Article 1 / 4

Guide to investing in propertyThe role of property in a balanced portfolio

Recessions typically lead to investors sharply revising their expectations for the property market.

As the most economically sensitive of asset classes, property tends to rise steeply as economic growth becomes entrenched, only to crash when the tide turns.

In the UK, over the past decade, the policies of record low interest rates and quantitative easing have boosted much of the UK’s property market, even without a concordant increase in economic growth.

The pandemic has shattered the fragile GDP growth being eked out in the UK.

Remote working

But in addition to the usual jerk downwards in property valuations as a result of the decline in economic activity, there is the added complication of the present necessity of remote working to potentially become a permanent part of the culture, hurting long-term demand for commercial property.

This will also affect residential property as workers consider where they want to live, in a working-from-home world.

Those uncertainties are compounded by the continuation and expansion of central bank policies which have in the past caused property prices to rise regardless of economic conditions, and the advent of rent and mortgage holidays for businesses.

The effect of these may be to prevent the usual cycle of evictions and repossessions that pockmark an economic downturn.

Paul Derrien, investment director at Canaccord Genuity Wealth Management says: “Usually an economic decline is a great opportunity to include property, as the asset class benefits from the recovery and adds some diversification from equities.

"The future, however, is unclear. The new normal may see lower demand for office space, retail space, even hospitality space in the short term, and all of this will provide a headwind at the very least for this asset class.

"Add in that many properties are owned with debt, and it could pay to be patient. The pandemic may even be a thing of the past when the greatest opportunity presents itself.”

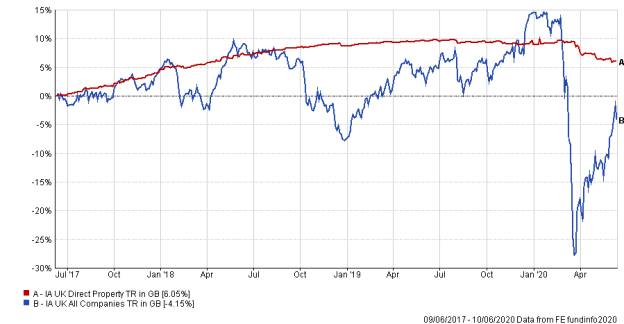

He added that investors considering allocating to property should be aware that the performance of the asset class tends to be relatively closely correlated to equities, and so an adviser considering allocating to property should consider whether those assets offer sufficient diversification.

Richard Shepherd Cross, managing director of Custodian Capital, the fund management arm of Mattioli Woods says: “After the pandemic, while many things may have changed, it is likely that the correlation between property investment and equities and bonds is likely to return to normal.

"That is to say, property will again be lowly or negatively correlated with equities and bonds. Low, or better still negative, correlations between assets in a balanced portfolio will reduce portfolio risk and volatility.”

Impact on property sectors

Luke Hyde-Smith, head of fund selection at Waverton says “Property assets undoubtedly face some unique challenges due to the Covid-19 crisis and the resultant lockdown imposed by governments globally.

"Certain sectors have been extremely resilient, such as supermarkets, healthcare and logistics, while others, such as those operating in more challenged areas including retail, office, leisure and hotels have been more negatively impacted.

"Many trends in place have accelerated due to Covid-19 and now more than ever it is important to ensure property investments are focused on areas underpinned with positive structural trends, such as demographics, technology and ongoing urbanisation.”

He added that property has often been viewed as a defensive asset class because the income comes from leasehold agreements, which are legally binding.

But he says that so many companies facing financial trouble and who may therefore be unable to pay the rent.

Investing in commercial property

Neil Birrell, chief investment officer at Premier Miton, says the multi-asset funds operated by his firm all have some investment in commercial property, and always will, with the amount each portfolio allocates to property determined by the risk level of each fund, while the multi-asset income fund tends to have more property than the non income funds due to the higher yield requirement.

He says: “I think we will always have property in portfolios. We tend to invest in Real Estate Investment Trusts (Reits) for property exposure.

"Because those are listed on the stock exchange, there is an element of equity risk with those, but there is liquidity. We don’t invest in open-ended property funds.”

Charlie Parker, managing director at Discretionary fund management firm Albemarle Street Partners says he thinks the performance of Reits will be broadly in line with that of the wider equity market, and so such assets do not, on their own, act as a diversifier away from equities.

Jason Hollands, managing director for business development and communications at wealth manager Tilney says: “Things were already dreadful for retail properties last year and 2020 is much, much worse as a result of the lockdown with shops and restaurants forced to close.

"Landlords are having to take a hit on some tenants and occupancy rates will soar as businesses fold.

"The lockdown has seen a collapse in retail sales, but it has also rapidly accelerated the rise of online shopping which means logistics and depots are in a relatively better place.

"The pain is also clearly extending into the office market, as the experiment of remote working is certain to mean that many businesses will be reviewing their future floor space needs with more flexible working arrangements in mind where these have worked well during the lockdown and not impacted productivity.”

He regards investing in property funds in the current climate as a “brave” investment decision.