shown in the graph, the top five UK retail ESG funds have shielded investors from the market falls experienced during the Covid-19 outbreak.

This outperformance was helped by the fact they missed out on the sharp oil price drop that saw the West Texas Intermediate drop into negative territory, briefly trading at almost -$40 on April 20.

The oil price shocks that started in February with a price war between Russia and Saudi Arabia brought blue-chip fossil fuel companies’ share prices crashing down. Having traded above £5 last November, BP share fell to £2.33 on March 18, before climbing back up to £3.20 as at the time of writing.

Mr Lightfoot-Brown commented: “I would say ESG is becoming mainstream investing these days. There are ESG slides in every presentation now.

“But with regards to relative performance, yes — for example, when we see an oil crisis like we are now, there will be a big underweight to that sector in ESG funds, so they will operate better on a relative basis.”

Advisers on the case

Regardless of sentiment shifting on both sides of the pond, there will soon be regulatory obligations coming into force that will force advisers to determine clients’ ESG preferences before any investment portfolio is drawn up.

Impending changes to Mifid II regulations will oblige advisers to incorporate ESG considerations within their suitability assessments, to best identify appropriate investments for investors that take into account the clients’ own ethical views.

But a recent study carried out by Square Mile Investment Consulting and Research found 47 per cent of financial advisers were unaware of the incoming regulatory obligations.

In fact, only 46 per cent of 184 adviser respondents to Square Mile’s polling said they included ESG in their attitude-to-risk questionnaires, and only 39 per cent have integrated ESG into their centralised investment propositions.

According to Square Mile, this suggests the whole financial services industry in the UK needed to work harder to improve ESG understanding, particularly in regard to the incoming regulatory changes.

Steve Kenny, commercial director for Square Mile, commented: “Our research into adviser attitudes towards ESG demonstrates there is still some way to go before ESG considerations are fully integrated into their advisory processes.

“The perspective that advisers feel there is insufficient client demand for strategies which incorporate ESG is undoubtedly influenced by the fact a significant number of advisers do not raise the subject with them.”

He added the old-fashioned “binary" choice between ESG strategies or performance has been proved wrong — as underlined by the performance data over the first four months of 2020.

Mr Kenny added: “The strong returns produced by many ESG funds over this period demonstrate that this is no longer the case. At the same time, it is clear that many advisers are not determining interest in ESG as part of their suitability assessments.

“It is particularly concerning that nearly half of those responding are unaware of imminent regulatory change that will compel them to do so.”

So, with the two big pressures approaching: the wealth transfer to younger, more ESG-savvy investors, and regulation, it will become even more important to put ESG at the heart of investment conversations.

But whether it translates to a global audience is yet to be determined. As Sage’s Mr Silapachai added: “The trend to ESG adoption has certainly been slower in Asia, especially among smaller investors.

“However, we’re seeing signs it’s starting to pick up, including an increase in sustainable investing by some of the largest institutional investors, helping to push sustainable investing into the mainstream.”

Notably, a 2019 survey by RBC Wealth Management found 74 per cent of younger generation investors globally said they felt it was increasingly important to consider ESG factors when investing, versus 63 per cent of older generation investors.

Sage’s Emma Smith added: “We see this trend continuing in Asia, as well as Europe and the US, as a generational shift of investable assets move to younger generations in the coming years.”

Simoney Kyriakou is editor of Financial Adviser