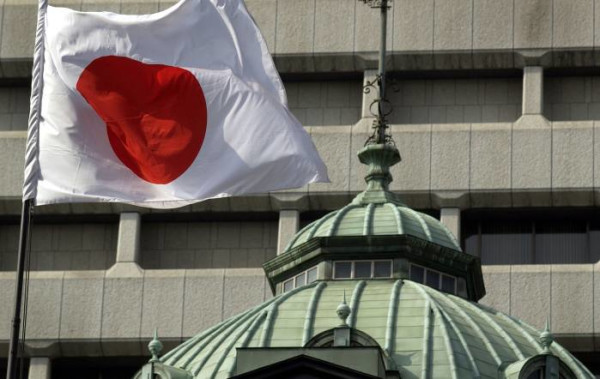

Japanese equities dominated the performance tables in September as the appointment of Yoshihide Suga was welcomed by investors and a strong Yen against the pound boosted returns.

The Baillie Gifford Japanese Smaller Companies fund was the absolute best performing portfolio in September, returning more than 15 per cent over the month.

Japanese funds accounted for seven of the 10 best performers in the period, with Invesco’s Japanese Smaller Companies portfolio and Legg Mason’s IF Japan fund making up the top three.

| Top performing funds, September 2020 | Performance (%) |

| Baillie Gifford Japanese Smaller Companies | 15.16 |

| Invesco Japanese Smaller Companies | 13.19 |

| Legg Mason IF Japan | 12.62 |

| JPM Japan | 10.79 |

| Polar Capital Biotechnology | 10.53 |

| Comgest Growth Japan | 10.46 |

| New Capital Japan Equity | 10.45 |

| ASI Japanese Smaller Companies | 10.3 |

| Pictet Biotech | 9.85 |

| T Rowe Price Japanese Equity | 9.74 |

Adrian Lowcock, head of personal investing at Willis Owen, said: “The appointment of Yoshihide Suga as prime minister of Japan was welcomed by investors.

“It removed the risk that Abe’s work would be unwound and Japan would return to its old ways.”

Mr Lowcock added that Japanese funds also benefited from a “weaker pound against the Yen” as investors grew concerned over the possibility of negative interest rates, a second lockdown and Brexit fears returning to the headlines.

Read more: Investors urged to look east as Japan appoints new PM

In terms of sectors, Japanese Smaller Companies saw the strongest returns with nearly 10 per cent in September (9.8 per cent) while Japan and Asia Pacific Inc Japan performed well, returning 6.3 and 4.3 per cent respectively.

The headwinds facing the UK also helped UK government bonds, a safe-haven asset, put in a positive performance in September.

| Worst performing sectors, September 2020 | Return (%) |

| UK Equity Income | -2.3 |

| UK All Companies | -1.76 |

| UK Equity & Bond Income | -1.56 |

| UK Smaller Companies | -1.2 |

| Property Other | -0.88 |

The precarious position of the UK was less good for UK equities, which accounted for four of the five worst performing sectors in the month.

Ben Yearsley, investment consultant at Fairview Investing, said: “The UK’s weak performance will continue until either there is a Covid vaccine or a Brexit deal with the EU is signed.

“In reality probably both are needed. As ever it pays to have a diversified portfolio and it can be too easy to write markets off that have under performed for a long period. This feels the case with the UK currently.”

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.