Returns from the Baillie Gifford US Growth trust may “run out of steam” after a supercharged year for growth strategies, analysts have warned.

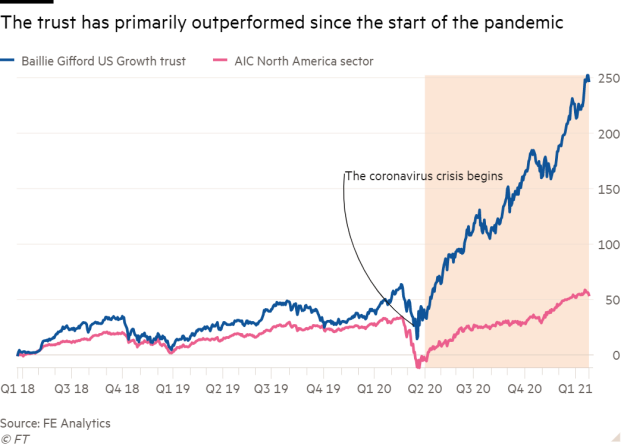

In a note to investors today (January 28), Stifel said the trust had an “amazing year in 2020”, outperforming the S&P 500 from March when the coronavirus crisis began.

But it added: “We worry that returns have been brought forward and may run out of steam and see consolidation in the near term.

“We rate the team and their long-term philosophy highly, but think that with growth companies trading and ambitious valuations, investors may wish to take profits.”

The trust, which launched in 2018, has returned 140 per cent in share price terms over the past year, compared to a 30 per cent average return from its peers in the North America AIC sector.

It is currently trading at an 8 per cent premium — where shares in the trust are more valuable than the underlying assets. Stifel said this was a “chunky” premium that was likely to be capped given the fact the trust is issuing equity on a daily basis.

Stifel has therefore downgraded the trust’s rating to neutral.

The analysts described 2020 as a “blowout year” for the trust, driven by its holding in Tesla.

It said: “[The trust’s] excellent results were driven by the portfolio’s largest holding, Tesla, which advanced by more than 700 per cent over the period and was responsible for one-sixth of the portfolio’s returns.

“This nicely captures the manager’s key points about the asymmetry of return. The team says it is not how often you are right that is important, but how much money you make when you are right.”

It’s other top 10 holdings — which include technology ‘growth’ stocks such as Shopify, Amazon, Netflix and Alphabet — have also done well amid the pandemic.

Value stocks, with low price tags, typically perform well in market downturns but the coronavirus crisis has seen quality growth stocks, such as US tech companies, outperform.

Proponents of value investing argue that ‘value’ stocks are currently undervalued and will be the companies most likely to benefit from any global economic recovery.

But quality growth investors say stocks such as Microsoft and Amazon have only improved their dominance throughout 2020, being at the forefront of changing commerce and providing vital new-age business and communications software.

Stifel said there were many positives about the trust, such as its excellent returns since its IPO, that it provides unique access to high growth, private companies, its experienced investment team and Baillie Gifford’s long-term, benchmark agnostic approach.

However, the analysts also warned on growth companies’ ambitious valuations, the fact that growth companies could de-rate if US interest rates increased and the fact that the market could be valuing the unlisted firms in the portfolio on a premium.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know