Retreating to cash during the market crashes of the past 12 years has left investors more than £50,000 worse off than their more patient counterparts, research has shown.

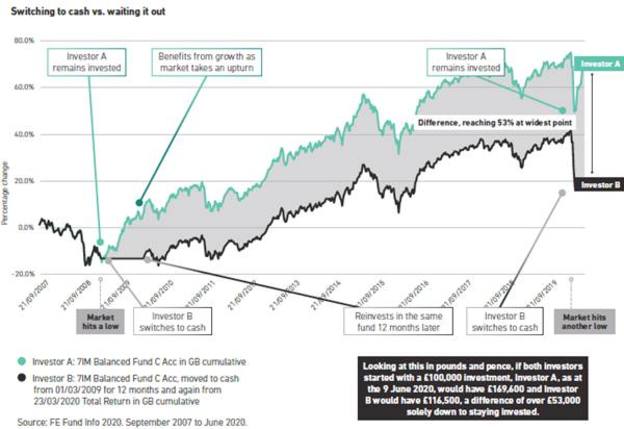

Data from Seven Investment Management showed an investor who retreated to cash in March 2009 and then again during the March crashes caused by the coronavirus crisis would have lost £53,000 compared to an investor who stayed in the same fund.

Investors who piled £100,000 in the 7IM Balanced Fund in 2007 and stayed put until June 2020 would have £169,600 in their pot, while investors who moved to cash in 2009, invested again a year later, and then pulled their funds again in March 2020 would only have £116,500.

Ben Kumar, senior investment strategist at 7IM, said: “The investment facts are clear. Moving to cash and trying to ‘time’ the market doesn’t work.

“No-one calls the top successfully, and no-one calls the bottom either. Stay invested. It sounds simple. It is simple. But for many investors, the simplest thing to do is often the hardest.”

Mr Kumar said there were two “particularly dangerous periods” for consumers invested in the stock market.

The first was when things started to go wrong, such as in March of 2020 when the pandemic took hold outside of Asia, but the second was a more “subtle” danger period.

He said: “When things get back to where they were before the crisis, for investors who stayed the course through the pain and have seen their portfolios rebound, there always comes this bit of time. They start to feel relieved that the money wasn’t lost.”

Mr Kumar said this was when investors could start to panic about further falls and be tempted to retreat to cash.

“Although markets are recovering”, he added, “we are not out of the woods yet”.

Ben Yearsley, investment consultant at Fairview Investing, agreed. He said: “If you’re going to cash, you are market timing. The problem with going to cash is when do you get back in? What’s your signal and do you go all back in?”

He warned timing the markets was a strategy “fraught with danger”.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.