US stocks have remained relatively flat since opening this afternoon, with the S&P 500 up just 0.5 per cent, as both Democrat candidates claimed victory in the race for their respective seats, though neither race has officially been called.

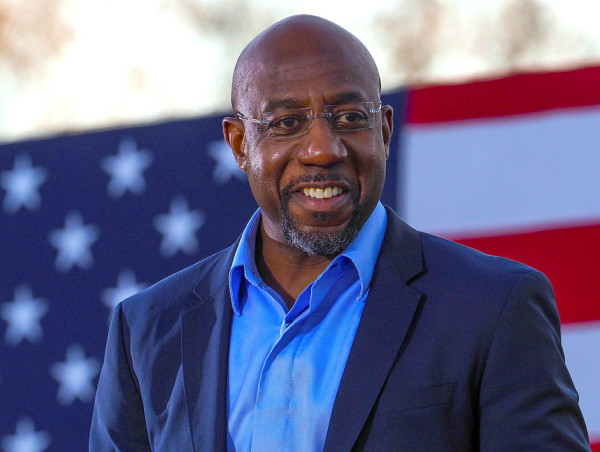

Democrat candidate Raphael Warnock is projected to have won his race with 50.6 per cent of the vote while Jon Ossoff, also a Democrat, is thought to have a lead of more than 16,000 votes.

If the Democrats win both seats, the Senate will be tied 50-50 and vice president Kamala Harris will hold the deciding vote — a scenario which will provide the Biden presidency with an easier path to pushing through legislation and making changes, without relying on Republican votes.

This is a “double-edged sword” for markets, experts have claimed.

Matthew Cady, investment strategist at Brooks Macdonald, said: “On the one hand, it could make an additional and larger fiscal stimulus in Q1 more of a possibility and with it a greater emphasis on infrastructure spending, which will provide greater support for markets as the US continues to face headwinds from the Covid-19 pandemic.

“On the other hand, further out it could also raise the chances of tax rises, tougher regulation and other less market-positive reforms.”

Fears of higher taxes and a potential ‘break up’ of big tech has seen the Nasdaq index — composed of technology stocks — drop 0.6 per cent this afternoon.

Meanwhile, responding positively to the likely boost in fiscal stimulus, 10-year US bond yields hit their highest point since mid-March at 1.044 per cent, having jumped more than 9 per cent today.

James Athey, investment director at Aberdeen Standard Investments, said: “Markets overwhelmingly see this result as being a driver of yet more fiscal policy support for the virus-ravaged US economy.

“This is likely to pressure treasury yields higher, particularly in longer tenors, as yields will have to reflect higher growth expectations and greater supply of treasuries all else equal.”

Mr Athey agreed there were a “few potential flies in the soothing ointment”, however. He points out that less market-friendly Democrat policies would now be a “realistic prospect”, including higher corporate, capital gains and income taxes.

Markets were relatively calm when Joe Biden was announced as incoming president of the United States in November last year, primarily because it seemed likely the Democrat president would face a Republican-run senate.

Both the S&P 500 and the Nasdaq index had climbed 5 per cent in the week following the election as the world anxiously awaited the drawn-out result.

Paul O’Connor, head of multi-asset at Janus Henderson Investors, said today’s news was “paradoxically” good news for the US economy but “probably bad news” for the relative performance of US stocks.

He said: “The prospect of higher corporate taxes, higher bond yields and concerns about regulatory intrusion will weigh most heavily on the media, technology and communications behemoths that dominate US indices.”

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know