Despite the fall in sterling – which has boosted overseas earnings – slow economic growth and uncertainty about Britain’s ongoing relationship with our closest neighbours and biggest trading partners have seen foreign investors remain cautious about investing in UK listed companies.

The difference in performance has been even more noticeable this year as the UK’s slower growth and lack of clarity from the ongoing Brexit negotiations have been compounded by the effect of the coronavirus pandemic.

When compared with Europe, Covid-19 has had a particularly severe impact on the UK both in terms of health and economic activity.

GDP in the second quarter saw the largest fall ever recorded.

The UK’s recovery is also likely to be slower than initially predicted.

The Office for Budget Responsibility’s central scenario predicts GDP will be back to pre-coronavirus levels by the end of 2022. This is not noticeably slower than current forecasts for the Eurozone and the US, but it is also not closing the increasingly large gap in economic recovery.

The past few years have seen UK equities tipped as an undervalued market with the potential to close the valuation gap with other developed markets if a workable relationship with the EU can be agreed.

This has become increasingly unlikely in the short-term as the damage done by Covid-19 continues to act as a drag on economic recovery.

In such a scenario, the ability to pick stocks that are unaffected by the economic cycle becomes even more important. The LF Gresham House UK Micro Cap fund aims to do just that.

UK smaller companies outperformed large caps in Q2, but this is a reversal of the recent trend as smaller companies have lagged over the past few years.

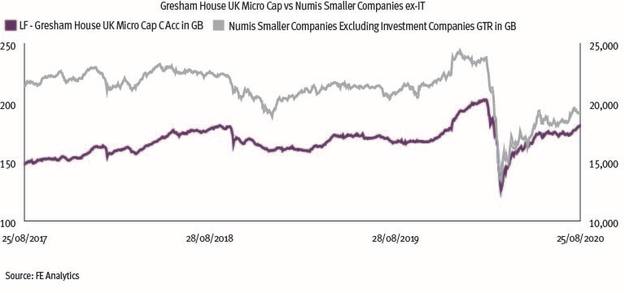

The Gresham House micro-cap fund has bucked this trend and has managed to consistently outperform its peer group, as well as UK large caps.

The fund has a relatively concentrated portfolio and currently holds 45 stocks. Its investment process screens out cyclical companies, so it has no exposure to banks, miners or oil and gas companies.

It also avoids early stage tech companies due to the rate these companies burn through cash while they get established. Instead, the investment process identifies companies that are already established and profitable.

As a true micro-cap fund it will not invest in companies that are valued at more than £250m, although they have to have a market cap of at least £50m to be eligible for investment.

The fund has returned 22 per cent over the past three years, far exceeding the IA UK Smaller Companies sector which has returned 3.9 per cent. Over the same period, the FTSE 100 is down 8 per cent and the Numis Smaller Companies ex-IT index is down 11.1 per cent.

Year-to-date fund performance has also held up well. The fund entered the year defensively positioned. In February the fund held around 18 per cent in cash to allow it to take advantage of buying opportunities presented by Brexit negotiations.

Not only did this help protect the fund’s value in the sell-off, it allowed the fund to top up several core holdings and participate in several share issues as businesses recapitalised.

The UK continues to face several headwinds, including the future relationship with Europe and the recovery from Covid-19. The end of the furlough scheme could hit smaller companies hard, and sentiment could quickly turn against smaller companies.

However, the fund remains defensively positioned and continues to hold a high level of cash (around 17 per cent of the portfolio). Combined with its focus on quality stock selection, the fund remains well positioned to benefit from short-term market fluctuation.

Charles Younes is research manager at FE Investments