Compared to other regions such as the US or Japan, the UK has a strong history and culture of many companies paying out a steady dividend and committing to a progressive dividend policy for shareholders.

Many people rely on the culture of dividend payouts in the UK as a very important part of their savings and investment portfolios. However, the Covid-19 crisis has forced companies around the world to cut or suspend their dividend payments.

So, what exactly has happened to dividends in the wake of the pandemic and what does the future look like for dividend-paying companies?

Lockdowns and other virus containment measures around the world have dealt a substantial blow to many businesses, who suddenly faced a significant drop in revenues, or no revenues at all.

At the same time, they were still facing recurring fixed costs, such as rents, wages, and leases. The impact this has had on working capital and liquidity positions has been so detrimental that it has exceeded the damage witnessed during the global financial crisis.

Consequently, several UK-listed companies announced suspensions, omissions or cuts to their dividend payments.

It came as no surprise that some of the first movers to cut dividends were companies in consumer-facing sectors such as retail, media and travel and leisure, where demand was among the hardest hit by restrictions on social movement and activities.

As the pandemic continued and measures intensified, this trend only expanded to start impacting other parts of the economy.

For example, the halting of building sites across the UK led to companies in the construction and housebuilding sectors needing to take similar measures.

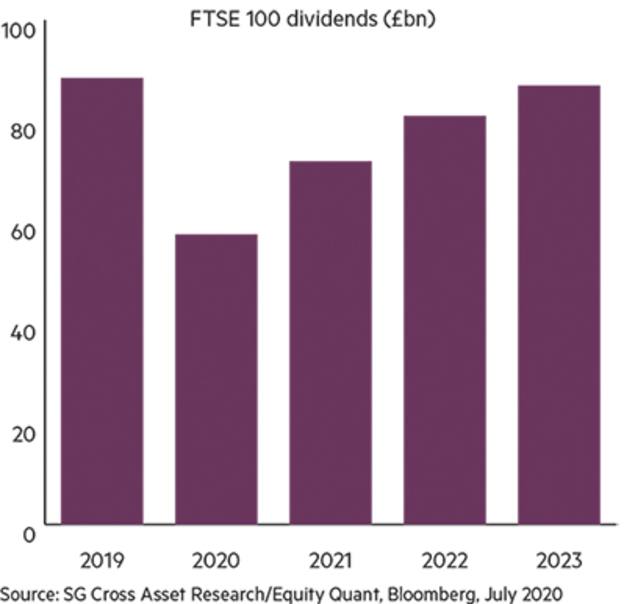

The financial sector, too, was not immune, with the Bank of England forcing many UK banks and insurers to suspend their dividends and buybacks. As a result, expectations for dividends across the broad UK market are expected to be around 40 per cent lower in 2020 than they were in 2019.

Within this context, active management has had the opportunity to prove its beneficial edge. While some active managers have been caught out by the dividend cuts in the financials and oil and gas sectors for example, many active managers have been able to weather the dividend storm and maintain dividend yield levels higher than the market.

The resilience of active portfolios is supported by actively tilting away from those companies that are more under strain in this environment and towards those with stronger balance sheets, and therefore more likelihood of being able to pay out dividends.

Indeed, there have been many UK companies who have continued and even increased their dividends through this period, benefiting from emerging consumer trends in the context of social restrictions.

For example, food retailers have benefited from a rise in grocery shopping during the stricter lockdowns, and some large personal goods companies have also managed to keep their dividends as planned.

The UK pharmaceutical giants have also seen their revenues unaffected and have continued to maintain their dividend policies.

Even with news of a vaccine on the horizon, dividends will not be able to simply bounce back to where they were.

The extent of the economic damage from the Covid crisis means that many experts are not expecting dividend payouts in 2021 to get back to 2019 levels, or to recover losses seen in 2020.

On the other hand, the dividend situation is expected to improve markedly in 2021 from current levels as the economy reopens, more industries return to work and businesses begin to restart their progressive dividend policies.

Furthermore, the pandemic could make some businesses think differently about how they pay out dividends in the future. Some companies could see this as an opportunity to rebase their dividends altogether.

Some analysts expect companies to maintain even more resilient balance sheets in the future, with less debt and more cash. It is possible that we see consumer-facing companies seeking to strengthen their balance sheets rather than paying out so many special dividends or doing buybacks.

Already we have seen those companies with more conservatively managed balance sheets being rewarded with higher stock prices.

Furthermore, those companies who have not taken government support and are still paying their dividends – and therefore demonstrated their resilience for investors – may be the ones that are more sought after in the future.

Alice Logue is manager research analyst at Fidelity International