Two veteran fixed income investors have warned the market is being too optimistic about the outlook for economies and are taking a cautious approach.

Bryn Jones of Rathbones and Nick Hayes of Axa took distinctly different approaches to investing in bonds during 2020, but shared a scepticism that the current risk-on trajectory of markets was prudent.

Many lower-risk bonds and bonds with a longer date to maturity have sold off in 2021 as investors fear higher inflation.

Jones, who as head of fixed income at Rathbones oversees a fund range with £3bn of assets, acknowledged the present economic conditions of recovering economies, historically low interest rates and increased government spending, should be ideal for investing in high yield bonds, the riskiest part of the bond market, but he said he wouldn't be increasing his exposure there.

He said: “Looking at the macroeconomics, you would say this is a great time to be in high yield, but you have also to look at the fundamentals, and at present valuations, high yield bonds are priced for perfection, the time to buy them is when they are pricing in more than an average number of companies defaulting on their debts. Right now, they are priced for a below average number of defaults.”

Hayes, head of sterling rates and credit at Axa Investment Management agreed, saying that with the yield on lower risk bonds rising, "we could see people selling off their high yield bonds and buying the sovereign bonds, despite the macroeconomic outlook".

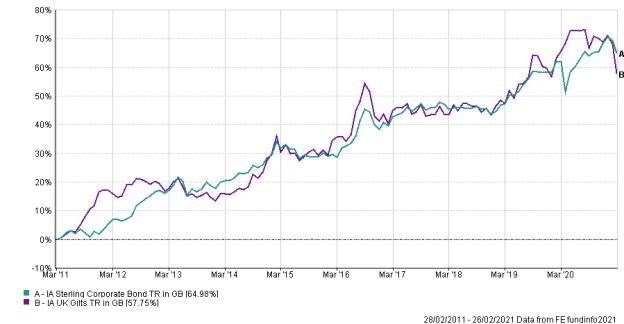

In general, lower-risk bonds have performed strongly for the past 40 years as the world adjusted to sharply lower inflation.

The price at which UK government bonds trade has fallen by about 6.5 per cent in 2021, while Eurozone and US government debt has also fallen in value.

The extent of the sell-off in UK debt can be seen in the rise in the yield available on UK 10 year government debt, which was 0.2 per cent on January 2, 2021, and is now 0.72 per cent.

Yields move inversely to prices. Yields rise for one of two reasons: either because the market has lost confidence in the ability of the borrower to make payments, or because the interest rate offered is relatively less attractive than that offered on assets which are riskier.

The UK’s vaccine roll-out programme has led to the market revising its view on the economy’s growth and inflation prospects.

Andy Haldane, chief economist at the Bank of England recently warned that inflation could rise sharply in the UK. This would make the fixed income from the bond is worth less as prices would be rising at a faster rate.

Having invested heavily in the types of bonds that did well as market sentiment became more optimistic, Jones is now looking at buying some of the assets, such as government bonds, which sold off sharply.

He says: “We have taken the opportunity of the recent sell-off to buy some of the assets that sold off, we cannot be sure that the recovery which is being seen in the US and in the UK will spread to Europe and to other parts.”

Jones spent the month of March 2020, when economies were shutting down and the world was plunged into a deep recession of uncertain length, buying higher risk corporate bonds, rather than embracing the traditional safe haven assets of government bonds, as many others did in the crisis.

He told FTAdviser: “In March 2020 we thought the opportunity was there, as central banks cut rates and increased their quantitative easing programmes, we thought this put a cushion under those bonds that are a riskier credit, and we felt that by 2021 the vaccines would be coming and herd immunity, so valuations were attractive and we have been rewarded for that in recent months.”

Hayes has positioned his funds for much of the past decade for a world in which inflation and economic growth would be low for the long-term. This led him to own government bonds and other instruments with long dates to maturity.

He says: “It’s an approach that made us money for the decade reading up to the pandemic, and at the start of the pandemic, but has been painful more recently.”

Hayes believes the current sell-off of government and other safe haven bonds is “more than halfway through” and so he is holding onto those he owns now in anticipation of future gains.

He said: “I think the new normal will, in terms of inflation and growth, look like the normal of the previous decade, with long duration bonds performing well.

"At the moment there seems to be a consensus view on inflation, that it will rise. But the previous 40 years will not be reversed in two years.

"If the US 10 year government bond goes to 2 per cent yield, that would be the market pricing in US interest rates to rise twice in 2022, which I think is unlikely, so I am sticking with more of the long duration bonds I have owned for a while, inflation expectations are now so high, its hard to see how it could shock people by being higher than it is currently priced."

Torcail Stewart, who runs the £1.2bn Baillie Gifford Strategic Bond fund, has about 40 per cent of the capital deployed into high yield bonds right now.

He said current market conditions were very supportive of the case for high yield bonds, and those conditions are not going anywhere for a while.

He said: "Interest rates are unlikely to rise for a few years, but when we get near to that time, that is when high yield would come under pressure.

"In terms of valuations, there are still many areas of the market where the yields are attractive, you have to be selective.

"I think a general feature of the bond market now is that rather than looking at whether something is high yield, or investment grade or something else, the key is to look at the individual bonds."

david.thorpe@ft.com