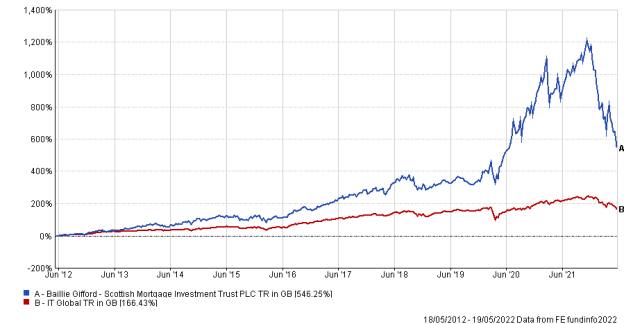

Its share price total return of more than 700 per cent meant that even after clients stopped adding to their holding, the proportion of their overall portfolio exposed to the trust kept rising.

And with the trust being exposed to technology companies which offered products that were widely adopted during the pandemic, the share price gains seemed less the result of a bubble and more a rational pricing by the market of a changing world.

But this year to date has seen a re-pricing, with the share price falling by around 50 per cent since January 1.

The reasons for this are numerous but includes a general market aversion to tech companies and biotech in a world of higher interest rates. Worries about the attractiveness of investing in Chinese companies amid recent regulatory interventions and the zero-Covid policy pursued by authorities in Beijing have also contributed to the under performance.

Although the trust is associated with large-cap US tech, and continues to have Tesla and Amazon among its top 10 holdings, the fund managers have been increasing exposure to biotech and China in recent years.

Indeed, there are more Chinese large-cap tech stocks – Alibaba, Meituan and Tencent – than US ones in the top 10 holdings.

Scottish Mortgage 10-year performance

The largest investment in the trust is the biotech Moderna, a company which developed a widely used Covid vaccine.

The trust’s managers remained very bullish on China and in 2021 reduced US technology exposure in favour of buying more in China.

The soon-to-retire fund manager James Anderson annoyed a number of the company’s US institutional clients by brushing off concerns about the macro environment in China, saying that (under the presidency of Donald Trump) it was debateable whether the US would still be a democracy in 10 years.

A third factor has been the investment in unquoted companies.

Simon Elliott, head of investment trust research at Winterflood Securities, says: "Investors in Scottish Mortgage investment trust must be forgiven for feeling as if they’re riding a rollercoaster. The trust’s share price is now down more than 40 per cent so far this year and has halved since its peak in November last year.

"This begs the question, should existing investors sell and minimise the risk of a further decline? Conversely, is the current share price an interesting entry point? The answer to both these questions basically depends on investors’ timescale.

"In our opinion, the trust suits long-term investors who can withstand significant drawdowns as have been seen in the past – most notably in 2008 at the time of the global financial crisis."

Elliott adds: "The Baillie Gifford investment team has made it clear that their investment philosophy and approach has not changed, with a focus on identifying exceptional growth prospects, with the potential to generate significant returns. Their track record is impressive in this regard and we rate the long-term global growth team led by Tom Slater highly."

More than one hundred re-valuations of the stakes in these assets took place in the first three months of 2022, as the managers sought to adjust the valuations to reflect the changed world.

Ewan Lovett-Turner, head of investment companies research at Numis Securities, says this is a positive as it means the (lower) valuations probably already reflect the changes in real world economic circumstances, so there should not be surprises in future.

But with the share price having fallen so far, could now be the time for clients to dip their toes back in to what is now the second largest investment trust in the UK?

Just under 30 per cent of the capital is deployed in the technology sector, while 16 per cent is invested in biotech.

Mick Gilligan, who runs the managed portfolio service at Killik and Co, says that while the deteriorating valuation has made the shares “more interesting”, he is not yet ready to buy, as he feels the interest rate rising cycle is not yet complete, and this makes it difficult for growth shares to perform.

He adds: “If we see a further derating in growth stocks then I would expect to see this impact the valuations of those venture capital type holdings that are value-based on quoted market comparatives.”

China syndrome

There have been some signs that the managers of the trust are revising some of their more bullish assumptions, with Slater, the lead manager, recently telling our sister publication the Financial Times that regulatory concerns around China are relevant, and that it was a mistake to sell US tech holdings to buy more in China.

Anthony Leatham, head of investment trust research at Peel Hunt, takes a more optimistic view, saying that while the nature of its investments means volatility will always be high, now could be a good entry point.

He says: “Scottish Mortgage is clear in its pursuit of the world’s most exceptional growth companies, but achieving this objective is not straightforward. Big winners over the past 10 years have included Tesla, NVIDIA, Amazon and ASML. If we focus on Tesla, over the life of SMT’s ownership, the shares fell more than 30 per cent on seven occasions.

"The past few months have been a painful experience for growth investors but, unless we are going back to an offline world, piling back into fossil fuels or turning our back on personalised medicine, the momentum behind some of the world’s largest tech-enabled disruptors appears structural.

"If an investor was nervous six months ago about buying the trust on a premium and elevated underlying portfolio valuations, then this undiscerning sell off and today’s 9 per cent discount signals a good time to look again.”

Jayna Rana, investment trust analyst at Quoted Data, says investors need also to be mindful of the "concentration risk" associated with the trust – that is, it owns large stakes in all of its investee companies and has relatively few investments given its size.

California dreaming

The trust has focused a lot of its time and energy in recent years on creating the infrastructure to help it generate and evaluate future ideas, including Slater spending extended periods of time in California in recent years in order to develop ties with the technology community.

Slater has a strong personal relationship with Tesla chief executive, and that company is a top 10 shareholding in the trust. Tesla shares performed extremely well during the pandemic lockdowns, but have fallen by around 27 per cent over the past month, as investors worry about the potential impact on Tesla’s share price after Elon Musk’s attempted takeover of Twitter.

Musk has already sold billions of dollars worth of shares in the company in order to raise cash for the Twitter purchase, while he has also pledged billions of dollars of his shares as collateral for cash he is borrowing from banks to fund his Twitter purchase.

On the biotech side, one of the non-executive directors of the Scottish Mortgage investment trust is a professor of medicine at Oxford University.

Baillie Gifford managers have recently expressed frustration that the share price of Moderna, which is the trust’s largest investment, has retreated to the level, in price/earnings terms, it was at before it created one of the Covid-19 vaccines.

That vaccine used MRNA technology, which had, until that point, been unproven, but which could have a wide range of clinical applications.

Lovett-Turner says many of the companies held in the Scottish Mortgage trust are actually performing well as businesses, but this is not being well reflected in the share prices, due to wider market sentiment.

He welcomed Slater’s acknowledgement that it was a mistake to continue to invest in Chinese companies at a time when Chinese authorities were adopting a different approach to regulation.

david.thorpe@ft.com