With its rarefied lingo of Series A rounds, burn rates, angels and unicorns, venture capital isn’t normally seen as an asset class for the person in the street.

And yet, over the past 25 years in the UK, tens of thousands of people who would not know an IRR from an IPO have become VC investors.

They have done this through venture capital trusts (VCTs), the first of which was launched almost exactly 25 years ago.

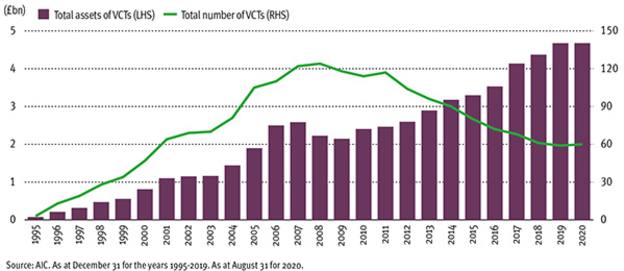

Endorsed (if occasionally revamped) by every occupant of 11 Downing Street since Ken Clarke, VCTs have grown into a £4.7bn industry – enough to make them a major player on the European venture capital scene. The aptly named Octopus Titan VCT, with assets of more than £910m, is the eighth biggest venture fund in Europe.

Risks and reinvestment

Though investors can subscribe for VCT shares directly, this is predominantly an advised market. Advisers have been attracted by a powerful combination of tax breaks, the best known of which is the 30 per cent upfront income tax relief, but there are tax-exempt capital gains and tax-free dividends available as well.

These incentives have become even more enticing since the tapering of the pension annual allowance for higher earners. In the four tax years since that change, VCTs have raised an average of £655m a year, up from £394m in the four prior years.

While the upfront income tax relief at 30 per cent is as close as maxed-out pension savers can get to pension tax reliefs, a stream of tax-free dividends looks an attractive prospect to supplement the income from a pension.

Key Points

- Tens of thousands of people have become VCT investors

- The VCT sector is predominantly advised

- There are fewer VCTs available than 10 years ago

But are advisers in danger of letting tax breaks determine investment choices? And, given their risks, are venture capital investments really a suitable supplement to a pension?

The risks of VCTs are self-evident. The whole point of the scheme is to support businesses that would otherwise struggle to secure funding for growth, and changes to the VCT rules since 2015 have narrowed the focus on high-risk/high-return opportunities.

These companies can become big names – over the past quarter-century, VCTs have backed the likes of Zoopla and Secret Escapes – but they can also fail completely.

But this risk is mitigated by an unusual feature of VCTs. Like their close cousins, investment trusts, but unlike institutional VC funds, most VCTs are evergreen – they reinvest the profits that they do not pay out in dividends.

This means that at any one time, a typical VCT will be invested in dozens of underlying businesses from a range of sectors, at different stages of development.

Smooth returns

VCTs invest in sectors as diverse as medical imaging, video games, enterprise software, niche consumer brands and quantum computing.

And of these businesses, some will be new investments, with ink barely dried on the deal, while others may be in the process of being sold – with most somewhere in between.

This diversification of both business sector and ‘maturity’ means that it is possible for VCTs to produce smoother returns than you would expect from a more conventional venture capital investment.

While share price volatility is not a good guide to risk in this case (it tends to be extremely low due to thin trading) the steady streams of tax-free dividends from many mature VCTs suggests that they have been successful in smoothing returns. That said, some VCT managers have highlighted that VCT rule changes since 2015 may make dividends lumpier in future.

The average VCT has returned 22 per cent over the past five years, excluding income tax relief, and 128 per cent over the last 10. In the past 12 months the sector has lost 3 per cent as the impact of the pandemic on the UK economy has been felt.

The non-financial returns of VCTs are harder to measure, but significant. Our research has estimated they have created 27,000 jobs by investing in high-growth businesses, but this is likely to be a substantial underestimate, as we do not have data on every single VCT-backed company.

With investors increasingly interested in the impact their money has, it is clear to see that £100,000 invested in a VCT is going to make incomparably more of a difference to the underlying businesses than the same amount ploughed into a UK or global index.

Advisers need to be discerning in their selection of VCT for a client. The array of options is not bewilderingly large – there are only 61 VCTs, and not all of these will raise money every tax year.

Basic information on VCTs is on the Association of Investment Companies’ website. Beyond this, a number of established companies offer independent research into VCT offers, looking at factors such as the strength of the VCT manager’s team, their record of successful exits, fees and charges, and the make-up of the existing portfolio.

Another important factor is the VCT manager’s buy-back scheme. Buy-backs give investors in VCTs an exit route – though they need to hold their shares for five years to retain all the tax breaks.

Buy-backs are usually done at a discount, and are not guaranteed.

The VCT sector has changed greatly in recent years. While assets in VCTs have almost doubled from £2.4bn in 2010 to £4.7bn this year, the number of VCTs has roughly halved over the same period.

This consolidation has been driven in part by the merging of VCTs, and the exit of some of the smaller managers from the sector.

Those that are left have generally been in the business for a long time, and have built extensive experience, earning advisers’ trust.

Assuming the restrictions on higher earners’ pension contributions are unlikely to be reversed, VCTs are likely to retain their importance as part of tax and retirement planning for wealthier clients.

Nick Britton is head of intermediary communications at the Association of Investment Companies