At this stage of the crisis, the human, social and financial costs of the coronavirus pandemic remain incalculable.

It will have both short and long-term consequences for individuals, families, finance, business and politics globally. But humanity has weathered severe crises before.

As a species, we are survivors. We adapt.

Global warming threat

However, humanity will have to summon all of its adaptive ingenuity to combat the bigger threat coming our way. A crisis of our own making threatens the entire sheltering capacity of the earth itself.

Global-warming risk varies from country to country, but for those in hotter and more humid countries the ability to work and even live are at risk as heat levels rise.

India is a case in point, where 42 per cent of the workforce are employed in the agricultural sector and another 4 per cent in construction. Nearly half the workforce stands to suffer grievous working conditions as the number of days of insufferable heat rockets.

By 2030, the effective number of outdoor daylight work hours lost in an average year among labourers may increase by 15 per cent, leading to a 2.5 per cent to 4.5 per cent drag on GDP.

About 10 per cent of Indians, or 120m people, already live in areas with a non-zero annual probability of lethal heatwaves – defined as three-day surges in temperatures that exceed the threshold of survivability for a healthy human being in the shade.

This proportion is expected to increase by 5 per cent to 10 per cent by 2050, when the number of Indian people expected to fall into the lethal-heatwave danger zone is forecast to range between 310m and 480m.

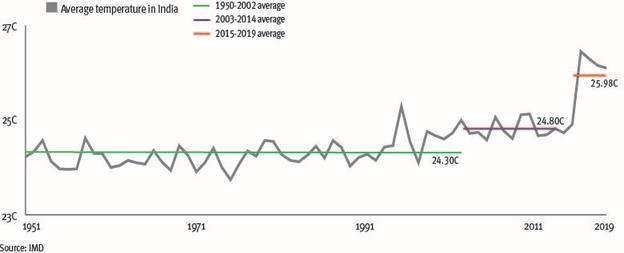

Looking farther out, in the last 20 years of this century, India is projected to experience 181 days a year with temperatures in excess of 35C. For context, the country’s average annual temperature in 2018 was 25.9C.

This would not only be hazardous to the health of the people and the natural environment, but render plenty of outside work, as it is currently done, impossible.

This is not to say companies and city planners in the country are unaware of the problem; they just are not aware enough.

Cost of global warming

A survey of the management of our portfolio holdings recently highlighted that much more thinking needs to be done if companies are to meet the upcoming challenges. The same is true at the municipal level, where awareness has dawned but finances and more immediate issues often shift the focus.

If we look beyond India and to a global scale, by 2050, there is an estimated 80 per cent cumulative average likelihood that a person living in an at-risk area will experience a lethal heatwave at least once over a 10-year period.

The threat is truly global. Summertime, the season longed for by schoolchildren everywhere, may become a time of increased danger and stress. Taking these projections on board is becoming important for all of us, wherever we live.

Emerging market investors in particular, however, will want to factor likely climate scenarios into their long-term analysis.

Despite our knowledge and better instincts, the slow onset of global warming, the high cost of combating or mitigating it, and its less immediately tangible impacts have made deferring action the default human response.

There is still time to act, but the longer we delay, the higher the costs will be and the slimmer our chances of achieving success.

We encourage all investors to make climate change a core theme of their interactions with businesses: all companies, not only those we invest in, must begin to focus on adapting for the rougher weather ahead. We all need to get some shelter.

Gary Greenberg is head of global emerging markets at the international business of Federated Hermes