As the end of 2020 approaches there is a lot to look back on.

The coronavirus pandemic has been the main driver of markets as lockdown and then government and central bank bailouts caused one of the sharpest stock market corrections in history, followed by an equally historic rally.

Amid all the twists and turns in financial markets this year, there are a few themes that are worth highlighting.

Absolute returns

Most absolute return funds were caught up in the correction that saw almost all other sectors fall steeply as investor confidence evaporated and investors tried to liquidate holdings to generate enough cash to see them through lockdown.

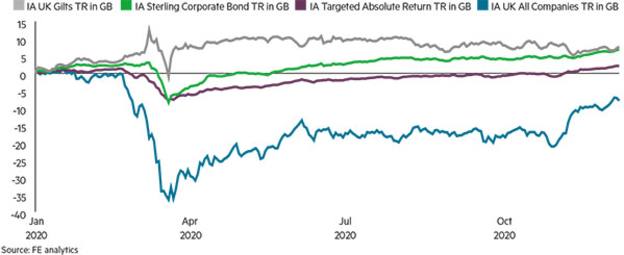

The initial rally in gilts in the first half in March, followed by their swift recovery, meant that gilts have been much better for capital preservation than absolute return funds in 2020.

But there is some positive news for absolute return funds. The recent vaccine rally has helped the Investment Association Absolute Return sector to a positive return for 2020, while the sector has displayed considerably less volatility than most major asset classes – in part due to a comparatively small fall in fund values during the March sell-off.

The average drop in value from peak to trough in the March sell-off was 9 per cent for absolute return funds. This compares to almost 12 per cent for gilt funds, 11 per cent for UK corporate bonds and 36 per cent for UK all company equities. This is reflected in maximum drawdown figures for 2020.

The IA Absolute Return sector’s maximum drawdown for the year to December 8 is -8.47 per cent, compared to -3.91 per cent for gilts, -9.32 per cent for corporate bonds and -33.63 per cent for UK all companies.

Corporate bonds

The recovery seen in corporate bonds was swift and presented many managers with once-in-a-lifetime buying opportunities as companies rushed to raise cash in the second quarter.

Credit funds were not spared the initial sell-off, with the IA Corporate Bond sector falling around 11 per cent during March – but once central banks intervened, particularly the US Federal Reserve, and committed to buying corporate bonds in the secondary market, investor confidence returned.

The extreme volatility seen in 2020 has enabled good bond managers to demonstrate their investment process can deal with both a sharp correction and sustained rally in bond values across the credit scale.

The TwentyFour Corporate Bond fund, for example, has performed in line with the IA Corporate Bond sector for the year to date – with a total return of 6.76 per cent compared to 6.9 per cent for the sector, but during the sell-off it significantly outperformed to limit losses from the fund during the period of heaviest selling.

Value rotation

As we approach the end of 2020, optimism over vaccines outweighs concern about the economic damage being done by the second wave of Covid.

The vaccine rally has seen a big shift in investor expectation for the economic outlook. Faster economic recovery would see an increase in demand for oil, along with the re-emergence of inflation and the potential for central bank interest rate increases.

As a result, investor attention is moving away from growth and into value stocks.

As shown in the graph below, value stocks have rallied hard since the beginning of November, particularly in the UK with its large weighting to financial services and energy. Mining stocks have also performed well as Chinese demand continues to fuel demand for industrial metals.

But value funds still have some way to go to close the performance gap – a gap that existed long before the pandemic. If the global vaccination runs smoothly, value should have the chance to continue to close the gap.

Charles Younes is research manager at FE Investments