The perennial debate among investors focused on adding property exposure to their clients portfolio is the choice of open or closed ended funds if investing in bricks and mortar property.

Open-ended funds can fall foul of a liquidity mis-match, whereby the end client can withdraw their money at one day’s notice, but the underlying investment is in an asset that cannot quickly be sold.

This creates the potential for funds to be unable to pay out clients in the event of an economic downturn. Fundhouse M&G suspended its property fund at the end of 2019 as investors withdrew £1bn.

And the Covid 19 crisis meant that the 11 open-ended property funds with daily dealing in the UK market have had to shut, with investors unable to get their cash out.

This has happened because surveyors have not been able to work during lockdown, so have not been able to value properties. This means open-ended property funds cannot publish a daily net asset value (NAV) and so investors cannot know the value of the assets they own.

Closed-ended funds

With an investment trust, the shares are traded daily on stock exchanges and so an investor can always see the price, and always sell at that price.

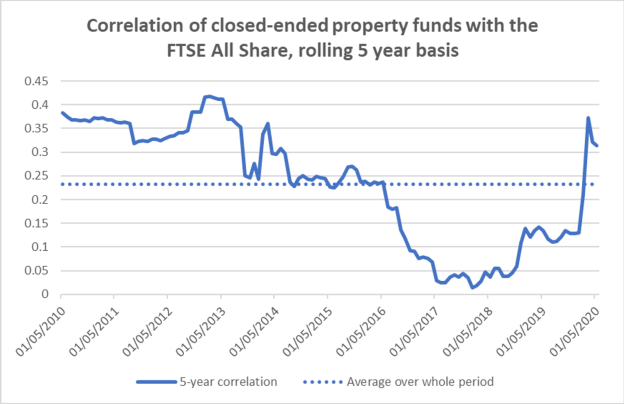

But because the shares are traded on a stock exchange, they are vulnerable to the possibility of falling in value when the wider stock market sells off, and so those assets are relatively more correlated with equities.

Paul Derrien, investment director at Canaccord Genuity Wealth Management says the type of property fund suitable for an individual client relies on their time horizon.

He says: “This really does depend on what type of property exposure investors are seeking and they come with their own risks.

"Once again a number of open-ended property funds became gated due to the pandemic, therefore investors cannot get their funds out so any investment into this asset class needs to be long term with the assumption that it is as illiquid as an actual property that you might buy.

"It is often better to go for property funds with quarterly redemption dates as these deter short-term trading and reduce the risk (but not eliminate it) of gating.

"The other option, if you are more short term is listed REITs (Real Estate Investment Trusts). These can provide excellent opportunities to access property at a discount to its theoretical value and often provides the greatest opportunities after an economic decline, as you get not only the increase in the property values, you can also receive a boost from the share price rising.”

Investment trusts can also use gearing, that is debt, to get even more exposure to the asset than they have with the cash they invested.

Correlation to equity markets

Open-ended property funds are also less correlated to wider equity markets as a result of those products keeping a significant slug of their capital in cash as a buffer. This means such funds are typically less invested in property as an asset class than are investment trusts.

Sunil Krishnan, head of multi-asset funds at Aviva Global Investors believes the benefits of diversification give open-ended property funds the edge.

He says: “Property funds have attracted some negative attention because of fund suspensions and general concern about the outlook for tenant solvency and occupancy rates in the face of a recession.

"That said, we think it’s important to see them in context. We believe they do offer diversification from equities and bonds, as they are less at the mercy of day-to-day investment sentiment.

"Many of the recent suspensions have had more to do with valuers unable to do their jobs of surveying properties, than mass outflows from the funds themselves.

"While the asset class retains sensitivity to the health of the real economy, if anything the co-ordinated behaviour of the Treasury and the Bank of England should provide more support to ensure tenants remain current, and their businesses afloat, than we have seen in previous deep recessions.”

Charlie Parker, managing director of Albemarle Street Partners, a discretionary fund management firm, says he tends not to use open-ended property funds.

He says: “As a point of principle we avoid bricks and mortar property funds. We recognise we are in a minority on this but tend to stick to the principle that we like the underlying assets in which we invest to have as much liquidity as the vehicle they are contained in – to avoid situations where investors are surprised by suspensions.

"Going forward our view is that Reits will largely recover in line with wider equity markets and we do not see a simple portfolio of generalist Reits as a major diversifier.”

Source: AIC/Morningstar

Luke Hyde-Smith, head of fund selection at Waverton says: “We do not hold and will never hold any open-ended, directly invested commercial property funds, the majority of which are currently suspended, but also hold high cash balances and have significant exposure to the most challenged areas such as retail and offices.

"We believe the most appropriate means to invest in the property sector for those that require daily liquidity is through listed real estate investment trusts, or closed-ended investment companies.”

Alex Price, chief executive of Fiera Real Estate, an open-ended property fund which does not offer daily dealing, says the correlation between equities and the property market is generally very low, though there is a much closer correlation between the performance of investment grade bonds.