By Clive Bolton, Managing Director LV= Savings and Retirement

Covid: a crisis that didn’t turn into a drama

Recent conversation around Covid has been dominated by the pandemic’s impact on industry, job security, and the wider economy.

But whilst devastating, there are reasons to be hopeful for businesses that have adapted well to new trends and opportunities.

For the Life and Pensions industry, virtual connectivity and online access for advisers and their clients isn’t new. But, the accelerated rate of change has caught many unaware.

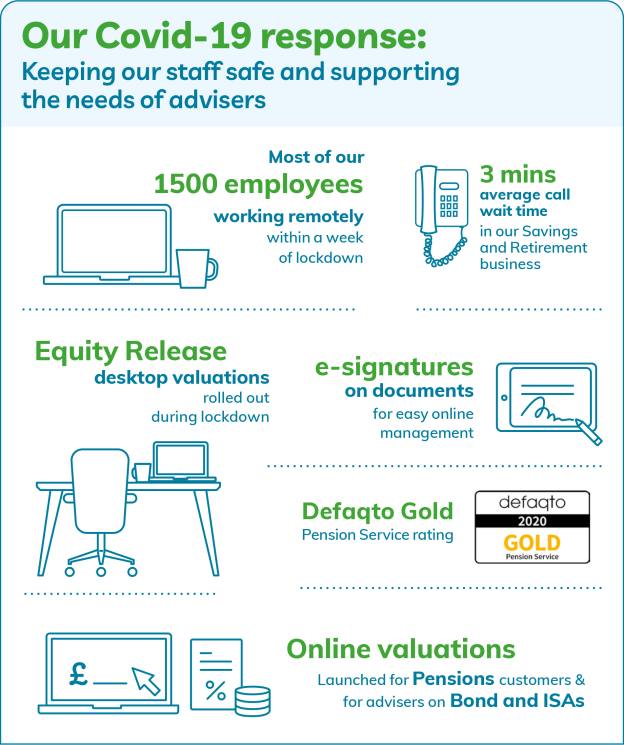

As a service provider, we’ve found that making several small changes to the way we conduct business, together with a quick response to the pandemic, allowed us to support the needs of advisers and their clients with minimal inconvenience.

One larger change we’ve made is a simplification of our Pension, which is now ordered in three tiers with costs starting from 20bps. This transparent structure works alongside our improved online access to deliver a modern, hassle-free pension proposition.

Connecting with our customers’ new reality

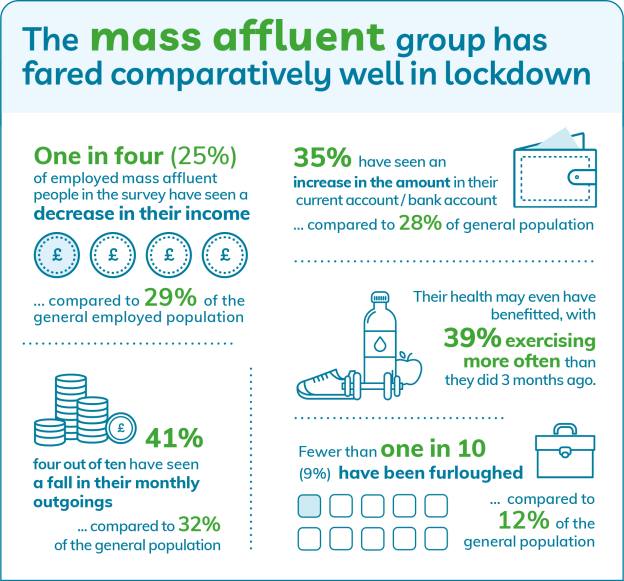

We’re focused on mass affluent customers, and providing them with financial resilience in retirement and later life.

But who are they?

The mass affluent group are in a financially comfortable position and our research1 shows:

- They’re sensible with their finances, with a strong savings habit

- 95% prefer low/medium risk investments

- 39% have children under 18, so often balance family support with saving for retirement.

- 49% are older than 55, so they’re retired or nearing retirement

They also know they need help with retirement planning and are open to financial advice

- 6 in 10 have used a financial adviser in the past, and 7 in 10 would use advice in the future

- 70% of have good general financial knowledge

1Source for statistics: research conducted by LV=, and by BDifferent on behalf of LV=, with nationally representative UK adults between January and June 2020.

Understanding our customers has helped us to recognise what support they may need after Covid, and to refine our new and existing propositions so that advisers feel confident that they’re meeting clients’ needs.

Smoothed Investment strategies win out

Understandably, financial planning and the protection of assets has become a major focus for risk-sensitive clients.

The requirement for investment options that offer steady long term growth, while helping protect against market volatility has proved crucial for this underserved client group.

For advisers, accessing straightforward, risk-rated solutions that support clients through all market conditions is just as important.

Our Smoothed Managed Fund range can be accessed via a pension, bond or ISA and was designed to offer a low volatility investor journey through all market conditions.

The funds come with a simple smoothing mechanism that averages daily fund prices over the previous 26 weeks to help protect against extreme market swings – and I’m pleased to say that it has performed exactly as intended, even through the market extremes we saw earlier this year.

Our smoothed funds have served as a flagship proposition throughout the crisis, reducing the impact of market volatility on client investments, and removing unnecessary stress and anxiety for those invested.