So you’ve engaged your clients, you’ve asked some open and probing questions and you’ve unearthed their preferences. It might then be helpful to start grouping your clients into segments from a responsible investment perspective.

This exercise can link into your PROD target market analysis as well as helping you map different responsible investment approaches and solutions to your clients.

Consumer research

We completed an extensive piece of research on responsible investment segmentation in the summer of 2020. This was based on interviews with 30 investors and more than 2,000 responses to an online survey.

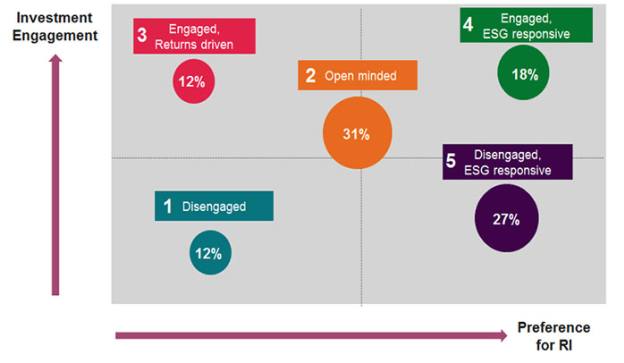

The research highlighted that consumers tend to sit in one of five different segments based on their engagement levels and overall preference for responsible investment. The chart below highlights where the five segments are plotted and the proportion of consumers that sat in each segment.

Adding colour to the segments

Consumers in segment one tend to be completely disengaged when it comes to investments and are quite unlikely to see an adviser on an ongoing basis. So, they’re highly unlikely to have any responsible investment preference.

Segment two has the highest proportion of consumers and the research highlighted that this segment is likely to be heavily guided by their adviser and has the potential to become highly engaged in responsible investment once they’ve been educated on the matter. Once informed, a variety of responsible investment approaches may appeal.

Consumers in segment three tend to be highly engaged in investments but are unlikely to prioritise responsible investment. However, the research indicated that these individuals can become engaged in responsible investment once it’s presented in the context of risk-adjusted returns. Individuals in this segment could be influenced to invest in solutions adopting environmental, social and governance integration once its impact on risk-adjusted returns has been explained to them.

Segment four contains consumers who are already fully engaged in responsible investment, so impact and sustainable solutions are likely to appeal to these individuals since they view responsible investment as an important consideration.

The final segment had the second highest proportion of individuals from our research. Consumers in this segment are hard to engage in long-term savings but are potentially very interested in responsible investment. Once engaged, exclusions and impact solutions may be appropriate approaches to adopt.

Example segmentation mapping:

- Segment one (disengaged) – No preference.

- Segment two (open minded) – Sustainability focus/ESG integration/stewardship.

- Segment three (engaged, returns driven) – ESG integration.

- Segment four (engaged, ESG responsive) – Sustainability focus/impact investing.

- Segment five (disengaged, ESG responsive) – Exclusions/impact investing.

Obviously, there’s much more to this exercise than just basing it on broad segments and research, but it can be helpful in identifying the different responsible investment approaches and where they can be adopted across a broad spectrum of individuals.

Attention can then turn to the finer details of solution selection.

To find out how Royal London can support you with responsible investment, visit: adviser.royallondon.com