Nearly two centuries ago, a little-known American politician running for his state’s Senate seat quoted the Biblical warning that “a house divided against itself cannot stand”.

Abraham Lincoln was right, of course, even if he lost that election and could not save his country from plunging into a civil war that led to some 750,000 deaths.

Today, the American people may be more sharply divided than at any time since the 1861-65 civil war.

Those divisions – over coronavirus, income and racial inequality, climate change and immigration, to cite just a few examples – are mirrored by a government that is just as polarised.

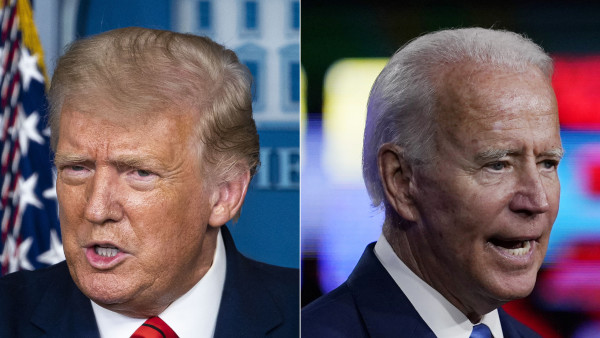

Looking ahead to the country’s election on November 3, the key outcome for the economy and markets will not be the winner of the race between Donald Trump and Joe Biden.

Instead, it will be if the US continues to be led by a divided government or if voters deliver a unified government – with the same party controlling the House of Representatives, the Senate and the White House.

As history shows, divided US governments tend to face gridlock, while unified governments hold the promise of significant policy change.

While the economy has come out of the deep hole of the first half, no US president has been re-elected in a year of recessionary conditions since 1952. Mr Biden currently leads Mr Trump in the polls by a wide margin: about 10 percentage points nationally, though by a narrower margin in likely swing states.

A Biden presidency, on its own, would come with different medium-term priorities, including higher income taxes on top earners and higher corporate taxes, increased infrastructure spending, a public healthcare option, a significant focus on sustainability and a less confrontational approach to global trade.

Key points

- A divided US government results in gridlock

- The make-up of Congress would affect Mr Biden's ability to enact policies, were he to win

- Market performance will likely depend on the ability to contain the virus

However, if the composition of Congress remains unchanged – with a Republican-controlled Senate and Democratic-majority House – Mr Biden would struggle to translate those priorities into legislation.

Consequently, the country’s economic and market outlook would most likely remain broadly the same, although increased regulation could put pressure on pharmaceutical, financial, energy and technology stocks.

A Democratic sweep, by comparison, would see higher state spending, especially on infrastructure projects, supporting faster growth.

The US dollar would weaken, and the yield curve would likely steepen, though only moderately, as the Federal Reserve would cap any interest rate increase. Higher corporate taxes, of course, would impact earnings.

However, surveys of voter intentions could be skewed by a misrepresentation of preferences. Anecdotally, this appears possible with candidates outside the mainstream. Notably, as we saw with the US election four years ago, today’s polls may not be fully accurate.

Even if those polls are accurate, they only represent how people say they intend to vote today and not necessarily how they will vote on November 3.

There is no way to reliably predict how intentions will translate into action. Betting markets likely reflect assumptions on what people think will happen, based on their assessment of what others will do.

They currently give Mr Biden close to a two-thirds probability of winning.

If Mr Trump is unexpectedly re-elected but Republicans fail to unify Congress – meaning that the status quo is maintained – then expect to see only moderate short-term policy changes, including a potential extension of expiring tax cuts. Fiscal policy would likely remain reactively expansionary.

A Republican sweep – which would be the most notable surprise, given today’s polls and betting odds – would likely mean further tax cuts.

Economic growth would accelerate and the dollar would strengthen. Financial services and energy companies would benefit from continued deregulation. Trade tensions with China would likely increase.

It is also possible that no official result will be announced in the standard timeframe. A delayed and/or contested result would likely be negative across sectors, at least initially, due to uncertainty and overall risk-off sentiment.

Unless that delay were extremely prolonged, it would likely support the US dollar on safe-haven flows.

A close look at US election cycles over the past 20 years reveals that, while significant legislative change is likely to be key over the medium term, the economic backdrop has been a far bigger driver of short-term market performance than the presidential winner or winning party.

For example, the pullback in the S&P 500 and Treasury yields following the 2000 and 2008 elections, when different parties won in clean sweeps, was more likely because of the economic crises prevailing at the time – and not necessarily a reaction to the election outcome.

Different parties won the White House in 2004 and 2012, too. An improving economy and the easing of the euro crisis were likely the key catalysts of the subsequent gains in stocks and bond yields.

The market rally following the 2016 Trump election and Republican sweep owed much to a sense of reflation and ongoing optimism about growth.

As the lessons of history suggest, US market performance in the months following this year’s election is more likely to hinge upon success in containing the pandemic and the domestic economic outlook than whether a Republican or Democrat takes the White House.

Once significant medical improvements materialise, in the form of a vaccine, better therapeutics, increased hospital capacity, and broad improvement in the healthcare system, we believe some key markets will react more in line with the recovery phases following the 2012 and 2016 elections – although one was won by a Democrat with a divided Congress and the other by a Republican with a clean sweep.

Daniele Antonucci is the chief economist at Quintet Private Bank