Advisers and analysts have criticised the responsible investment sector for its confusing and conflated terminology, a lack of clarity around weightings, greenwashing fears and “woolly” responses, as warning bells are sounded that lingering issues could cause further problems.

Steve Nelson, consultant at the Lang Cat, told FTAdviser the industry was “doomed to rinse and repeat the same issues of old” until it collectively improved understanding on what ESG “actually means on a practical and individual level”.

He said: “The sector has gone to ‘solution mode’ without fully understanding the problem and without fully engaging with the people that matter – that’s customers, or advisers on the hook for sourcing and recommending investment ranges.

“I don’t envy the thousands of high-quality planners facing the umpteenth round of regulatory change with so little clarity and consensus on this seemingly increasingly important issue.”

Advisers admitted they were facing an uphill battle when it came to working within the existing ESG frameworks.

Ricky Chan, director at IFS Wealth & Pensions, said: “The usage of terms such as ESG, ethical and sustainable are quite often used synonymously, despite attempts at a framework from the Investment Association.

“Within ESG specifically, who determines the weighting or importance placed on each of the factors? And furthermore, the subfactors within these could encompass a lot more considerations and questions.”

Mr Chan added that greenwashing – making an investment seem ‘greener’ than it is – was a growing issue as investment fund houses attempted to “capture some of the profits”.

Tim Morris, IFA at Russell & Co Financial Advisers, agreed. He had “lost count” of the number of fund managers who claimed that ESG formed part of their process, but when questioned were only able to provide “woolly answers that skirt around the issue”.

ESG investing has boomed in popularity as more investors consider the impact of their money.

Good Money Week, which takes place next week (October 24-30), is a national campaign promoting sustainable and ethical options for banking, pensions, savings and investments, with the tagline: “Money that’s good for people, the planet and our pockets.”

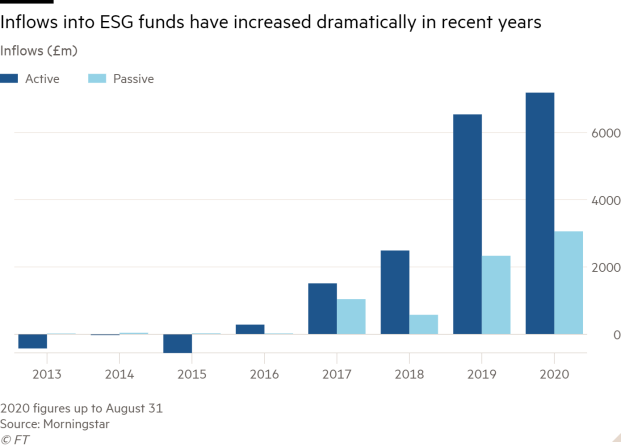

According to data from Morningstar, investors pumped more than £10bn into UK-based ESG funds in the first eight months of 2020 – already beating last year’s £8.9bn total.

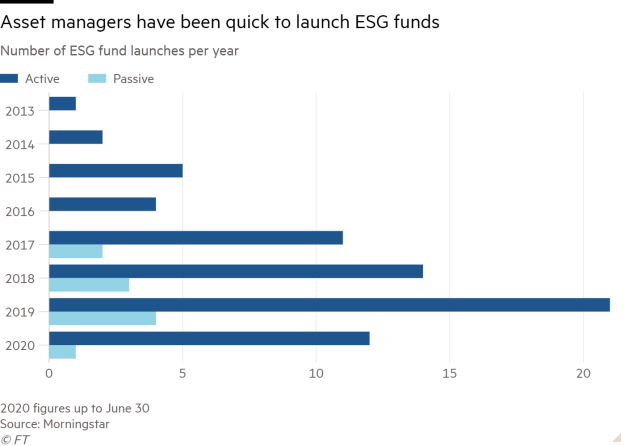

And fund managers have been quick to respond to the ongoing trend with numerous fund launches, with 25 new ESG funds launched in 2019 compared to 2016’s four.

The trend is likely to continue to grow as EU regulations, set to come into force in early 2021, will require advisers to ask about clients’ ESG preferences.

Gemma Woodward, director of responsible investment at Quilter Cheviot, said: “The likes of David Attenborough and Greta Thunberg can take a lot of credit for awakening the public conscience, which has no doubt been cemented by terrible bushfires in Australia at the start of the year and ongoing forest fires in the US.”

Ryan Hughes, head of active portfolios at AJ Bell, agreed. He said: “We have seen the increasing coverage of climate issues and the impact corporations have on societies, and we are now seeing real momentum, with that translating into the way corporations are behaving. Now, investors are starting to have an impact with their money.”

Mr Chan and Mr Morris said they have “certainly” noticed a rising trend over the past few years.

Others were more sceptical. Darren Cooke of Red Circle Financial Planning said he saw “almost no interest at all” from clients.

He said: “In truth people don’t care, but if you ask them, they absolutely will tell you they do.

“And what is ESG after all? It’s a farce, and what might class as ESG to one person won’t to another.”

On top of this, the world of ESG investing is not all rosy.

The recent Boohoo scandal was a prime example of the issue – the fast-fashion retailer was held by at least 20 ESG funds when it was alleged that workers making its clothes were paid below minimum wage and suffered poor working conditions.

Situations like Boohoo’s, combined with the complex nature of a client’s ESG choices, have created a confusing and challenging maze for advisers.

Do not be an ostrich

With regulations set to come into force next year, advisers have been urged to not be an “ESG ostrich” and “bury their heads in the sand”.

Ms Woodward said: “The regulatory mandated inclusion of sustainability preferences into the advice process is an important development, but many advice firms have more to do to properly account for client’s ESG choices.

“For many firms, it is still very much work in progress.”

Webinars and conferences could help, although she stressed the need to realise that no two clients are the same when it comes to ESG.

Mr Hughes agreed, adding it was “vital” for advisers to “look closely under the bonnet” to really understand how a fund’s ESG approach was integrated.

He said: “There are a lot of new entrants in the market right now and some have little heritage of managing ESG funds, while others have significant pedigree.

“I much prefer to focus on those who have the experience of working in this way for many years rather than those who have just seen the light.”

Both Mr Morris and Mr Chan urged fellow advisers to embed ESG into its advice process and investment proposition.

Mr Chan said: “We’ve embedded it into our process at an early stage of the business, so we explore these investment preferences for all new and existing clients, to ensure investments are aligned with their values.”

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.